Categories

Open OQtima's 0.0 pips Spread Account | ECN Execution

Switch your broker to OQtima and start saving money on your trading cost.

A strictly regulated broker with thirty years of experience, OQtima is considered by traders an excellent alternative for engaging with markets quickly and effectively, given the high quality of service offered and the favorable trading conditions that ensure cost-effective trading and excellent fund management. The main goal of the broker is based on creating an environment primarily focused on total security and full compatibility with any level of experience. Being aware of the diversity and various needs of traders, the broker is constantly committed to providing flexible services and features, which will allow both novice and experienced traders to shape them according to their own modus operandi to negotiate to the best of their abilities.

Furthermore, as a broker that leverages ECN technologies, OQtima allows traders to interact directly on the markets without any intermediaries and to benefit from high and rapid liquidity, provided by top-level banks. In summary, a respectable company, aiming for complete customer satisfaction with transparency, security, and quality.

- Absolute Security.

- As a strictly regulated broker, the broker provides traders with an environment with very high safety standards. Having to comply with the rules imposed by regulatory bodies, OQtima guarantees its trusted clients complete transparency and protection of sensitive data. Moreover, all traders’ funds are held in accounts separate from those of the company, ensuring they are never used for ulterior purposes.

- High Quality of Services Offered.

- OQtima is constantly engaged in studying and researching excellent level functions or services, aimed at structuring an environment suitable for any trader and with infinite investment opportunities.

- Trust.

- A characteristic considered fundamental by traders worldwide to operate in the markets with transparency and security. Being a company created by industry professionals, OQtima has immediately allowed its customers to know any parameter, commission, spread or additional cost very easily at any time.

- List of Accounts Offered.

- Although not particularly extensive, the list of accounts offered by the broker has been structured to allow traders of any level to operate best in the markets. Based on their style, needs, or trading preferences, each trader can opt for the most suitable solution and negotiate to the best of their possibilities. Of course, characteristics such as: instruments, functions, spreads, and commissions, will vary depending on the type of account selected and the trader’s country of residence.

- State-of-the-Art Platforms.

- To allow customers to operate in the markets making the most of their abilities, the broker has state-of-the-art software, among the most powerful and popular in the world: MT4 – MT5 and cTrader. (the platforms offered change based on the country of residence of the trader).

- Spreads and Commissions.

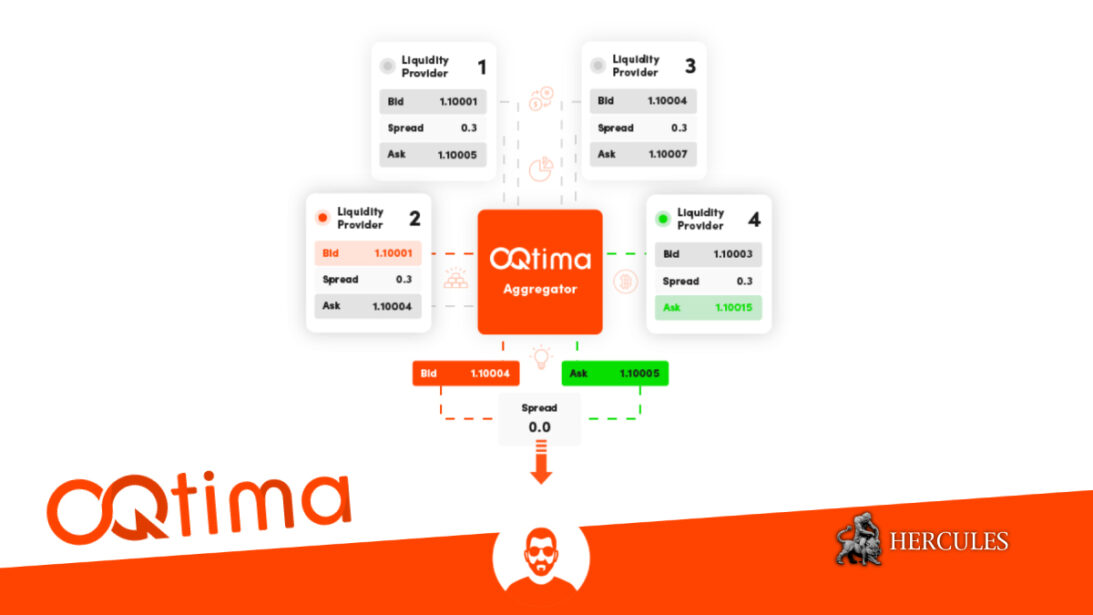

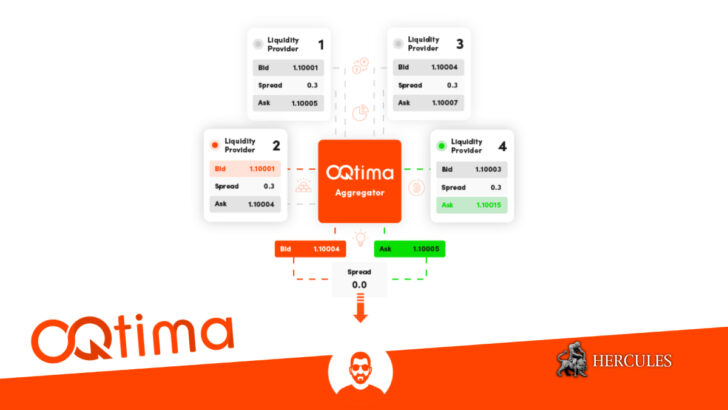

- Being an ECN broker, OQtima has the ability to aggregate a large number of price providers, which allows traders to access more competitive quotes with spreads reduced to a minimum, very high institutional-grade liquidity, and direct and fast execution on the entire range of available instruments.

Visit the official OQtima website

Spreads and Commissions

Finding a broker capable of offering cost-effective trading with maximum transparency is not simple. There are brokers in the world (sometimes even regulated) that, despite providing good service, do not offer clear information on the commissions and spreads to be incurred. OQtima is definitely not among these. Any trader, client or not, will have the means to view all the costs related to trading at any time, simply by viewing the dedicated page or asking for information from the efficient, always available support team. Moreover, by accessing the legal documentation (which varies according to the regulator), the trader will have the opportunity to know in detail the management of costs, privacy protection, anti-money laundering policies, etc.

As already mentioned, being an ECN broker, OQtima offers traders spreads minimized to the lowest and very advantageous trading commissions. A feature much appreciated by traders, as it allows them to manage both the operations to be carried out and the risks involved more effectively.

Following, a detailed overview of OQtima’s spreads and commissions, divided according to the markets and type of account:

The spread offered by the broker is variable and changes according to the markets and the selected instrument.

ECN + and ONE Account Spreads

Forex Spreads

| Forex Currency Pairs | ECN Account | ONE Account |

|---|---|---|

| AUDUSD | Minimum Spread 0.00 pip – Average 0.14pip | Minimum Spread 1.00 pip- Average 1.14 pip |

| EURJPY | Minimum Spread 0.00 pip – Average 0.80 pip | Minimum Spread 1.00 pip – Average 1.80 |

| EURUSD | Minimum Spread 0.00 pip – Average 0.12 pip | Minimum Spread 1.00 pip – Average 1.12 pip |

| GBPCAD | Minimum Spread 0.00 pip – Average 2.09 pip | Minimum Spread 1.00 pip – Average 3.09 pip |

| GBPJPY | Minimum Spread 0.00 pip – Average 1.61 pip | Minimum Spread 1.00 pip – Average 2.61 pip |

| GBPUSD | Minimum Spread 0.00 pip – Average 0.36 pip | Minimum Spread 1.00 pip – Average 1.36 pip |

| USDCHF | Minimum Spread 0.00 pip – Average 0.60 pip | Minimum Spread 1.00 pip- Average 1.60 pip |

| NZDUSD | Minimum Spread 0.00 pip – Average 0.40 pip | Minimum Spread 1.00 pip – Average 1.40 pip |

Index Spreads

| Indexes | ECN Account | ONE Account |

|---|---|---|

| USIDX | Minimum Spread 0.02 pip – Average 0.03 pip | Minimum Spread 1.02 pip- Average 1.03 pip |

| US2000 | Minimum Spread 0.08 pip – Average 0.30 pip | Minimum Spread 1.08 pip – Average 1.30 |

| TW88 | Minimum Spread 0.09 pip – Average 0.40 pip | Minimum Spread 1.09 pip – Average 1.40 pip |

| VIX | Minimum Spread 0.09 pip – Average 0.40 pip | Minimum Spread 1.09 pip – Average 1.40 pip |

| NETH25 | Minimum Spread 0.30 pip – Average 0.40 pip | Minimum Spread 1.30 pip – Average 1.40 pip |

| FRA40 | Minimum Spread 2.00 pip – Average 3.10 pip | Minimum Spread 3.00 pip – Average 4.10 pip |

| UK100 | Minimum Spread 2.00 pip – Average 2.60 pip | Minimum Spread 3.00 pip- Average 3.60 pip |

Commodity Spreads

| Commodities | ECN Account | ONE Account |

|---|---|---|

| XAGUSD | Minimum Spread 0.20 pip – Average 1.05 pip | Minimum Spread 1.20 pip- Average 2.05 pip |

| XAGEUR | Minimum Spread 0.50 pip – Average 0.50 pip | Minimum Spread 1.50 pip – Average 1.50 |

| XAUEUR | Minimum Spread 0.50 pip – Average 0.50 pip | Minimum Spread 1.50 pip – Average 1.50 |

| XAUUSD | Minimum Spread 0.70 pip – Average 0.79 pip | Minimum Spread 1.70 pip – Average 1.79 pip |

| XPTUSD | Minimum Spread 7.10 pip – Average 32.10 pip | Minimum Spread 8.10 pip – Average 33.10 pip |

Cryptocurrency Spreads

| Crypto Pairs | ECN Account | ONE Account |

|---|---|---|

| DOGEUSD | Minimum Spread 0.90 pip – Average 2.16pip | Minimum Spread 2.90 pip- Average 3.16 pip |

| MATUSD | Minimum Spread 2.10 pip – Average 2.32 pip | Minimum Spread 3.10 pip – Average 3.32 |

| ADAUSD | Minimum Spread 2.10 pip – Average 2.38 pip | Minimum Spread 3.10 pip – Average 3.38 pip |

| XRPUSD | Minimum Spread 2.10 pip – Average 2.66 pip | Minimum Spread 3.10 pip – Average 3.66 pip |

| EOSUSD | Minimum Spread 2.10 pip – Average 2.66 pip | Minimum Spread 3.10 pip – Average 10.07 pip |

| DOTUSD | Minimum Spread 2.20 pip – Average 2.27 pip | Minimum Spread 3.20 pip – Average 3.27 pip |

| LNKUSD | Minimum Spread 2.30 pip – Average 2.30 pip | Minimum Spread 3.30 pip – Average 3.42 pip |

Take advantage of OQtima’s favorable spreads

Commissions

Commissions will be charged on ECN + type accounts. ONE accounts do not involve any trading commissions.

| Account Currency | Commission per 1 lot (100,000 Base Currency) |

|---|---|

| USD | $ 3.00 per lot traded ($6 round trip) |

| EUR | € 3.00 per lot traded (€6 round trip) |

| GBP | £ 2.50 per lot traded (£5 round trip) |

| CHF | ₣ 3.00 per lot traded (₣ 6 round trip) |

| SGD | S$ 3.50 per lot traded (S$ 7 round trip) |

| JPY | ¥450 per lot traded (¥900 round trip) |

| CAD | Can$ 4.00 per lot traded (Can$ 8 round trip) |

| ZAR | R 60 per lot traded (R 120 round trip) |

Open a real account with OQtima

Accounts Available with OQtima

The available accounts have been carefully created to meet the needs of any category of trader. Despite the broker having only two accounts for trading, the features of both allow traders, both experienced and beginners, to operate at their best on markets around the world. It’s important to note that trading conditions, features, and tools available may vary based on the trader’s country of residence. To obtain more information regarding the characteristics and pricing plan of the selected account, visit the website available in your country of origin or contact the support team.

The accounts offered by the broker are:

- OQtima ECN +.

- OQtima ONE.

Open a real account with OQtima

OQtima ECN + Account

An account type created exclusively for experienced traders who need particular tools and functions to negotiate, the ECN + account offers traders a professional environment with high performance. Through the use of a complex electronic network that directly connects financial intermediaries and liquidity providers, the trader will have the opportunity to interact directly on the markets without any intermediaries. Furthermore, by electronically crossing purchase and sale orders and using state-of-the-art tools and functions, each trader can create their strategies with accuracy and speed.

| Features | International OQtima ECN Plus account | European OQtima ECN Plus account |

|---|---|---|

| Variable Spread | Starting from 0.0 pip | Starting from 0.0 pip |

| Trading Commissions | Starting from $3.00 USD (varies by selected instrument) | Starting from $3.00 USD per side traded (varies by selected instrument) |

| Minimum Deposit | $100 USD | $200 USD |

| Maximum Financial Leverage | 1:1000 | 1:30 |

| Hedging | Allowed | Allowed |

| EA and Scalper | Yes | Yes |

| Available Currencies | USD, EUR, JPY, GBP, CAD, CHF, SGD, ZAR | USD, EUR, GBP, CHF |

| Margin Call | 80% | 80% |

| Stop out | 20% | 20% |

| Deposit Commissions | Zero | Zero |

| Withdrawal Commissions | None | None |

| Available Markets | 7: Cryptocurrencies, Indices, Forex, Metals, Stocks, Energy, ETFs | 7: Cryptocurrencies, Indices, Forex, Metals, Stocks, Energy, ETFs |

| Total Symbols | Over 300 | Over 300 |

Open a real account with OQtima

OQtima ONE Account

An account typically chosen by novice traders, the ONE account offers a standard approach to the markets, capable of meeting the needs of traders eager to engage without having to risk excessive funds. The ONE account offers trading with sustained and calculable costs before any negotiation can be carried out. Zero commissions, sustained spreads, and a wide range of advantageous solutions for investing in the markets.

| Features | International OQtima ONE account | European OQtima ONE account |

|---|---|---|

| Variable Spread | Starting from 1.0 pips | Starting from 1.0 pips |

| Trading Commissions | Zero | Zero |

| Minimum Deposit | $100 USD | $200 USD |

| Maximum Financial Leverage | 1:1000 | 1:30 |

| Hedging | Allowed | Allowed |

| EA and Scalper | Yes | Yes |

| Available Currencies | USD, EUR, JPY, GBP, CAD, CHF, SGD, ZAR | USD, EUR, GBP, CHF |

| Margin Call | 80% | 80% |

| Stop out | 20% | 20% |

| Deposit Commissions | Zero | Zero |

| Withdrawal Commissions | None | None |

| Available Markets | 7: Cryptocurrencies, Indices, Forex, Metals, Stocks, Energy, ETFs | 7: Cryptocurrencies, Indices, Forex, Metals, Stocks, Energy, ETFs |

| Total Symbols | Over 300 | Over 300 |

Open an ONE account with OQtima

How to Open an OQtima Account

Regardless of the country of residence and the account chosen for trading, the procedure that allows the trader to open a new account remains unchanged. Every trader will have the opportunity to register, verify the data submitted, make a deposit, and start trading quickly. Moreover, following the opening of the account, the client will have the opportunity to tailor it according to their own needs, modifying parameters, functions, and much more.

To open a new account, simply execute the following very simple steps:

- First Step

- To start, the trader will need to visit the official website and click on the “Registration” icon, visible at the top right of the screen. On the new page, fill out the first registration form by entering: first name, last name, country of residence, phone number, valid email, and secure password. Read the terms and conditions of use carefully, accept them, and click on “Continue”.

- Second Step

- In this phase, the client will need to provide detailed information regarding personal data, trading experience, and capital to invest. Essential information to allow the broker to offer a service perfectly suited to the needs of the requester:

- Personal Information: country of residence, tax code, type of occupation, political exposure, etc.

- Financial situation and investment goals: source of income, annual income, net worth, how much to invest, risk tolerance, preferred type of trading, etc.

- Knowledge and experience: answer questions about trading to allow the broker to assess the level of experience.

- Last Step

- To successfully complete the registration, the client will need to verify the data provided and prove their identity and country of residence. To do this, they will need to send a clear front and back photo of an identification document (driver’s license, passport, ID card) and a recent utility bill (electricity, phone, internet). Once the account is successfully verified, the trader can select the platform to use, set various parameters according to their modus operandi, make an initial deposit, and start investing.