Categories

VTMarkets vs. XM: Comprehensive Broker Comparison and Which One to Choose

Explore the detailed comparison between VTMarkets and XM, covering their bonuses, trading platforms, and regulatory status to determine the best FX broker.

VTMarkets, a newer FX broker started in 2020, offers distinct features such as bonuses and a points program, comparing itself to XM, an established broker from 2010. While VTMarkets forms partnerships with entities like Maserati MSG Racing in Formula E, XM has longstanding associations with major brands including Visa. Financially, VTMarkets is licensed in multiple regions including Austria and South Africa, suggesting a broad regulatory acceptance compared to XM’s select licenses. The comparison extends to trading conditions where VTMarkets allows for high leverage and diverse account options, but XM generally offers more extensive services like higher bonuses and a wider range of trading instruments. Overall, XM is recommended for its more comprehensive offerings and reliability due to its longer history and broader regulatory approval.

| Feature | VTMarkets | XM |

|---|---|---|

| Year Established | 2020 | 2010 |

| Partnerships | Maserati MSG Racing | Visa Cash Up RB |

| Financial Licenses | Austria, South Africa, Mauritius | Selective global licenses |

| Trading Instruments | 900+ assets | Extensive, including 55+ cryptocurrencies |

| Leverage | 500x | 1000x |

| Bonuses | Up to $10,000 deposit bonus | Higher bonuses + loyalty points |

| Account Types | Standard, Raw | Standard, Micro, Zero, Kiwami |

| Minimum Deposit | $100 | $5 |

| Automated Trading | Supports Copy Trading, PAMM, MAM | Not available |

| Trading Platforms | MT4, MT5, WebTrader | MT4, MT5 |

| Swap-Free Accounts | Available for almost all assets | Available for selected assets |

| Deposit Methods | Credit Card, Bank Transfer, Crypto | Credit Card, Bank Transfer |

| Overall Recommendation | Best for traders interested in emerging brokers and automation | Best for comprehensive services and reliability |

Clearly Explaining the Features of VTMarkets

We will clearly explain what kind of FX broker VTMarkets is.

VTMarkets offers bonuses and a points program, so we will compare it with XM / XMTrading, which has similar features.

First, we compare VTMarkets and XM based on differences in corporate image related to partnerships and financial licenses.

Differences in Years of Operation Between VTMarkets and XM

VTMarkets started its operations around 2020.

| Comparison Item | VTMarkets | XM |

|---|---|---|

| Year Established | 2020 | 2010 |

| Recommended Level | +0 Points | +1 Point |

If you prefer an FX broker with a longer history of operation, XM is recommended.

Differences in Partnerships Between VTMarkets and XM

VTMarkets has partnered with Maserati MSG Racing.

| Comparison Item | VTMarkets | XM |

|---|---|---|

| Partnerships | Maserati MSG Racing | Visa Cash Up RB |

| Recommended Level | +0 Points | +0 Points |

VTMarkets has been partnering with ‘Maserati MSG Racing,’ a team in Formula E, often called the electric F1, since 2023.

Differences in Financial Licenses & Regulations Between VTMarkets and XM

VTMarkets has obtained financial licenses in Austria, South Africa, and Mauritius.

| Financial License | VTMarkets | XM |

|---|---|---|

| Mauritius FSC | Obtained | Obtained |

| Austria ASIC | Obtained | Not Obtained |

| South Africa FSCA | Obtained | Not Obtained |

| Seychelles FSA | Not Obtained | Obtained |

| Recommended Level | +2 Points | +1 Point |

If you prefer a broker with more financial licenses and regulations, VTMarkets is recommended.

Differences in Methods of Managing Trader’s Margin Between VTMarkets and XM

The method of managing trader’s margin at VTMarkets is segregated management.

| Security | VTMarkets | XM |

|---|---|---|

| Method of Managing Margin | Segregated Management | Segregated Management |

| Recommended Level | +0 Points | +0 Points |

If you have any questions about segregated management at VTMarkets, please contact VTMarkets Customer Support.

Next, we compare VTMarkets and XM as bonus brokers.

Differences in Bonus Amounts Between VTMarkets and XM

At VTMarkets, you can receive a total of $10,000 in bonuses just for opening an account and making a deposit.

| Bonus | VTMarkets | XM |

|---|---|---|

| Account Opening Bonus | (None) | $90 |

| 100% Deposit Bonus | Up to $500 on First Deposit | Total $500 |

| 20% Deposit Bonus | Total $9,500 | Total $10,000 |

| Recommended Level | +0 Points | +3 Points |

Since the total bonus amount, including the account opening bonus (no deposit bonus) and the 100% deposit bonus, and the 20% deposit bonus, is high, XM is recommended.

Differences in Points Programs Between VTMarkets and XM

VTMarkets offers a points program called Club Blue.

| Points | VTMarkets | XM |

|---|---|---|

| Acquisition Rate | 100 points per lot | Up to 20 XMP per lot |

| Redemption Rate | (Varies) | 1 dollar for every 3 XMP |

| Recommended Level | +0 Points | +1 Point |

For a constant redemption rate and clarity of the program content, XM is recommended.

From here, we compare VTMarkets and XM in terms of the most important trading environment and conditions for FX trading.

Differences in Handled Brands Between VTMarkets and XM

At VTMarkets, you can trade over 900 brands in 8 categories from one FX account.

| Category | VTMarkets | XM |

|---|---|---|

| FX Currency Pairs | Over 40 pairs | Over 50 pairs |

| Precious Metals | Over 5 brands | Over 5 brands |

| Energy | Over 5 brands | Over 5 brands |

| Commodities | Over 5 brands | Over 5 brands |

| Stock Indices | Over 15 brands | Over 20 brands |

| Stocks | Over 800 companies | Over 1,300 companies |

| Bonds | Over 5 brands | (Not tradable) |

| ETFs | Over 50 brands | (Not tradable) |

| Cryptocurrencies | (Not tradable) | Over 55 pairs |

| Recommended Level | +2 Points | +4 Points |

For traders who prefer a wide range of handled brands, XM is recommended.

Differences in Maximum Leverage Between VTMarkets and XM

The maximum leverage at VTMarkets is 500 times.

| Comparison Item | VTMarkets | XM |

|---|---|---|

| Maximum Leverage | 500 times | 1,000 times |

| Recommended Level | +0 Points | +1 Point |

For traders who want even a slight increase in leverage for FX trading, XM is recommended.

Differences in Leverage by Brand Between VTMarkets and XM

The leverage at VTMarkets varies by brand.

Below is a table comparing the most popular trading brands and their maximum leverage at VTMarkets and XM.

| Trading Brand | VTMarkets | XM |

|---|---|---|

| USD/JPY | 500 times | 1,000 times |

| Gold | 500 times | 1,000 times |

| WTI Crude Oil | 333 times | 200 times |

| Nikkei Stock Average | 500 times | 500 times |

| US Stocks | 20 times | 20 times |

| Bitcoin | (Not tradable) | 500 times |

| Recommended Level | +1 Point | +3 Points |

If you want to trade popular brands like USD/JPY, gold, and the Nikkei Stock Average with less margin required, XM is recommended.

Differences in Trading Platforms Between VTMarkets and XM

The trading platforms at VTMarkets include MT4, MT5, and WebTrader.

| Trading Platform | VTMarkets | XM |

|---|---|---|

| MT5 | Supported | Supported |

| MT4 | Supported | Supported |

| WebTrader | Supported | Supported |

| Recommended Level | +0 Points | +0 Points |

Both VTMarkets and XM support MT4 (MetaTrader 4) and MT5 (MetaTrader 5).

Differences in Account Types Between VTMarkets and XM

The account types at VTMarkets are either a “standard account with no transaction fees” or a “raw account with transaction fees but narrower spreads.”

| Account Type | VTMarkets | XM |

|---|---|---|

| Standard Account | Standard STP Account | Standard Account |

| Micro Account | (None) | Micro Account |

| Pro Account | (None) | KIWAMI Extreme Account |

| Superior Account | Raw ECN Account | XM Zero Account |

| Recommended Level | +0 Points | +2 Points |

VTMarkets has a simple choice of two account types.

VTMarkets does not have popular automated trading micro accounts or the KIWAMI extreme account with no transaction fees and narrow spreads like XM.

If you prefer a variety of account types, XM is recommended.

Differences in Transaction Fees for Superior Accounts Between VTMarkets and XM

The superior account at VTMarkets, which incurs transaction fees, is the Raw ECN account.

| Account Type | VTMarkets | XM |

|---|---|---|

| Standard Account | No Transaction Fees | No Transaction Fees |

| Micro Account | (Cannot Open) | No Transaction Fees |

| Pro Account | (Cannot Open) | No Transaction Fees (KIWAMI Extreme Account) |

| Superior Account | $6 per lot | $10 per lot |

| Recommended Level | +1 Point | +0 Points |

If you are choosing based on the lowest transaction fees for superior accounts, VTMarkets is recommended.

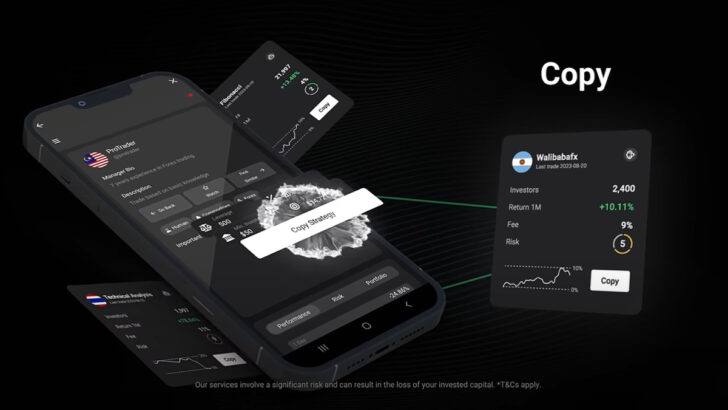

Differences in Automated Trading Between VTMarkets and XM

At VTMarkets, you can engage in automated trading such as copy trading, PAMM, and MAM.

| Comparison Item | VTMarkets | XM |

|---|---|---|

| Copy Trading | Provided | Not Provided |

| PAMM Account | Provided | Not Provided |

| MAM Account | Provided | Not Provided |

| Recommended Level | +3 Points | +0 Points |

At VTMarkets, you can engage in copy trading called VTrade.

Differences in Swap-Free Options Between VTMarkets and XM

At VTMarkets, even general traders can open a swap-free account.

| Comparison Item | VTMarkets | XM |

|---|---|---|

| Swap-Free | Supported | Supported |

| Target Brands | Almost All | FX Precious Metals Energy Stock Indices |

| Recommended Level | +1 Point | +0 Points |

VTMarkets does not clearly disclose the target brands for swap-free trading like XM and exness.

When trading swap-free at VTMarkets, please contact VTMarkets Customer Support as needed.

Differences in Demo Accounts Between VTMarkets and XM

At VTMarkets, you can open a demo account.

| Comparison Item | VTMarkets | XM |

|---|---|---|

| Demo Account | Can be Opened | Can be Opened |

| Recommended Level | +0 Points | +0 Points |

A demo account is for practice virtual trading, so profits cannot be withdrawn.

Differences in Account Currency Units Between VTMarkets and XM

At VTMarkets, you can choose currency units for your account beyond just Japanese yen or US dollars.

| Account Currency Unit | VTMarkets | XM |

|---|---|---|

| Japanese Yen Account | Can be Opened | Can be Opened |

| US Dollar Account | Can be Opened | Can be Opened |

| Euro Account | Can be Opened | Can be Opened |

| Australian Dollar Account | Can be Opened | Cannot be Opened |

| Canadian Dollar Account | Can be Opened | Cannot be Opened |

| Pound Account | Can be Opened | Cannot be Opened |

| Recommended Level | +3 Points | +0 Points |

For traders who want to deposit in Australian dollars, Canadian dollars, or British pounds, VTMarkets is recommended.

Differences in Deposit Methods Between VTMarkets and XM

At VTMarkets, you can deposit using credit cards or bank transfers.

| Deposit Method | VTMarkets | XM |

|---|---|---|

| Credit Card | Depositable | Depositable |

| Debit Card | Depositable | Depositable |

| Bank Transfer | Depositable | Depositable |

| Cryptocurrency | Depositable | Not Depositable |

| Online Wallet | Depositable | Depositable |

| Recommended Level | +1 Point | +0 Points |

For traders who want to deposit using cryptocurrencies like Bitcoin, VTMarkets is recommended.

Differences in Minimum Deposit Amounts Between VTMarkets and XM

The minimum deposit amount at VTMarkets is approximately $100.

| Minimum Deposit Amount | VTMarkets | XM |

|---|---|---|

| Japanese Yen | Approximately 15,000 yen | 750 yen |

| US Dollar | $100 | $5 |

| Recommended Level | +0 Points | +1 Point |

For traders who want to start FX trading with a small amount, XM is recommended.

Comparing Overall Points Between VTMarkets and XM

Below are the results of comparing VTMarkets and XM based on points.

| Comparison Item | VTMarkets | XM |

|---|---|---|

| Points | 14 Points | 19 Points |

Although VTMarkets also offers a $10,000 deposit bonus, it is recommended for traders who have used up bonuses at XM or are interested in emerging brokers.

For Forex beginners, XM, with higher overall points, is recommended.

FAQs to summarize the article

- What is VTMarkets?

- VTMarkets is a relatively new FX broker established in 2020, offering a range of trading features including bonuses and a unique points program.

- How does VTMarkets compare to XM in terms of financial licenses?

- VTMarkets is licensed in multiple countries including Austria and South Africa, whereas XM has a more limited but significant licensing portfolio.

- What bonuses do VTMarkets and XM offer?

- VTMarkets offers up to $10,000 in bonuses based on deposits, while XM provides similar bonuses plus a loyalty points system.

- Can I trade cryptocurrencies with VTMarkets or XM?

- VTMarkets does not currently offer cryptocurrency trading, whereas XM provides options to trade over 55 cryptocurrency pairs.

- What account types are available with VTMarkets and XM?

- VTMarkets offers standard and raw accounts, while XM offers a more varied range including micro and zero accounts.

- What is the minimum deposit required at VTMarkets and XM?

- VTMarkets has a minimum deposit requirement of $100, while XM allows traders to start with as little as $5.

- Do VTMarkets and XM support automated trading?

- VTMarkets supports a range of automated trading options including copy trading, while XM does not provide these features.

- Which broker is recommended for swap-free accounts?

- Both brokers offer swap-free accounts, but VTMarkets offers this for almost all brands compared to XM’s more limited range.

- What trading platforms are supported by VTMarkets and XM?

- Both brokers support popular platforms like MT4 and MT5, catering to a wide range of trading preferences.

- Which broker is better for experienced traders?

- XM is generally recommended for experienced traders due to its comprehensive service offerings and higher overall points in comparisons.

Latest Features

- Close