Question: Is JDRSecurities a safe and legit broker? Is it regulated?

JDR Securities, incorporated in St. Vincent and the Grenadines, is monitored by the Financial Services Authority and offers robust security measures through technologies like MetaTrader 4, ensuring client data and transaction safety. The firm’s affiliation with the Financial Commission provides a compensation fund of up to €20,000 per client, enhancing trust and financial security. JDR Securities offers competitive trading conditions with spreads as low as 0.0 pip and leverage up to 1:400, accommodating both conservative and aggressive trading strategies. Various account types are available, including Standard and Pro accounts, which cater to different levels of traders with options for low spreads and zero commissions. Deposits and withdrawals are streamlined through multiple methods, including digital payments and e-wallets, providing convenience and efficiency for global traders.

Invest in Forex with JDRSecurities

JDR Securities Review: Secure, Flexible Trading Environment for Global Traders

Discover JDR Securities’ secure trading platform, offering variable spreads, high leverage, and strong client protection mechanisms.

| Aspect | Details |

|---|---|

| Regulation | Incorporated in St. Vincent and the Grenadines, overseen by the FSA, affiliated with the Financial Commission. |

| Security | Advanced technological safeguards, use of MetaTrader 4 with encryption and secure communication protocols. |

| Client Protection | Compensation fund up to €20,000 per case through the Financial Commission. |

| Trading Conditions | Spreads from 0.0 pip, no minimum deposit required, leverage up to 1:400. |

| Platform and Tools | MetaTrader 4 platform, real-time data feeds, technical analysis tools, educational resources. |

| Deposit and Withdrawal Options | Bank transfers, digital payments, e-wallets like Neteller and Skrill, low to zero commissions. |

| Account Types | Standard and Pro accounts with low spreads and zero commission options. |

Trade with confidence at JDR Securities – where security meets innovation in forex and CFD trading!

JDR Securities has emerged as an international brokerage firm that facilitates trading in forex, commodities, and indices. With competitive trading conditions, including variable spreads and zero commissions, it caters to a diverse clientele, from beginners to experienced traders. This article delves into the regulatory framework, security measures, and client protection mechanisms that define JDR Securities’ operations.

Regulatory Framework

JDR Securities is incorporated in St. Vincent and the Grenadines under the registration number 26326 BC 2021, overseen by the Registrar of International Business Companies and monitored by the Financial Services Authority (FSA). This incorporation ensures that the broker operates under a recognized legal framework which mandates transparency and client protection. Additionally, JDR Securities is affiliated with the Financial Commission, enhancing its commitment to uphold investor protection through dispute resolution and compensation schemes.

Invest in Forex with JDRSecurities

Security Measures

Security is paramount at JDR Securities, especially given the digital nature of trading. The brokerage employs state-of-the-art technological safeguards to protect client data and financial transactions. The use of the MetaTrader 4 platform further underscores this, as it is renowned for robust security features including data encryption and secure communication protocols. Clients are assured of the integrity of their trading operations and the safeguarding of their personal and financial information.

Client Protection Mechanisms

One of the standout features of JDR Securities’ approach to client safety is its participation in a compensation fund managed by the Financial Commission. This fund provides coverage of up to €20,000 per case if a member broker fails to meet its financial obligations to a client. Such a mechanism is crucial for enhancing client confidence and providing an additional layer of financial security.

Invest in Forex with JDRSecurities

Trading Conditions

Clients of JDR Securities benefit from one of the most competitive trading environments in the industry. With spreads starting as low as 0.0 pip and no minimum deposit required to open an account, the firm makes trading accessible to a wide range of investors. The broker supports various trading strategies and styles by offering leverage up to 1:400, thereby catering to both conservative and aggressive traders.

Platform and Tools

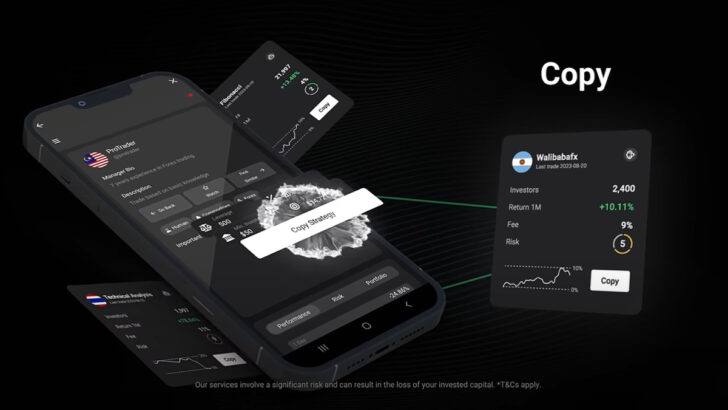

JDR Securities provides its clients access to the widely acclaimed MetaTrader 4 platform, known for its user-friendly interface and extensive functionality. Whether trading from a desktop or through a mobile application, users have robust tools at their disposal for market analysis, including real-time data feeds, technical analysis tools, and customizable charts. Additionally, the broker offers educational resources to aid clients in refining their trading skills and strategies.

Invest in Forex with JDRSecurities

Deposits and Withdrawals

The broker supports a variety of deposit and withdrawal methods, ensuring flexibility and convenience for its clients. These methods include bank transfers, digital payments, and popular e-wallets like Neteller and Skrill, with most offering instant processing times and low to zero commissions. This flexibility supports traders in managing their funds efficiently and effectively.

Account Types

JDR Securities offers multiple account types to suit various trading preferences and strategies. Both the Standard and Pro accounts feature competitive conditions, such as low spreads and the option for zero commissions. This tailored approach ensures that both novice traders and seasoned professionals can find a suitable trading environment that aligns with their investment goals and trading style.

In conclusion, JDR Securities provides a secure and regulated trading environment that is both flexible and accessible to traders worldwide. By adhering to regulatory standards, implementing rigorous security protocols, and offering robust client protection measures, JDR Securities stands out as a reliable broker for engaging with the global financial markets. Prospective and existing traders can benefit from the firm’s comprehensive offerings, ensuring a trading experience that is both efficient and reassuring.

Invest in Forex with JDRSecurities

FAQs

- What regulatory body oversees JDR Securities?

- JDR Securities is monitored by the Financial Services Authority of St. Vincent and the Grenadines.

- What security measures does JDR Securities employ?

- It uses MetaTrader 4 with data encryption and secure communication protocols to protect client information and transactions.

- What client protection mechanisms are in place?

- JDR Securities participates in a compensation fund that covers up to €20,000 per client case.

- What are the typical trading conditions at JDR Securities?

- The broker offers spreads starting at 0.0 pip and leverage up to 1:400, with no minimum deposit required.

- What trading platform is available?

- Clients have access to MetaTrader 4, known for its extensive functionality and user-friendly interface.

- How can I make deposits and withdrawals?

- Deposits and withdrawals can be made via bank transfers, digital payments, and e-wallets, with most methods offering instant processing times.

- What types of accounts does JDR Securities offer?

- The broker offers Standard and Pro accounts, tailored to different trading needs and preferences.

- Are there educational resources available?

- JDR Securities provides comprehensive educational resources including webinars, articles, and training modules.

- Is there a minimum deposit required to open an account?

- No, JDR Securities does not require a minimum deposit to open an account, making it accessible to a wide range of traders.

- What kind of trading strategies does JDR Securities support?

- The broker supports various trading strategies and styles by offering different types of accounts and high leverage options.

Latest Features

- Close