Categories

How to Invest with Bybit - Copy Trading, Automated Strategies, and other profitable opportunities

Explore Bybit’s crypto trading platform with P2P trading, copy trading, AI-driven market insights, staking rewards, and automated strategies.

Bybit is a leading cryptocurrency exchange offering various investment options, including P2P trading, copy trading, and AI-driven TradeGPT analysis. The platform provides leverage up to 1:100 and allows trading on multiple assets with minimal fees and secure transactions. Bybit’s automated trading bots, including Grid, DCA, and Martingale strategies, enable traders to execute trades efficiently. Users can also benefit from staking services, on-chain earnings, and an automated market maker system to enhance liquidity. With high security standards, 24/7 multilingual support, and innovative investment tools, Bybit stands out as a comprehensive platform for crypto traders.

Open an investment account with bybit

| Feature | Details |

|---|---|

| Investment Options | P2P Trading, Copy Trading, AI-Powered TradeGPT, Trading Bots, Asset Conversion |

| Leverage | Up to 1:100 |

| Trading Fees | Starting from 0.015% |

| Security Features | KYC Verification, Cold Wallet Storage, Two-Factor Authentication |

| Minimum Deposit | Starting from $1 |

| Supported Trading Platforms | Proprietary Platform, TradingView, MT5 |

| Available Assets | BTC/USD, ETH/USD, XRP/USD, Derivatives, Futures |

| Automated Trading | Trading Bots (Grid, DCA, Martingale), AMM, TradeGPT AI |

| Staking Services | On-Chain Earn, PoS Staking, Flexible & Fixed APRs |

| Customer Support | 24/7 Multilingual Support |

Bybit

| Features | Details |

|---|---|

| Virtual Asset Regulatory Authority | Dubai – National Bank of Georgia – Astana Financial Services Authority, Kazakhstan |

| Available Instruments | BTC/USD, ETH/USD, XRP/USD, EOS/USD and BTC/USDT, USDT: ETH/USDT, LINK/USDT, LTC/USDT, XTZ/USDT – Derivatives – Futures |

| Trading Platforms | Proprietary platform, TradingView, MT5 |

| Minimum Deposit | Starting from USD 1 |

| Leverage | Up to 1:100 |

| Spread | Variable starting from 0.1 pips |

| Trading Fees | Starting from 0.0150 % |

| Leveraged Token Fees | Starting from: minimum subscription amount 100 USDT up to maximum subscription amount 5000 |

| Deposit/Withdrawal Fees | Deposit: Zero Withdrawal: starting from zero, varies based on country of residence and payment method |

| Account Types | Standard account, demo account |

| Negative Balance Protection | No |

| Customer Support | 24/7 Multilingual |

| Security Measures | Two-factor authentication – Verification (KYC) – Successful hack – Cold wallet storage – Investor protection fund |

| PAMM – MAM Accounts | Not available |

| Minimum – Maximum Order | Not available |

| Stop out | Not available |

| Margin call | Not available |

| Contests and Bonuses | Offered periodically but for a short time |

| Order Execution | Market, limit, conditional |

| Liquidity Provider | No |

| Affiliate Program | Yes |

| Account Currency | Cryptocurrencies |

| Deposit – Withdrawal Methods | Bank transfer, PayPal, Visa/Mastercard, Cryptocurrencies, Advcash Wallet, Google Pay, Apple Pay |

Open an investment account with bybit

Renowned for crypto investments, Bybit has distinguished itself from the start for the high quality of the service offered, excellent security standards, and numerous interesting and advantageous investment solutions. Undoubtedly one of the best cryptocurrency exchanges on the financial market.

Extremely popular for derivative trading with leverage up to 1:100 (unusually high) and for the wide list of innovative instruments and functions, Bybit allows traders to trade on a wide range of products, including BTC/USD and ETH/USD, on technologically advanced platforms with a very intuitive interface.

To optimize the work of customers and make each trading experience engaging, the exchange offers customers innovative investment solutions based on artificial intelligence, staking options, a dedicated section for copy trading, and much more.

Bybit allows traders to activate an account and start trading with deposits starting from 1 USD and presents a clear and transparent fee structure that allows customers to know any costs to be incurred simply by accessing the relevant area.

Despite less regulatory oversight compared to traditional brokers, Bybit guarantees customers an environment with very high levels of security, allowing traders to focus exclusively on executing operations.

With 24/7 customer support, an excellent list of available accounts, innovative tools, and effective investment solutions, Bybit offers high-performance but flexible crypto trading, given the extremely advantageous trading conditions.

In this article, we will clarify why it is advantageous to invest with Bybit, illustrating all the most innovative services and trading methods.

Peer-to-peer (P2P) Bybit

The Peer-to-peer (P2P) offered by Bybit is a platform that simplifies the buying and selling operations of shares between two (2) users at an optimal and agreed price.

In practice, P2P crypto trading is a popular method of buying and selling cryptocurrencies that allows direct online interaction between various users without the intervention of any intermediaries. Through the platform, traders will be able to access the markets, use numerous payment options, and access interesting offers

In addition to allowing direct contact for sales and purchase operations, the platform guarantees customers high levels of protection, with secure transactions and minimal fraud risks. Every trader has the opportunity to consult the crypto ads and publish their own with the utmost security, guaranteed by excellent feedback and rating systems.

Furthermore, to further optimize transparency and the security standards offered, the Exchange uses an escrow service to protect the cryptocurrencies bought and sold until the transaction is confirmed by both parties. For example, a trader decides to sell Bitcoin for fiat, Bybit will hold his Bitcoins (BTC) in escrow. Once the fiat funds are received, the transaction can be confirmed and the BTC will be credited to the buyer’s wallet.

Main advantages of Bybit’s P2P trading

- No commission

- The Exchange will not charge any commission for using the service, drastically lowering the entry barrier and allowing customers to keep a larger share of their cryptocurrencies.

- More currencies and payment methods

- With the aim of providing greater flexibility to traders, there are over 600 payment methods and more than 370 currencies available.

- High levels of security.

- To guarantee customers a safe environment for trading, Bybit requires traders to undergo a KYC verification process, through which both buyers and advertisers must prove their identity and country of origin, submitting the necessary documentation. P2P advertisers are also chosen based on strict control criteria. With the aim of preventing fraud and ensuring the security of customer funds, the exchange conducts strict protocols for proper asset management.

P2P Block

An innovative decentralized method that allows interested parties to buy or sell large amounts of cryptocurrencies with fiat currencies directly. The P2P block is ideal for a quick and secure execution of P2P orders.

- Quick and advantageous: all operations are carried out quickly and with maximum efficiency, excluding inconveniences caused by multiple orders or nerve-wracking waits for the exchange’s matching.

- Price slippage reduced to a minimum: direct negotiation of a price drastically reduces the risk of slippage, ensuring that the execution price is as close as possible to the desired level.

- No commission.

- no commission will be charged for P2P blocks, allowing traders to keep a larger share of their cryptocurrencies for use in investments.

- More security.

- Strict security procedures for customer identification and high security standards regarding asset management.

- Competitive trading limits.

- The P2P Block platform offered by Bybit has a unique minimum order limit of 10,000 USDT and a unique maximum order limit of 200,000 USDT. It should be noted that actual trading limits may vary based on the specific settings of the advertiser.

Open an investment account with bybit

One-click Trading Bybit

A feature as innovative as it is advantageous, considered indispensable by customers for trading on highly volatile markets such as crypto, one-click trading allows traders to easily purchase cryptocurrencies using fiat currencies. The function is extremely flexible and supports an excellent list of payment methods, including bank cards, Google Pay, Apple Pay, P2P trading, third-party payments, and fiat balance (the payment methods available vary based on: the cryptocurrency, the fiat currency, and the country of residence of the trader).

To be able to use the function and purchase crypto quickly, just follow these steps:

- Select the desired fiat currency and cryptocurrency.

- Enter the purchase amount and choose the most suitable payment method for your needs.

- The purchased crypto will generally be credited to the customer’s account within 10 minutes (but in some cases it may take up to 48 hours)

Access the crypto markets with Bybit

Asset Conversion

With the aim of further perfecting and optimizing the trading experience of each customer, Bybit allows you to convert coins directly on the Exchange’s platform, with any crypto tool supported by spot accounts, on derivative accounts (or inverse derivative accounts), on unified trading accounts, or on the funding account conversion function.

With access to the service, with just a few clicks the customer will be able to instantly convert all the supported crypto into any other asset. There will be no need to manually place orders on the spot market, and the customer will not have to fear any market impacts, resulting from high-volume transactions.

- With access to the service, the customer will not be required to pay any commissions. The quoted credits will be equivalent to the amount of assets that the trader will receive in their account, as soon as the conversion is carried out.

- Conversion operations are usually carried out almost instantaneously. But in the case of unsuccessful conversions, the trader will simply have to try again to carry out the operation which will most likely be executed successfully (since the failure is often not due to a customer error). But if the problem reoccurs, the trader can contact the support team and request assistance.

- The real-time conversion rate is based on the best quote price of several market makers based on the current index price and consequently, may differ from the spot market.

- Every trader will have the opportunity to view the entire conversion history, present in the upper right corner of the Bybit Convert page.

Open an investment account with bybit

To be able to correctly execute a conversion, just follow the next simple steps:

- First step

- In the navigation bar, the trader will need to click on the “Trade” icon and select the “Convert” item. Alternatively: they can also click on the “Convert” icon, visible in the funding account – access the Asset column, visible on the right side of the derivatives page and click on “Convert”.

- Second step.

- On the conversion page the trader will need to:

- Select the account on which you want to perform the conversion. If the trader opts for a Funding Account, the available balance will be used for the conversion. The converted amount will also be credited to the funding account.

- Select the asset you actually want to convert.

- Enter the amount you want to convert. Click on the “Convert” icon.

- Carefully check the accuracy of the data entered and click on “Confirm”.

Useful information:

- It is important to note that the exchange rate will be updated every 15 seconds.

- With a possible cross margin, the action taken by the trader could affect the liquidation price.

- If the trader decides to carry out the conversion from the derivatives trading page, they will need to click on the “Request Quote” button to be able to view the exchange rate before conversion. If the real-time exchange rate and the quoted rate have a difference that exceeds 0.5%, the order will be automatically canceled and it will be necessary to try again.

- Conversion is currently available only through spot accounts, funding accounts, derivatives, inverse derivatives, and unified trading accounts. To access the service, the trader will need to transfer their funds to one of these accounts before proceeding with the conversion.

- Bonus balance cannot be converted into other coins.

- The real-time exchange rate is based on the best quote price of several market makers based on the current index price.

- To be able to know in detail the minimum and maximum transaction limits of each coin, the trader will need to access the official website and visit the page dedicated to the service

Copy Trading

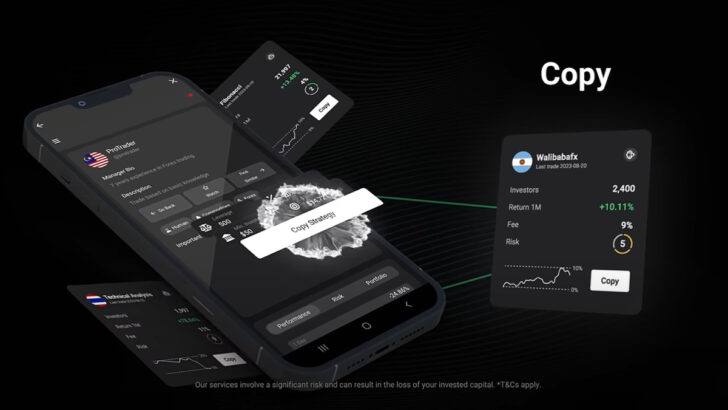

Another service as popular as it is advantageous offered by Bybit, Copy Trading allows traders to follow and copy the operations of traders with proven experience and reap the same benefits. With access to the list of available masters, each customer will be able to choose the most suitable for their style, being able to view every characteristic of the selected master such as: risk propensity, trading volume, commission to be borne, trading preferences, etc.

Access to the platform is totally free, each customer will have to pay any fees only to the masters followed and only if the copied operations are successful. Selecting the master and the strategy to be copied, the operation will be carried out automatically also on the Follower’s (customer’s) account.

- The trader will not have to pay any commission to access the platform. The trading and financing fees will be the same as those applied for trading on Bybit’s Derivatives platform. No additional costs will be charged.

- Every follower will have the opportunity to follow up to 10 masters simultaneously. It is important to underline that the settings and any fees vary from Master to Master. Orders copied from multiple Master Traders will not be cumulative.

Copy the operations of Bybit professionals

TradeGPT

A revolutionary tool based on artificial intelligence, TradeGPT offers customers access to useful information updated in real time and in-depth market analysis, essential for informed trading and making detailed investment decisions. TradeGPT is based on the practical language model of artificial intelligence (AI), ChatGPT, which integrates perfectly with the Bybit platform. The tool allows traders to access a complete set of trading data such as market volume, long and short ratios, sentiment indices, and more.

Main features:

- Automatic market analysis briefing:

- The service allows customers to access a useful automatic summary of the market analysis at the opening, ensuring that the customer remains updated on the latest market trends to be able to make accurate investment decisions.

- Analysis of technical indicators.

- TradeGPT allows customers to understand in detail the functional characteristics of KDJ, RSI, MACD, Bollinger Bands, and other technical indicators, to be used to best negotiate the selected instruments. In addition, using an innovative backtesting service, the trader will be able to test their trading strategy in a simulated environment, using historical data and analyzing the risks and profitability before investing in real markets.

- Intelligent questions and answers with recommended questions:

- Another extremely useful function, “intelligent questions and answers of TradeGPT” allows customers to access recommended questions that will automatically provide immediate and relevant answers. This allows traders to optimize time and receive information without having to consult excessively extensive menus.

- Customizable requests.

- Each customer will have total freedom to request specific information on cryptocurrencies, price forecasts, market trends, and even investment strategies. TradeGPT offers analysis and totally customized answers to any trader’s question.

To be able to access and use the function, just follow the next very simple steps:

- Traders who want to access the service on the official website will need to visit the dedicated page, click on “Tools” in the navigation bar and click on the TradeGPT icon.

- Traders with the app installed on their mobile device can access TradeGPT by clicking on the “More” icon, visible on the home page and selecting TradeGPT.

For users of the Bybit website, it is enough to click on this link or access Tools in the navigation bar of the Bybit page and select TradeGPT. Bybit app users can access TradeGPT by clicking on More on the Bybit home page and selecting TradeGPT.

Open an investment account with bybit

TradeGPT Master Trader: revolutionary

The pinnacle of the TradeGPT service is the innovative Master Trader. The function merges automated trading strategies with Copy Trading. A virtually perfect combination for high-performance trading.

- Data-focused trading

- The service uses technologically advanced algorithms for an investment methodology based exclusively on data, in order to analyze both market trends and patterns with extreme accuracy.

- Proven returns

- The service boasts an excellent track record regarding the percentage of constant returns. A very sought-after feature, especially by traders with a low risk propensity.

- No coding required

- The service completely eliminates the need for coding. This offers a simplified approach in managing operations and allows for the best use of carefully structured strategies without complex programming. In practice, traders from all over the world will be able to use carefully detailed automatic strategies for use in copy trading, without having to engage in accurate analysis, market research, or other time-consuming and experience-required procedures. Both novice and experienced traders will be able to access the service with a few clicks and take advantage of its benefits.

- No profit sharing

- Despite fully automated operations, the customer will always have full control over the profits made. No profit sharing and zero commissions for advantageous and transparent trading.

It is important to note that:

- The exchange is fully aware of how important it is to offer a personalized service that allows customers to receive customized and superior quality responses.

- Every trader will have the opportunity to consult TradeGPT up to 8 times a day.

Access the TradeGPT Master Trader

Trading Bot

Bybit Trading Bot is an innovative platform dedicated to automated cryptocurrency trading that allows traders of any level to trade this extremely volatile market easily, efficiently, and quickly. The platform offers customers a wide range of different solutions, created by experts in the sector with the sole aim of meeting the needs of any trader, regardless of the level of experience or trading preferences. Using automated strategies, the trader will drastically reduce the time needed to create an effective investment plan and will simply be able to earn profits by starting the bot without having to pay any additional costs for the service provided.

As mentioned, the Bybit Trading Bot does not present additional costs. All expenses to be incurred are based on the VIP status of the customer and will be calculated at the actual execution of the orders.

The extremely intuitive interface allows novice traders to easily create their own automatic strategies with pre-configured parameters, thanks to the revolutionary auto-fill function or using high-APR bot parameters. In addition to being able to profit from automated operations, every beginner will have the opportunity to gain experience and refine their trading techniques, constantly analyzing the performance of the bots on the markets.

In addition to creating complex strategies with a high percentage of profit, professional traders will have the opportunity to access an excellent community to obtain the latest market analysis and useful advice for creating future strategies.

Open an investment account with bybit

The automated strategies available on the platform can be divided into 3 main categories:

- Grid Bot: created to allow customers to profit from lateral markets by buying low and selling high.

- DCA Bot: created with the aim of accumulating the desired cryptocurrency at regular intervals, both in bull and bear markets.

- Martingale Bot: an excellent solution to double the invested funds to recover from unexpected losses.

- Grid Bot

- Trading strategy mainly focused on price volatility, commonly used in the Spot trading market. The strategy establishes buying and selling limits for a product, setting a series of price points for both buying and selling within a certain price range, and buys or sells when the market price reaches the limit, in order to consequently obtain a profit. Here’s how it works: a Grid Bot places buy orders lower than the reference price of a certain cryptocurrency and sell orders higher than the reference price. The set of buy and sell orders are equidistant from each other and can be set within a strict price range. If the price rises, a sell order will be triggered and a new buy order will be placed below the price of the cryptocurrency, to modify the most recently executed sell order. Similarly, when the price drops, the buy order will be triggered and a new sell order will be placed above the price of the cryptocurrency. The difference between the buy and sell orders is the profit.

- DCA (Dollar-Cost Averaging)

- An extremely popular long-term investment strategy among traders who prefer to invest in crypto. The DCA invests at regular intervals a certain amount of funds in the target asset, with the aim of obtaining the average cost price and holding the target asset for a long period of time, in order to obtain long-term returns. The bot is programmed to buy a fixed amount of a cryptocurrency at regular intervals, rather than making a single large purchase. Using DCA bots, the trader will have the flexibility to set the frequency and amount of all operations. This means that it will be allowed to set without restrictions the frequency and amount with which you want to make the purchase, creating strategies totally compatible with your own modus operandi.

- Martingale

- An extremely popular strategy that had its first use in gambling, the martingale is now used in various financial markets, including cryptocurrency trading. In practice, the strategy aims to double the invested capital after each loss, with the purpose of recovering all previous losses and obtaining a profit equal to the initial investment. In summary, this type of strategy can be considered winning only if after a series of operations gone bad, the last investment made will cover the entire loss and generate a profit equal to the initially invested capital. In crypto trading, Martingale Bots automatically place an additional order when the market price undergoes a specific percentage fluctuation, with the main goal of recovering all losses and making a profit when the market moves in favor.

In addition to the strategies just described, the exchange offers other interesting solutions for automated trading, including:

- Futures Grid: an automated strategy mainly focused on market volatility, Futures Grid is very popular among traders who usually invest in Futures trading. Very similar in many respects to the Spot Grid strategy, Futures Grid establishes buying and selling grids, setting a series of points with a certain interval between the purchase or sale price, when the market price touches the grid to obtain a profit.

- Futures Combo Bot: an interesting and intuitive tool, the Futures Combo Bot has been designed to simplify futures trading as much as possible. It allows customers of any level of experience to create portfolios with multiple futures contracts and automatically recalibrate operations with the aim of maintaining the preset weight of each contract, regardless of market fluctuations.

Invest with automated strategies

Bybit On-Chain Earn

On-Chain Earn by Bybit is an easy-to-use staking service that allows customers to stake cryptocurrencies on the blockchain and receive rewards. The service supports Proof-of-Stake (PoS) networks and this contributes to improving both their security and their decentralization. Normally, traditional staking requires technical skills and hardware. The innovative service offered by the exchange allows you to stake the most popular PoS tokens, such as Ethereum (ETH) and Solana (SOL), with just a few clicks.

Like many other tools or services dedicated to cryptocurrencies, staking can be both simple and complex. But the basic principle is always the same: the staking activity allows traders to earn rewards simply by owning cryptocurrencies. If the customer’s crypto is compatible with the service, it will be possible to stake some positions and receive rewards over time.

The reason why certain cryptocurrencies allow traders to earn through staking is that the blockchain employs them in its mechanisms. Indeed, compatible cryptos use a “consensus mechanism” called Proof-of-Stake. Undoubtedly the most effective method to ensure secure and verified operations, without having to rely on banks or other intermediaries. When the trader decides to do staking, his cryptocurrency will become an integral part of this process.

Open an investment account with bybit

Proof-of-stake (PoS) and proof-of-work (PoW): differences

Proof-of-stake (PoS) and proof-of-work (PoW) represent the two main consensus mechanisms used in blockchain networks. Being the proof-of-work (PoW) the oldest of the two, it consumes an enormous amount of energy, raising concerns about its environmental impact, being based on miners who use their computing power to execute complex equations and validate transactions.

On the contrary, staking in PoS systems offers a much more energy-efficient alternative to achieving consensus. In PoS blockchains, network participants stake predetermined amounts of cryptocurrency to validate new transactions and add new blocks to the blockchain, earning staking rewards in the process. Created with the aim of increasing speed, quality, and at the same time, reducing the fees to be borne, the Proof of Stake (PoS) protocol does not require miners to constantly solve mathematical problems, being an energy-intensive process. Transactions are instead validated directly by people who stake their tokens.

Staking methods

Every trader can opt for various staking methods to engage their crypto. Among these, it is possible to distinguish: independent staking, staking pools, and staking on exchanges. Each solution has advantages and disadvantages, which vary based on factors such as technical skills, available resources, and risk tolerance.

- Independent staking

- This method allows the crypto owner to become a validator on a PoS blockchain, using a minimum amount of cryptocurrencies and certain technical knowledge. To become a validator, the interested trader will need to lock a certain amount of native network cryptocurrencies (such as 32 ETH for Ethereum) and participate in the consensus process, which consists of signing blocks and subsequent attestation of the signature. This operation contributes significantly to increasing network security and rewards stakers for their relentless work, with cryptocurrencies and staking rewards.

- Staking pools

- A much more accessible solution given its characteristics, staking pools allow traders with limited investment possibilities to take advantage of the service. For example, many liquid staking options for Ethereum, such as Lido (stETH) and Rocket Pool (rETH), have been designed as low-cost and easy-to-use solutions, given the complexity and excessive demand for ETH staking. In a staking pool, multiple token holders merge their tokens to increase their staking power, with the aim of being chosen to validate blocks and earn rewards. By joining a staking pool, participants will share both the expenses to be borne and the rewards.

- Staking on exchanges

- Many cryptocurrency exchanges allow customers to take advantage of staking, being able to put their assets directly on the platform with the payment of fees. But it should be noted that this option is much more expensive compared to other staking methods, since the trader will be required to pay a commission for each operation performed. Bybit offers you a safe environment to be able to do staking of cryptocurrencies. With accurate security protocols, such as triple-layer asset protection where all user funds are stored in cold wallets, the Bybit Savings service is the right solution to negotiate making the most of any investment opportunity. Bybit Savings is an interesting investment product, offering both flexible and fixed product conditions, with extremely competitive and guaranteed APRs. The product supports BTC, ETH, USDT, and other popular cryptocurrencies.

Open an investment account with bybit

Automated Market Maker

An extremely important service in the crypto market is decentralized finance (DeFi). Since DeFi offers traders smart contracts, price negotiation between traders could be expensive and inefficient, as constant updates are indispensable, which could lead to a drastic reduction in liquidity. To overcome this type of problem, an innovative exchange protocol called Automated Market Maker (AMM) has been created.

Who are the market makers?

By definition, market makers are individuals or companies that play an essential role in ensuring liquidity in the markets. By liquidity, we mean the ease with which a particular crypto instrument can be sold or bought without excessive price variations. Market makers, in a certain sense, simplify trading operations, allowing traders to carry out buying and selling operations at quoted prices.

Market makers are active participants in the liquidity of the exchange, promoting excellent trading solutions for both the buyer and the seller. In practical terms, the seller wants to sell his assets at a well-determined price, while the buyer aims to buy a product at a different price (generally lower than the one offered). Market making allows traders to find prices and quantities between different buyers and sellers.

For example: trader “A” puts up for sale 10 BTC at a price of $40,000 each. A potential buyer “B” wants to buy 6 BTC at a price of $35,000 each. The market maker encourages trader “A” to lower the price to $37,000, while suggesting to buyer B to buy at a slightly higher price of $37,000. Such requests will be cataloged and recorded in an order book. In this way, the BTC is sold through a common agreement concluded between the parties, who adapt their choices to be able to satisfy their own interests. This allows market making to increase liquidity.

What is an automated market maker (AMM)?

Undoubtedly a significant innovation in the world of decentralized trading, the automated market maker (AMM) is a revolutionary protocol that simplifies the trading of cryptocurrencies, categorically excluding the intervention of traditional intermediaries. Available on blockchain platforms, AMMs use smart contracts that automate both the liquidity supply process and the asset exchange.

Unlike traditional methods focused on the order book, AMMs exploit liquidity pools through which all traders have the opportunity to deposit their crypto, thus providing liquidity for various trading pairs. These specific categories of pools are managed through complex algorithmic calculations and prices are determined based on a mathematical formula. Every trader will have the opportunity to operate directly against the pool, while the smart contract dynamically calibrates the prices to maintain a constant balance.

Very popular on decentralized finance (DeFi) platforms, AMMs can be considered as promoters of a democratization of financial services, allowing traders of any level to access the crypto markets without additional permissions.

As just described earlier, traditional market makers use smart contracts for the purchase or sale of an asset. To ensure that the seller lowers the selling price or that the buyer increases the purchase price, smart contracts must continuously seek compromises that can satisfy both parties. But creating a new smart contract every time traders change their order can be expensive and require prolonged times before the transaction is concluded. For this problem, a new DEX protocol known as automated market maker (AMM) has been devised.

AMM contains a price determination algorithm, a variable formula from exchange to exchange. The most common formula is as follows: x * y = k

- x is the amount of the token of the first asset in the liquidity pool;

- y is the token amount of the second;

- k is the constant that must always remain the same value.

Thanks to this innovative algorithmic calculation, AMM allows a fair negotiation between the parties. In practice, AMMs are smart contracts that conduct negotiations and transactions without an order book. AMMs have managed to exponentially increase the liquidity of coins and tokens in the world of cryptocurrencies.

Open an investment account with bybit

FAQs

- What is Bybit?

- Bybit is a cryptocurrency exchange offering P2P trading, derivatives, copy trading, and AI-powered market insights.

- How can I open a Bybit account?

- Sign up on the Bybit website, complete identity verification, and start trading with a deposit as low as $1.

- What leverage does Bybit offer?

- Bybit provides leverage up to 1:100, allowing traders to amplify their positions.

- Does Bybit charge trading fees?

- Trading fees start from 0.015%, with competitive rates across various trading pairs.

- What assets can I trade on Bybit?

- Bybit supports BTC/USD, ETH/USD, XRP/USD, futures, and other derivatives.

- What is Bybit’s Copy Trading feature?

- Copy Trading allows users to automatically follow and replicate trades from experienced traders.

- How does Bybit ensure security?

- Bybit offers two-factor authentication, cold wallet storage, and KYC verification for enhanced security.

- Can I use automated trading on Bybit?

- Yes, Bybit offers Grid, DCA, and Martingale bots, along with AI-driven TradeGPT insights.

- Does Bybit offer staking rewards?

- Yes, Bybit provides On-Chain Earn staking for PoS cryptocurrencies with competitive APRs.

- What customer support does Bybit provide?

- Bybit offers 24/7 multilingual customer support to assist traders worldwide.

Latest Features

- Close