Categories

Top 5 Brokers with the Most Clients Worldwide | The Largest Forex Brokers

Discover why millions trust these top Forex brokers for secure, efficient, and flexible trading experiences – join the best today!

Table of Contents

The article discusses the top five brokers globally, valued by traders for their service quality and security standards. These brokers are Deriv, ICMarkets, FxPro, HFM (HF Markets), and XM, each providing advanced trading tools, transparency, and regulatory compliance to ensure trader confidence and satisfaction. Specific features such as low to zero minimum deposits, high leverage options, and comprehensive educational resources cater to both novice and experienced traders. Rapid, secure transaction processing and diverse account options further enhance their attractiveness. These brokers stand out in the financial trading field for their commitment to providing secure, efficient, and flexible trading conditions.

| Rank | Broker | Key Characteristics |

|---|---|---|

| 1 | Deriv | Modern and secure environment, advanced tools, high leverage options, comprehensive educational resources. |

| 2 | ICMarkets | Over 200,000 clients globally, high transaction volume, transparent and secure services. |

| 3 | FxPro | High operational standards, multiple regulatory compliances, direct market access. |

| 4 | HF Markets (HFM) | Regulated by over 30 bodies, wide range of instruments, educational support, transparent conditions. |

| 5 | XM | Large client base, comprehensive platform options, competitive conditions, variety of financial products. |

The best chosen by millions of traders

What drives a trader to choose a broker to entrust their funds? What are the characteristics, services, and especially the guarantees needed?

These are questions that every investor (whether professional or beginner) asks themselves in order to invest with peace of mind and efficiency in markets around the world.

There are thousands of online brokers in the world that allow investing, but only a few of these offer a service that is both secure and transparent as well as rich in cutting-edge tools and features.

Primarily, every trader must ensure that the broker with which they start investing offers:

- A strictly regulated environment by control bodies.

- Maximum transparency.

- Rapid, economical, and secure deposits and withdrawals.

- High-quality tools and functions for investing to the fullest of their abilities and minimizing the risk of loss.

As in any other field, in online trading there are brokers considered leaders in the industry. True giants that offer traders a service with high standards of safety and technical features that border on perfection.

Regulated, more than competitive trading conditions, maximum flexibility, customizable services, solutions suitable for any level of experience, and total transparency. Factors that induce millions of traders to choose them for investing.

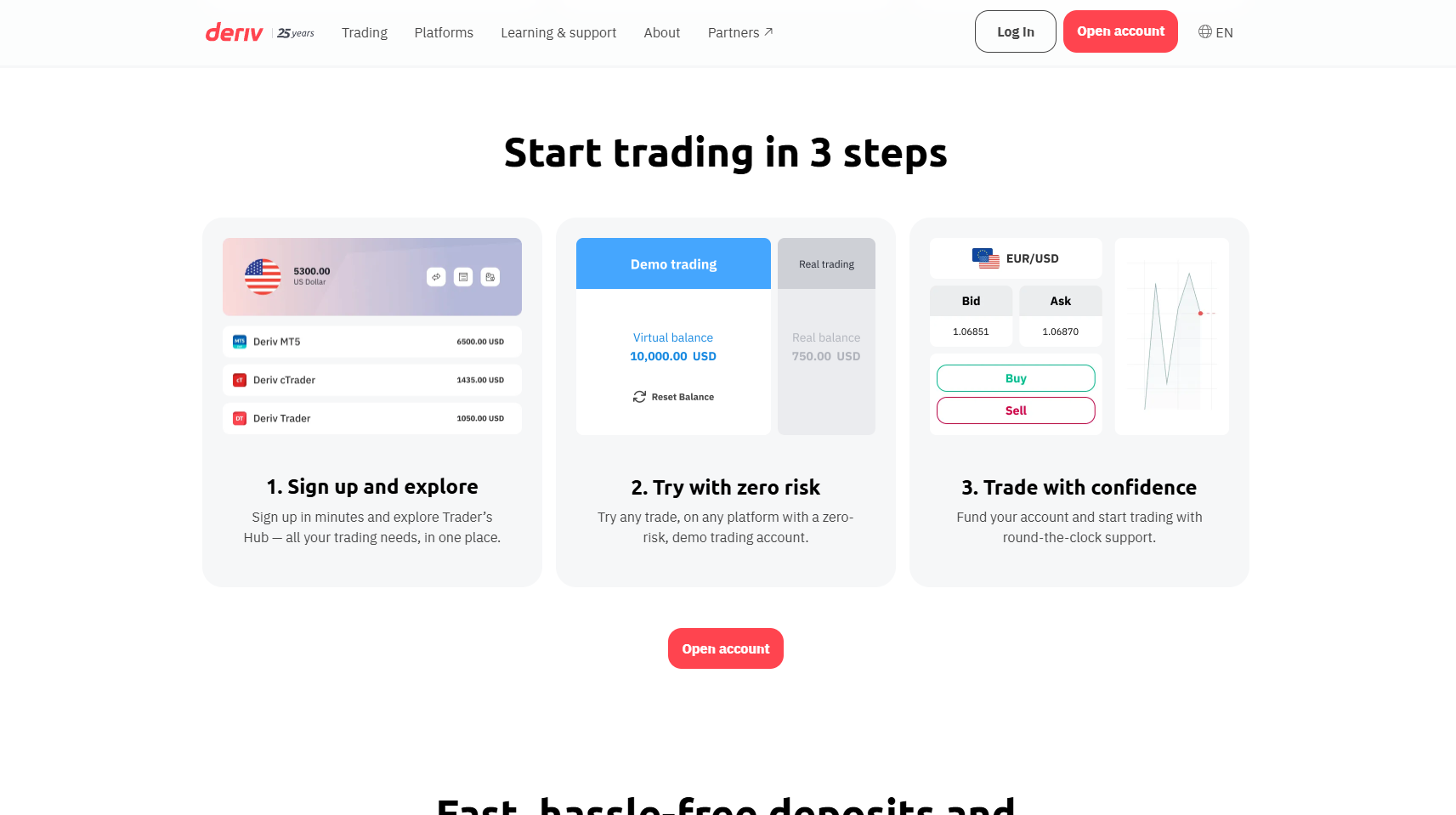

Deriv

One of the largest online brokers in the world, Deriv offers an innovative and secure service to over 2.5 million customers worldwide.

Having created a modern and secure environment, the broker offers clients of any category an excellent investment experience, with state-of-the-art tools, cutting-edge technologies, and almost revolutionary trading conditions for investing in Forex, stocks and indices, cryptocurrencies, and commodities.

| Characteristics | Deriv |

|---|---|

| Regulations | Malta Financial Services Authority – Labuan Financial Services Authority – British Virgin Islands Financial Services Commission – Vanuatu Financial Services Commission – Financial Services Commission, Mauritius |

| Demo Account | Available |

| Minimum Deposit | Starting from zero (varies based on the selected account) |

| Maximum Leverage | 1:4000 (varies based on the selected instrument) |

| Platforms | MT5 – cTrader, Deriv X app, Deriv GO app |

| Negative Balance Protection | Available |

| Available Instruments | FX, stocks, ETFs, cryptocurrencies, precious metals, indices, CFDs |

| Social Trading and Copy Trading | Available |

| Spreads | Variable starting from 0.0 pips (varies based on the type of account) |

| Trading Commissions | Starting from zero (varies based on the account) |

| Deposit Commissions | None |

| Withdrawal Commissions | Vary based on the selected payment method |

| Available Accounts | Standard Account, Zero Spread Account, Financial Account, Gold Account |

| Swap-Free Account (Islamic Account) | Available |

| Educational Material | Available |

| Promotions and Contests | Available |

Accounts offered by Deriv

Deriv offers its customers four different types of accounts, available on the MT5 platform. Each account has its own distinctive characteristics, and each client will have the opportunity to choose the one most compatible with their modus operandi. It is important to note that the broker does not allow anyone to know the details of the accounts offered. Interested traders can contact the support team and request all the necessary information to open a new account.

- Standard.

- Account compatible with any level of experience or trading need, the Standard account allows trading on a wide range of derivative and financial instruments with excellent trading conditions (including variable spreads starting from 0.1 pip and no trading commissions).

- Zero Spread

- Type of account that offers trading at fixed costs, characterized by minimized risks and costs. The Zero Spread account is an excellent choice for clients who intend to trade by planning costs well in advance, so as not to risk unexpected losses caused by the increase in spread.

- Swap-Free

- Account designed exclusively for traders of the Islamic faith, the “Swap free” account allows investing without overnight swap commissions on offered instruments.

- Financial.

- Type of account designed for clients who usually opt for trading on the financial markets with extremely advantageous spreads. The Financial Account is an excellent choice for high-volume traders.

ICMarkets

With over 200,000 trusted clients worldwide and over $15 billion in FX transactions processed every single day, ICMarkets is undoubtedly one of the best brokers in the world. The broker offers traders an intuitive environment rich in excellent investment solutions. Strictly regulated by multiple control bodies, ICMarkets boasts a transparent and highly secure service, both in terms of sensitive client data and deposited funds. IC Markets allows traders to trade on Forex, Metals, Stocks, Indices, Energy, Commodities, Cryptocurrencies, Bonds, and Futures with flexible trading conditions and state-of-the-art tools for high-level trading.

| Characteristics | ICMarkets |

|---|---|

| Regulations | CySEC Cyprus Securities and Exchange Commission – FSA Seychelles Financial Services Authority – ASIC Trading Point of Financial Instruments Pty Limited (Australia) |

| Demo Account | Available |

| Minimum Deposit | Starting from $200 (varies based on the selected account) |

| Maximum Leverage | 1:500 (varies based on the instrument and the country of residence of the trader) |

| Platforms | MetaTrader 4, MetaTrader 5, Webtrader, cTrader, TradingView |

| Negative Balance Protection | Available |

| Available Instruments | Forex, Metals, Stocks, Indices, Energy, Commodities, Cryptocurrencies, Bonds, Futures |

| Social Trading and Copy Trading | Available |

| Stop Out Level | Starting at 50% (varies based on the account and country of residence) |

| Margin Call | Starting at 100% (varies based on the account and country of residence) |

| Spreads | Variable starting from 0.0 pips (varies based on the type of account) |

| Trading Commissions | Starting from zero (varies based on the account) |

| Deposit Commissions | None |

| Withdrawal Commissions | Vary based on the selected payment method |

| Available Accounts | Standard Account, cTrader Raw Spread Account, Raw Spread Account |

| Swap-Free Account (Islamic Account) | Available |

| Educational Material | Available |

| Promotions and Contests | Available (availability depends on the region and country of residence) |

Open an account with ICMarkets

Accounts offered by ICMarkets

| Characteristics | cTrader Raw Spread | Raw Spread Account | Standard Account |

|---|---|---|---|

| Trading platform | cTrader | MetaTrader 4 – MetaTrader 5 | MetaTrader 4 – MetaTrader 5 |

| Trading commission (per lot) | $3.0 ($6.0 per round trip lot) | $3.5 ($7.0 per round trip lot) | |

| Spreads | Variable starting from 0.0 pip | Variable starting from 0.0 pip | Variable starting from 0.8 pip |

| Initial deposit | $200 | $200 | $200 |

| Maximum available leverage | 1:500 (1:30 for European traders) | 1:500 (1:30 for European traders) | 1:500 (1:30 for European traders) |

| Maximum number of orders – positions (per account) | 2000 | 200 | 200 |

| Server location | London | New York | New York |

| Micro Lot Trading (0.01) | Available | Available | Available |

| Currency pairs | 61 | 61 | 61 |

| CFD on indices | Available | Available | Available |

| Stop Out Level | 50% | 50% | 50% |

| One-click trading | Yes | Yes | Yes |

| Islamic account option (zero swap) | Available | Available | Available |

| Allowed trading styles | All | All | All |

| Trading restrictions | None | None | None |

| Programming language | C# | MQL4 | MQL4 |

| Suitable for | Day Trader & Scalper | EA and Scalper | Beginners and Discretionary Traders |

Open an account with ICMarkets

FXPro

With a total of 755,000,000 transactions executed by over 100,000 clients worldwide, FxPro is considered by many to be the best broker in the world, both for the high quality of the service offered and for the excellent safety standards. Regulated by multiple control bodies, the broker ensures a clear and safe environment for trading on forex, spot indices, futures, spot metals, and spot energy. Instruments and features of the latest generation, advantageous trading conditions, extremely high liquidity (guaranteed by international banks), and direct interaction on the markets without any intermediary.

| Characteristics | FXPro |

|---|---|

| Regulations | FCA Financial Conduct Authority – CySEC Cyprus Securities and Exchange Commission – Financial Sector Authority (FSCA) – Securities Commission of The Bahamas – Financial Services Authority of the Seychelles (FSA) |

| Demo Account | Available |

| Minimum Deposit | Zero (varies based on the selected account) |

| Maximum Leverage | 1:200 (varies based on the instrument and the country of residence of the trader) |

| Platforms | MT4 desktop – mobile – Webtrader – iOS/Android app – FxPro EDGE web – mobile FxPro app for iOS/Android |

| Negative Balance Protection | Available |

| Available Instruments | Forex, metals, indices, energy, futures, cryptocurrencies, and stocks |

| Social Trading and Copy Trading | Available |

| Stop Out Level | Starting at 50% (varies based on the account and country of residence) |

| Margin Call | N.D. |

| Spreads | Variable starting from 0.0 pips (varies based on the type of account) |

| Trading Commissions | Starting from zero (varies based on the account) |

| Deposit Commissions | None |

| Withdrawal Commissions | Vary based on the selected payment method. |

| Available Accounts | MT4 Instant & MT4 Fixed Account, FxPro MT4 Account, FxPro MT5 Account, FxPro cTrader Account, FxPro Platform |

| Swap-Free Account (Islamic Account) | Available |

| Educational Material | Available |

| Promotions and Contests | Available (availability depends on the region and country of residence) |

FXPro Comparative Account Table

| Characteristics | MT4 Instant & MT4 Fixed | FxPro MT4 | FxPro MT5 | FxPro cTrader | FxPro Platform |

|---|---|---|---|---|---|

| CFD Instruments | Forex, metals, indices, energy, futures | Forex, metals, indices, energy, futures, cryptocurrencies, and stocks | Forex, metals, indices, energy, futures, cryptocurrencies, and stocks | Forex, metals, indices, energy, cryptocurrencies | Forex, metals, indices, energy, futures, cryptocurrencies, and stocks |

| Available platforms | MT4 desktop – mobile – Webtrader – iOS/Android App – FxPro EDGE web – FxPro mobile App for iOS/Android | MT4 desktop – mobile – Webtrader – iOS/Android App – FxPro EDGE web – FxPro mobile App for iOS/Android | MT5 desktop – mobile – Webtrader – iOS/Android App – FxPro EDGE web – FxPro mobile App for iOS/Android | cTrader desktop – mobile – Webtrader – iOS/Android App | MT4 desktop – mobile – Webtrader – iOS/Android App – FxPro EDGE web – FxPro mobile App for iOS/Android |

| Minimum trading sizes | Starting from 0.01 micro lots | Starting from 0.01 micro lots | Starting from 0.01 micro lots | Starting from 0.01 micro lots | Starting from 0.01 micro lots |

| Trading commissions | Zero | Zero | Zero | Forex and metals: $35 per $1 million traded, zero commissions on indices, energy, and cryptocurrencies | Zero |

| Spreads | Instant Account: variable spreads based on the market – Fixed Account: fixed spreads applied on 10 FX pairs and variable on remaining instruments | Variable spreads based on the market | Variable spreads based on the market | Variable spreads based on the market | Variable spreads based on the market |

| Minimum stop levels | Minimum 1 pip from the current price | Minimum 1 pip from the current price | Minimum 1 pip from the current price | No minimum stop | Minimum 1 pip from the current price |

| Type of execution | Instant | Market | Market | Market | Market |

| Hedging operations | Allowed | Allowed | Allowed | Allowed | Allowed |

| Trading times | Forex trading 24 hours a day, 5 days a week | Forex trading 24 hours a day, 5 days a week, cryptocurrency trading 24 hours a day, 7 days a week | Forex trading 24 hours a day, 5 days a week, cryptocurrency trading 24 hours a day, 7 days a week | Forex trading 24 hours a day, 5 days a week | Forex trading 24 hours a day, 5 days a week, cryptocurrency trading 24 hours a day, 7 days a week |

| Order execution model | No Dealing Desk intervention | No Dealing Desk intervention | No Dealing Desk intervention | No Dealing Desk intervention | No Dealing Desk intervention |

| Stop out | 50% | 50% | 50% | 50% | 50% |

| Available leverage | Up to 1:200 (varies based on the country of residence of the trader) | Up to 1:200 (varies based on the country of residence of the trader) | Up to 1:200 (varies based on the country of residence of the trader) | Up to 1:200 (varies based on the country of residence of the trader) | Up to 1:200 (varies based on the country of residence of the trader) |

HF Markets

Regulated by over 30 control bodies to offer over 2.5 million clients the utmost in security and clarity in trading, HFM is undoubtedly one of the most popular and clicked online brokers in the world.

HF Markets offers a well-structured environment rich in numerous investment solutions, adaptable to any style or trading need. Investments in forex, metals, indices, stocks, commodities, ETFs, bonds, and cryptocurrencies with advantageous conditions and a wide range of instruments and functions for trading to the best of one’s ability.

Furthermore, the broker firmly believes in trading based exclusively on knowledge and field experience. For this reason, the broker offers access to an excellent learning section that includes both basic notions and information for creating more complex strategies.

| Characteristics | HF Markets |

|---|---|

| Regulations | CySEC Cyprus Securities and Exchange Commission – FCA Financial Conduct Authority (UK) – DFSA Dubai Financial Services Authority – Financial Sector Authority (FSCA) – Financial Services Authority of the Seychelles (FSA) + 29 national regulatory bodies |

| Demo Account | Available |

| Minimum Deposit | Zero (varies based on the selected account) |

| Maximum Leverage | 1:2000 (varies based on the instrument and the country of residence of the trader) |

| Platforms | MetaTrader 4, MetaTrader 5, Webtrader, Mobile Trading, and HFM Platform |

| Negative Balance Protection | Available |

| Available Instruments | Forex, Metals, Stocks, Bonds, Indices, Energy, Commodities, Cryptocurrencies, and ETFs |

| Social Trading and Copy Trading | Available |

| Stop Out Level | Starting at 20% (varies based on the account and country of residence) |

| Margin Call | Starting at 50% (varies based on the account and country of residence) |

| Spreads | Variable starting from 0.0 pips (varies based on the type of account) |

| Trading Commissions | Starting from zero (varies based on the account) |

| Deposit Commissions | None |

| Withdrawal Commissions | Vary based on the selected payment method |

| Available Accounts | Standard Account, ECN Account, Cent Account |

| Swap-Free Account (Islamic Account) | Available |

| Educational Material | Available |

| Promotions and Contests | Available (availability depends on the region and country of residence) |

List of HF Markets Accounts

| Characteristics | Zero Account | Premium Account | Pro Account | Cent Account |

|---|---|---|---|---|

| Available platforms | MetaTrader 4, MetaTrader 5, Webtrader, and mobile app | MetaTrader 4, MetaTrader 5, Webtrader, and mobile app | MetaTrader 4, MetaTrader 5, Webtrader, and mobile app | MetaTrader 4, MetaTrader 5, Webtrader, and mobile app |

| Spreads | Variable starting from 0.0 pip | Variable starting from 1.2 pip | Variable starting from 0.6 pip | Variable starting from 1.2 pip |

| Contract size | 1 lot equals 100,000 units | 1 lot equals 100,000 units | 1 lot equals 100,000 units | 1 lot equals 1,000 units |

| Available instruments for trading | CFD on forex, metals, indices, stocks, commodities, ETFs, bonds, and cryptocurrencies | CFD on forex, metals, indices, stocks, commodities, ETFs, bonds, and cryptocurrencies | CFD on forex, metals, indices, stocks, commodities, ETFs, bonds, and cryptocurrencies | CFD on forex, metals, indices, stocks, commodities, ETFs, bonds, and cryptocurrencies |

| Fifth decimal | Yes | Yes | Yes | Yes |

| Maximum leverage | Up to 1:2000 (varies based on the country of residence of the trader) | Up to 1:2000 (varies based on the country of residence of the trader) | Up to 1:2000 (varies based on the country of residence of the trader) | Up to 1:2000 (varies based on the country of residence of the trader) |

| Execution | Market | Market | Market | Market |

| Minimum required deposit | None | None | $100 – ₦50,000 – €100 – ¥13,000 | Zero |

| Minimum trading size | 0.01 LOT (1,000 units of base currency) | 0.01 LOT (1,000 units of base currency) | 0.01 LOT (1,000 units of base currency) | 0.01 LOT (1,000 units of base currency) |

| Maximum total trading size | 60 standard lots per position | 60 standard lots per position | 60 standard lots per position | 200 Cent Lots per position – 500 Cent Lots total per account |

| Maximum number of open orders simultaneously | 500 | 500 | 500 | 150 |

| Margin Call | 50% | 50% | 50% | 50% |

| Stop out | 20% | 20% | 20% | 20% |

| Telephone trading | Available | Available | Available | Available |

| Currency available for account | USD, EUR, NGN, JPY | USD, EUR, NGN, JPY | USD, EUR, NGN, JPY | USD |

| Personal account manager | Available | Available | Available | Available |

| Trading commissions | Variable starting from $0.03 per lot | Zero | Zero | Zero |

| Islamic account option without swap | Available | Available | Available | Available |

XM

One of the most popular brokers in the world with over 15 million clients and a total of 8.5 billion transactions executed on the markets, XM is one of the most powerful and efficient brokers in the world that allows trading on Forex, CFDs on cryptocurrencies, stocks, commodities, indices, metals, and energy products with extremely competitive trading conditions. Obviously regulated by multiple control bodies to ensure a safe service to traders worldwide, XM ensures maximum transparency and protection of funds and sensitive data.

| Characteristics | HF Markets |

|---|---|

| Regulations | CySEC Cyprus Securities and Exchange Commission – FCA Financial Conduct Authority (UK) – ASIC Trading Point of Financial Instruments Pty Limited (Australia) – BAFIN Federal Financial Supervisory Authority – CNMV National Securities Market Commission – MNB Hungarian National Bank – CONSOB National Commission for Companies and the Stock Exchange – ACPR French Prudential Supervision and Resolution Authority – FIN-FSA Finnish Financial Supervisory Authority – KNF Polish Financial Supervision Authority – AFM Netherlands Authority for the Financial Markets – FI Swedish Financial Supervisory Authority |

| Demo Account | Available |

| Minimum Deposit | Starting from $5 (varies based on the selected account) |

| Maximum Leverage | 1:1000 (varies based on the instrument and the country of residence of the trader) |

| Platforms | MetaTrader 4, MetaTrader 5, Webtrader, Mobile Trading XM |

| Negative Balance Protection | Available |

| Available Instruments | Forex, Metals, Stocks, Indices, Energy, Commodities, Cryptocurrencies |

| Social Trading and Copy Trading | Available |

| Stop Out Level | Starting at 20% (varies based on the account and country of residence) |

| Margin Call | Starting at 50% (varies based on the account and country of residence) |

| Spreads | Variable starting from 0.6 pips (varies based on the type of account) |

| Trading Commissions | Starting from zero (varies based on the account) |

| Deposit Commissions | None |

| Withdrawal Commissions | Vary based on the selected payment method |

| Available Accounts | Standard Account, Micro Account, Cent Account, XM Ultra Low Account, Shares Account |

| Swap-Free Account (Islamic Account) | Available |

| Educational Material | Available |

| Promotions and Contests | Available (availability depends on the region and country of residence) |

Available Accounts with XM

| Characteristics | Micro Account | Standard Account | Ultra Low Account | Shares Account |

|---|---|---|---|---|

| Base currency for account | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR | EUR, USD, GBP, AUD, ZAR, SGD | USD |

| Contract size | 1 Lot = 1,000 | 1 Lot = 100,000 | Standard Ultra: 1 Lot = 100,000 – Micro Ultra: 1 Lot = 1,000 | 1 Share |

| Max leverage | Up to 1000:1 | Up to 1000:1 | Up to 1000:1 | Not available |

| Protection from negative balance | Available | Available | Available | Available |

| Spreads | Variable starting from 1 pip | Variable starting from 1 pip | Variable starting from 0.6 pip | As per underlying exchange |

| Trading commissions | Zero | Zero | Zero | Variable based on the selected instrument |

| Maximum number of open orders – pending | 300 positions | 300 positions | 300 positions | 50 positions |

| Minimum volume of trading | 0.1 Lots | 0.1 Lots | Standard Ultra: 0.01 Lots – Micro Ultra: 0.1 Lots | 1 Lot |

| Lot limit per ticket | 100 Lots | 100 Lots | Standard Ultra: 50 Lots – Micro Ultra: 100 Lots | Varies depending on the selected instrument |

| Hedging | Allowed | Allowed | Not allowed | Not allowed |

| Swap | Yes | Yes | No | No |

| Islamic account | Optional | Optional | Optional | Yes |

| Minimum deposit | $5 | $5 | $5 | $10,000 |

In conclusion, these top five brokers distinguish themselves by offering robust trading platforms, diverse financial instruments, and client-centric services that prioritize security and transparency. Their commitment to regulatory compliance and customer support reassures traders of a reliable trading environment. With options for traders of all experience levels, these brokers ensure accessibility and competitiveness in the global markets. Their ability to provide quick and secure financial transactions and a variety of account options solidifies their reputation as preferred choices for traders seeking dependable online brokerage services. Overall, these brokers exemplify what it means to combine technological innovation with trader security and convenience.

FAQs of this article

- What factors make a broker desirable for traders?

- Factors include quick and unrestricted execution of deposits and withdrawals, data security, a wide range of trading instruments, superior trading conditions, cutting-edge platforms, and transparent fee structures.

- Why are rapid deposits crucial for traders?

- Rapid deposits allow traders to take immediate advantage of trading opportunities or to cover positions in volatile markets, enhancing their trading strategy effectiveness.

- What encourages traders to invest with a broker?

- Having the ability to withdraw funds anytime without restrictions encourages traders to invest more with a broker, knowing they can access their money easily.

- How do fast and secure transactions affect a trader’s choice of broker?

- Efficient transaction processes that allow for speedy deposits and withdrawals with high security are a primary reason for traders choosing a particular broker.

- What standards do brokers claim to meet regarding deposit/withdrawal services?

- Many brokers claim to offer efficient deposit/withdrawal services, but only a few actually ensure transactions are both rapid and secure, which is crucial for traders.

- Who are considered the top brokers for easy and secure deposits/withdrawals?

- The top brokers known for easy and secure deposits and withdrawals include Deriv, easyMarkets, HFM, LiteFinance, and eToro.