Categories

Brokers with Fast and Secure Deposits/Withdrawals | The Best Ranking

Trade with confidence with brokers who prioritize swift and secure transactions, perfect for traders who value efficiency and safety!

The article discusses the importance of quick and secure deposit and withdrawal processes as critical factors for traders choosing a broker, alongside data security, a range of trading instruments, excellent trading conditions, and advanced platforms. Deriv, easyMarkets, HFM, LiteFinance, and eToro are identified as the top brokers offering efficient deposit and withdrawal services, with each providing unique features such as zero withdrawal and deposit fees, a wide range of funding methods, and rapid transaction times. Deriv stands out for its global reach and regulatory compliance, offering advanced trading platforms like MT5 and cTrader, and features such as social and copy trading, with a focus on fast and secure transaction processes. easyMarkets offers a straightforward trading environment with access to various markets including forex and cryptocurrencies, and emphasizes no commission on deposits and withdrawals, providing a robust suite of trading platforms like MetaTrader 4 and TradingView. Each broker offers various account types, leverage options, and educational materials, catering to both novice and experienced traders, ensuring they can trade effectively and securely across different financial instruments.

| Rank | Broker | Key Characteristics |

|---|---|---|

| 1 | Deriv | Global reach, zero deposit and withdrawal fees, advanced platforms (MT5, cTrader), social and copy trading. |

| 2 | easyMarkets | No commission on deposits and withdrawals, offers MetaTrader 4 and TradingView, robust trading conditions. |

| 3 | HFM | High regulatory compliance, a wide range of trading instruments, various account types, rapid transactions. |

| 4 | LiteFinance | Offers a transparent trading environment with instant and free deposit/withdrawal processes, advanced security measures. |

| 5 | eToro | Wide range of funding methods, rapid transaction times, social trading features, strong regulatory framework. |

Fast and Secure Withdrawals/Deposits: Which Broker to Choose?

Certainly, it is not new news; traders around the world are constantly looking for guarantees to be able to trade at their best, guarantees that protect both the handling of personal data and the execution of withdrawals and deposits.

Regulations, a wide range of instruments to trade on, excellent trading conditions, cutting-edge platforms, and other useful functions to trade at their best, are undoubtedly factors synonymous with high-quality service, but the main reason that induces a trader to select a broker to trust is the efficiency of the transactions, which allows for the execution of deposits / withdrawals quickly, speedily, and without any restrictions.

- Executing rapid deposits is essential to be able to take full advantage of operations or to take corrective action in case of adverse markets.

- Being able to withdraw funds always and without restrictions is a factor that encourages the trader to invest with the selected broker.

- Maximum transparency on fees and short execution times.

- Low or no fees

- High security standards and constant checks.

- A wide range of funding methods available.

There are numerous brokers around the world who claim to offer efficient deposit / withdrawal service, but which one is actually the best? Who really is able to guarantee transactions that are both rapid and secure?

In the following, the 5 brokers that we believe are the best in the world offering simple and secure deposits and withdrawals:

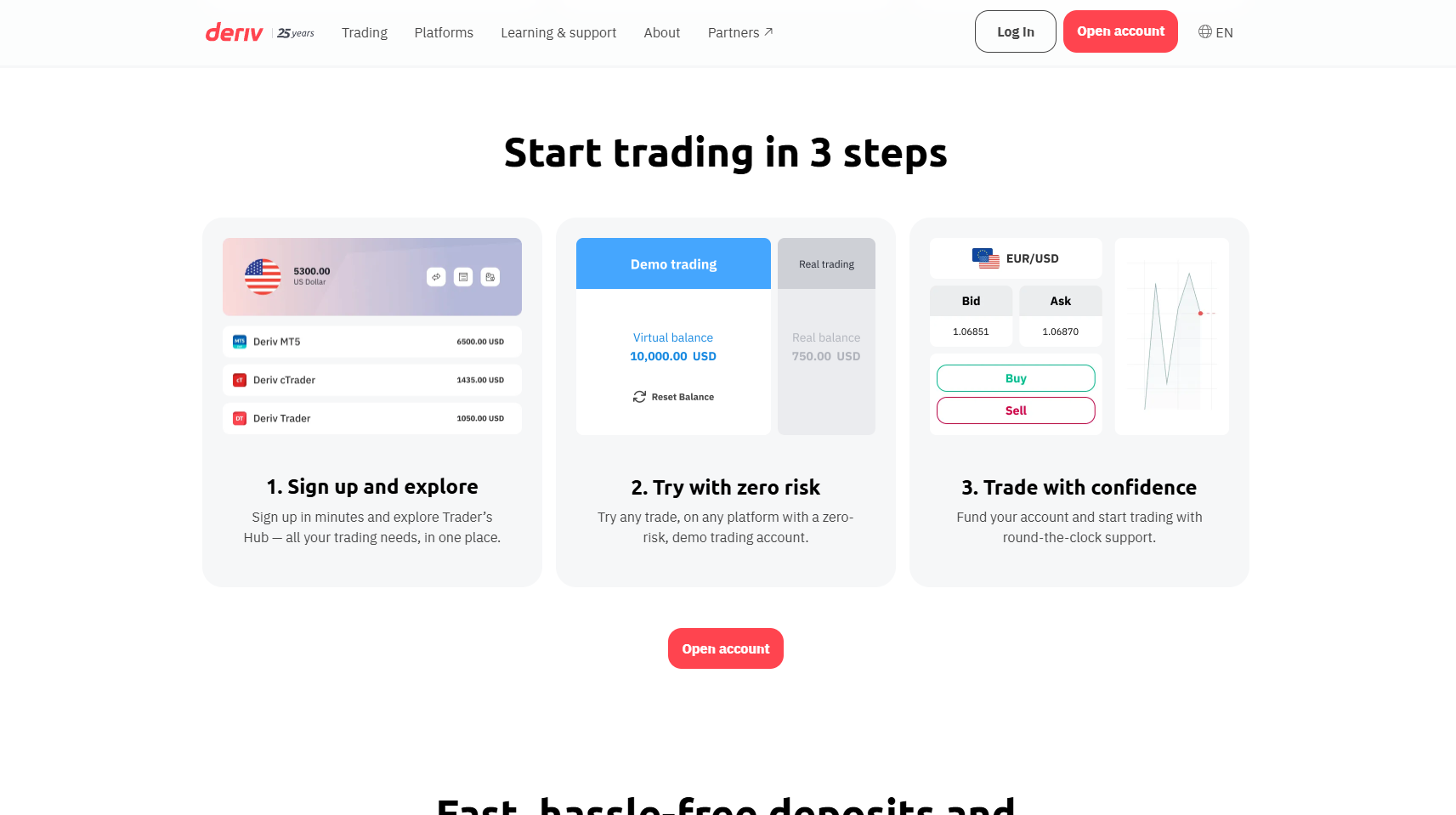

Deriv

Chosen by over 2.5 million traders worldwide, Deriv is in the top ten best brokers in the world both for the excellent service offered and for the very high levels of security. With an innovative environment and cutting-edge tools, the broker allows traders of any level to negotiate with efficiency and ease on Forex, stocks and indices, cryptocurrencies, and commodities.

| Characteristics | Deriv |

|---|---|

| Regulations | Malta Financial Services Authority – Labuan Financial Services Authority – British Virgin Islands Financial Services Commission – Vanuatu Financial Services Commission – Mauritius Financial Services Commission |

| Demo Account | Available |

| Minimum Deposit | Starting from zero (varies by selected account) |

| Maximum Leverage | 1:4000 (varies by selected instrument) |

| Platforms | MT5 – cTrader, Deriv X app, Deriv GO app |

| Negative Balance Protection | Available |

| Available Instruments | FX, stocks, ETFs, cryptocurrencies, precious metals, indices, CFDs |

| Social and Copy Trading | Available |

| Spread | Variable starting from 0.0 pips (varies by account type) |

| Trading Commissions | Starting from zero (varies by account) |

| Deposit Commissions | None |

| Withdrawal Commissions | Vary by selected payment method |

| Available Accounts | Standard Account, Zero Spread Account, Financial Account, Gold Account |

| Swap-free Account (Islamic Account) | Available |

| Educational Material | Available |

| Promotions and Competitions | Available |

Among the numerous services characterized by high transparency and simplicity of use, the financing methods stand out, allowing customers to perform operations quickly, securely, and especially easily. Moreover, the broker does not impose any commission, allowing the customer to choose the most suitable method for their needs without being influenced by excessive expenses or too high processing times.

| Financing Method | Compatible Currencies | Minimum – Maximum Deposit | Minimum – Maximum Withdrawal | Deposit Processing Time | Withdrawal Processing Time |

|---|---|---|---|---|---|

| Visa | USD, EUR | 10 – 500 | 10 – 500 | Instantaneous | 1 working day |

| Visa Electron | USD, EUR | 10 – 500 | 10 – 500 | Instantaneous | 1 working day |

| Mastercard | USD, EUR | 10 – 500 | Not available | Instantaneous | Not available |

| Maestro | USD, EUR | 10 – 500 | Not available | Instantaneous | Not available |

| Skrill | USD, EUR | 10 – 500 | 10 – 500 | 1 working day | 1 working day |

| Neteller | USD, EUR | 10 – 500 | 10 – 500 | 1 working day | 1 working day |

| Jetonbank | EUR | 10 – 500 | 10 – 500 | 1 working day | 1 working day |

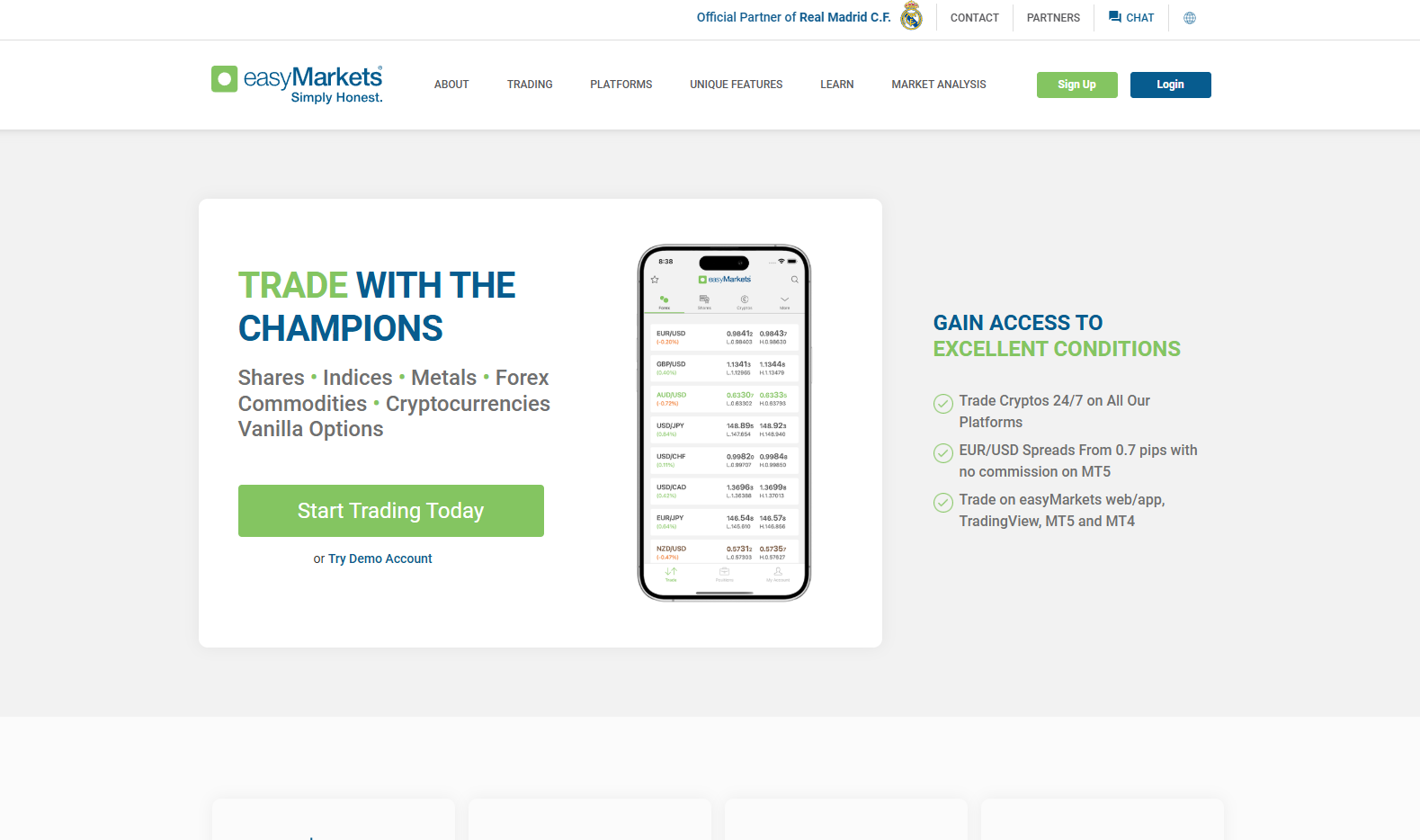

easyMarkets

Another giant in online trading services, easyMarkets is an international multi-asset broker that allows trading on forex, cryptocurrencies, indices, stocks, and commodities in an environment of undeniable levels of security and full of cutting-edge tools to allow millions of clients to trade to the best of their abilities. An STP type broker that offers access to markets without intermediaries, easyMarkets allows clients to trade with exceptional trading conditions, which include no conversion commission, trading commissions starting from zero, a mandatory minimum deposit starting from $25 and zero commissions for deposits and withdrawals.

Open an account with easyMarkets

| Characteristics | easyMarkets |

|---|---|

| Regulations | CySEC Cyprus Securities and Exchange Commission – Australian Securities and Investments Commission ASIC – Seychelles Financial Services Authority (FSA) – Financial Services Commission FSC British Virgin Islands – South Africa Financial Sector Conduct Authority FSCA |

| Demo Account | Available |

| Minimum Deposit | $25 (varies by selected account) |

| Maximum Leverage | 1:1000 (varies by instrument and country of residence of the trader) |

| Platforms | MetaTrader 4, MetaTrader 5, easyMarkets Platform, TradingView, Mobile App |

| Negative Balance Protection | Available |

| Available Instruments | Forex, metals, indices, commodities, cryptocurrencies, and stocks |

| Social and Copy Trading | Available |

| Stop Out Level | Starting from 30% (varies by account and country of residence) |

| Margin Call | Starting from 30% (varies by account and country of residence) |

| Spread | Variable starting from 0.0 pips (varies by selected account type) |

| Trading Commissions | Starting from zero (varies by account and country of residence) |

| Deposit Commissions | None |

| Withdrawal Commissions | Zero. |

| Available Accounts | easyMarkets Web/App and TradingView accounts, MT4 accounts, MT5 accounts |

| Swap-free Account (Islamic Account) | Available |

| Educational Material | Available |

| Promotions and Competitions | Available (availability depends on the region and country of residence) |

Open an account with easyMarkets

The broker allows clients to carry out rapid and efficient deposit and withdrawal transactions. Being able to choose the most suitable method for their needs, and especially without paying any commission (both on deposits and withdrawals), each client will be able to plan their investment plan better and decide when and how much to trade.

| Financing Method | Countries | Deposit Processing Time | Commission |

|---|---|---|---|

| Credit/debit card Visa | All countries (subject to exclusions) | Immediate | Free |

| Credit/debit card Mastercard | Europe | Immediate | Free |

| Credit/debit card Maestro | Europe | Immediate | Free |

| Online banking | As for specified EU countries, countries may be added or removed | up to 24 hours | Free |

| iDeal | Available only for the Netherlands | up to 1 hour | Free |

| Neteller | Excluded countries list on the official website | Immediate | Free |

| Skrill | Excluded countries list on the official website | Immediate | Free |

| Bank transfer | List of countries on the official website | 1 working day | Free |

- The minimum withdrawal amount starts from zero, for bank transfers a minimum of $50

- To be able to carry out any operation the customer must be strictly verified

- Usually a withdrawal is processed within 24 hours. For credit to your bank account it may take from 3 to 10 working days.

Open an account with easyMarkets

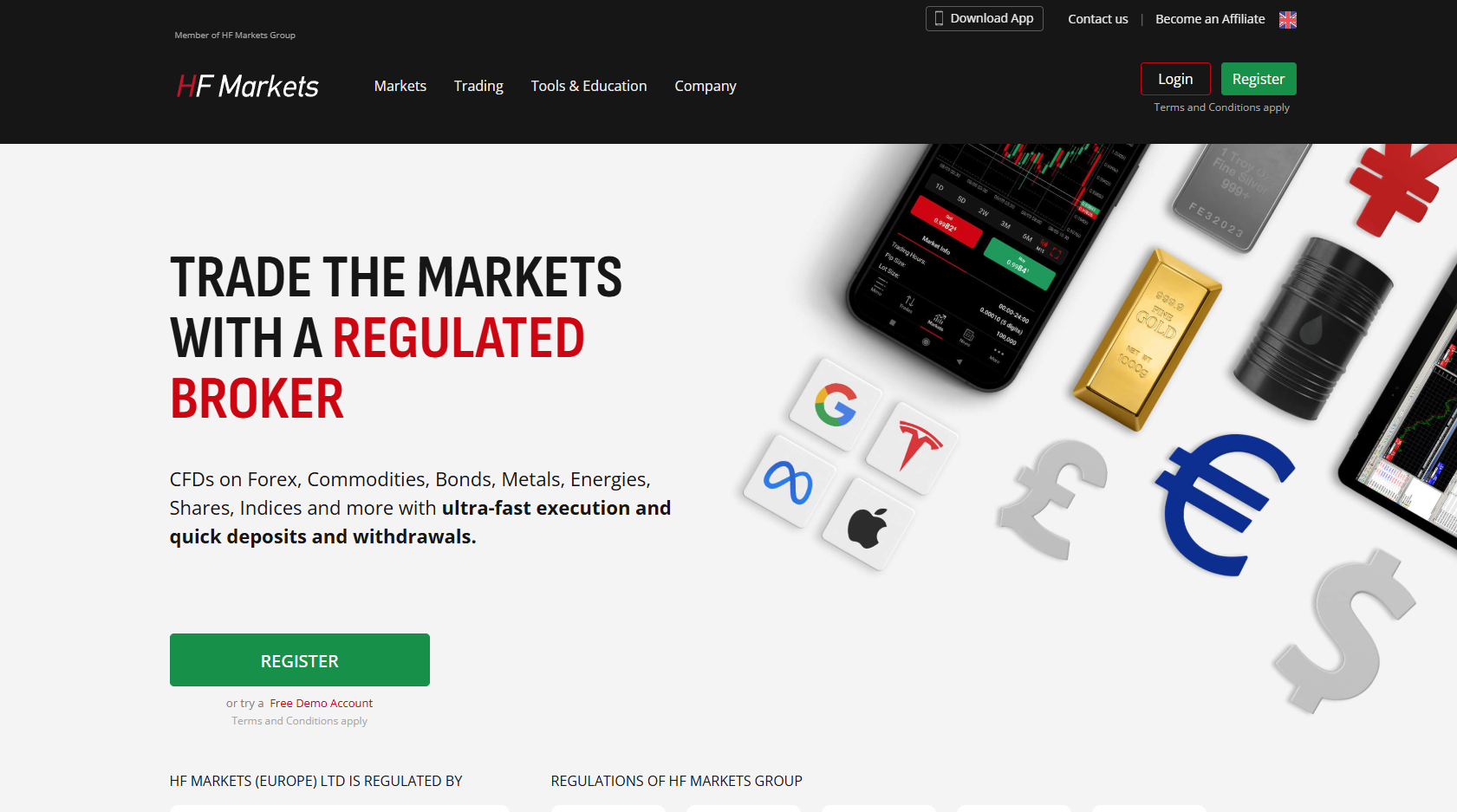

HFM

One of the most popular and widely used brokers in the world, HFM is a leader in the industry considered by clients an indispensable partner to face the markets with efficiency. The environment offered borders on perfection from every point of view. Guaranteeing very high levels of security and cutting-edge tools, the broker has as its main objective, the realization of a service that is simple to use by any category of trader. Transparent and flexible trading conditions, a wide list of products to invest in, and intuitive and rapid financing methods

| Characteristics | HF Markets |

|---|---|

| Regulations | CySEC Cyprus Securities and Exchange Commission – FCA Financial Conduct Authority (UK) – DFSA Dubai Financial Services Authority – Financial Sector Authority (FSCA) – Seychelles Financial Services Authority (FSA) + 29 national regulatory bodies |

| Demo Account | Available |

| Minimum Deposit | Zero (varies by selected account) |

| Maximum Leverage | 1:2000 (varies by instrument and country of residence of the trader) |

| Platforms | MetaTrader 4, MetaTrader 5, Webtrader, Mobile Trading, and HFM Platform |

| Negative Balance Protection | Available |

| Available Instruments | Forex, Metals, Stocks, Bonds, Indices, Energy, Commodities, Cryptocurrencies, and ETFs |

| Social and Copy Trading | Available |

| Stop Out Level | Starting from 20% (varies by account and country of residence) |

| Margin Call | Starting from 50% (varies by account and country of residence) |

| Spread | Variable starting from 0.0 pips (varies by account type) |

| Trading Commissions | Starting from zero (varies by account) |

| Deposit Commissions | None |

| Withdrawal Commissions | Vary by selected payment method. |

| Available Accounts | Standard Account, ECN Account, Cent Account |

| Swap-free Account (Islamic Account) | Available |

| Educational Material | Available |

| Promotions and Competitions | Available (availability depends on the region and country of residence) |

As mentioned, the broker offers clients the possibility to carry out deposit and withdrawal operations with extreme simplicity and without having to pay any additional costs. Being able to access the extensive list of available methods, the customer will be able to decide which is the best for their needs and carry out any operation with ease and security.

Deposits

| Financing Methods | Minimum Deposit Amount | Maximum Deposit Amount | Processing Time | Commissions |

|---|---|---|---|---|

| Bank transfer | 250 USD | Unlimited | From two to seven working days | Zero |

| Mastercard | 50 USD | 10,000 USD | Up to 10 minutes | Zero |

| Visa | 50 USD | 10,000 USD | Up to 10 minutes | Zero |

| Neteller | 50 USD | 5,000 USD | Up to 10 minutes | Zero |

| Skrill | 50 USD | 10,000 USD | Up to 10 minutes | Zero |

Withdrawals

| Financing Methods | Minimum Withdrawal Amount | Processing Time | Commissions |

|---|---|---|---|

| Bank transfer | 100 USD | From 2 to 10 working days, depending on the corresponding bank | Zero |

| Mastercard | 5 USD | From 2 to 10 working days, depending on your own bank | Zero |

| Visa | 5 USD | From 2 to 10 working days, depending on your own bank | Zero |

| Neteller | 5 USD | Instantaneous | Zero |

| Skrill | 5 USD | Instantaneous | Zero |

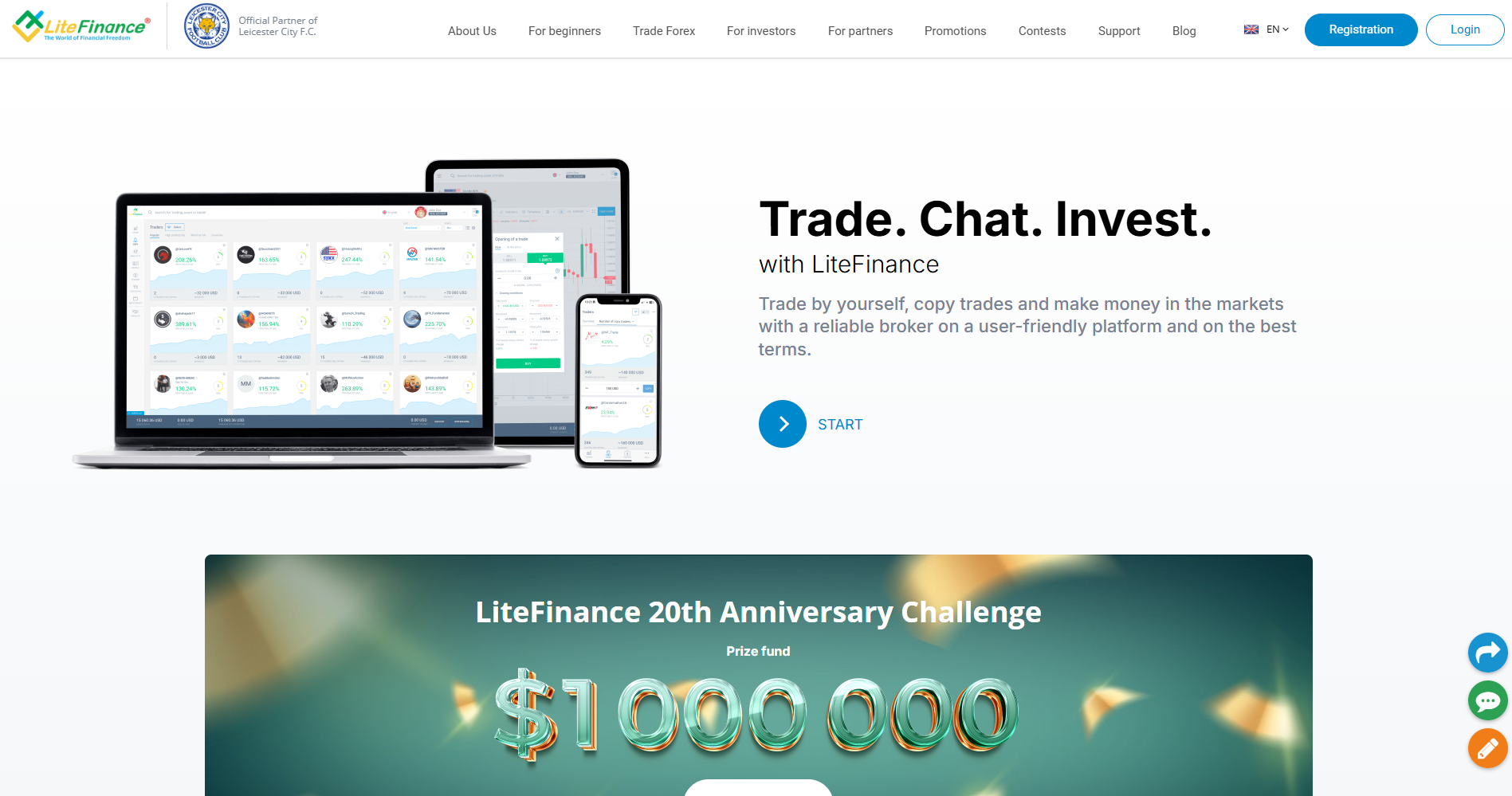

LiteFinance

Direct access to markets with unmanipulated raw prices, impeccable security standards, advantageous trading conditions, and simple deposits/withdrawals to execute, are characteristics of a leading broker in the industry that allows beginners and experts to trade on forex, precious metals, stocks, indices, cryptocurrencies, and crude oil to the best of their ability.

| Characteristics | Lite Finance |

|---|---|

| Regulations | CySEC Cyprus Securities and Exchange Commission – Financial Services Commission (FSC) of the Republic of Mauritius – Financial Services Authority of St. Vincent and Grenadines (SVG) |

| Demo Account | Available |

| Minimum Deposit | Starting from $50 |

| Maximum Leverage | 1:1000 (varies by instrument and country of residence of the trader) |

| Platforms | MetaTrader 4, MetaTrader 5, Webtrader, cTrader, LiteFinance App |

| Negative Balance Protection | Available |

| Available Instruments | Forex, precious metals, stocks, indices, cryptocurrencies, and crude oil |

| Social and Copy Trading | Available |

| Stop Out Level | Starting from 20% (varies by country of residence) |

| Margin Call | Starting from 100% (varies by country of residence) |

| Spread | Variable starting from 0.0 pips (varies by account type and selected instrument) |

| Trading Commissions | Starting from zero (varies by account) |

| Deposit Commissions | None |

| Withdrawal Commissions | Vary by selected payment method |

| Available Accounts | ECN Account, Classic Account |

| Swap-free Account (Islamic Account) | Available |

| Educational Material | Available |

| Promotions and Competitions | Available (availability depends on the region and country of residence) |

Open an account with LiteFinance

Rigorously regulated, LiteFinance offers traders advantageous transparent deposit methods, which allow them to carry out any operation with extreme ease.

With access to their client area, the trader will have the opportunity to choose the method compatible with their needs and deposit or withdraw funds quickly, without any problems.

| Deposit Method | Commission | Minimum Deposit |

|---|---|---|

| Visa debit / credit card | Zero | $10 |

| Mastercard debit / credit card | Zero | $10 |

| Local Deposit | Zero | $1 |

| Bank transfer | Zero | $100 |

| Sticpay | 2.5% + $0.3 | $10 |

| Skrill | Zero | $10 |

| Perfect Money | Zero | $10 |

| M-Pesa Kenya | 0% + 100 KES | $1 |

| M-Pesa Tanzania | 0% + 2000 TZS | $1 |

| Africa Mobile Money | GHS: 4.5% | $10 |

| Wallet (e.g., ADVCASH) | Zero | $10 |

Open an account with LiteFinance

eToro

An international broker created in 2007, in a short time eToro has earned a place among the best brokers in the world, both for the high quality of the service and for the strict security standards, which guarantee the client a reliable environment with which to invest in complete peace of mind.

A wide range of instruments to invest in (Forex, precious metals, stocks, indices, cryptocurrencies, and ETFs) with conditions that perfectly adapt to the client’s needs and technologically advanced tools.

| Characteristics | eToro |

|---|---|

| Regulations | United Kingdom Financial Conduct Authority (“FCA”) – De Nederlandsche Bank N.V. (“DNB”) as a provider of cryptocurrency services – French Financial Markets Authority (AMF) – In Italy as providers of crypto/digital wallets Organismo Agenti e Mediatori (“OAM”) – German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht—BaFin) – Malta Financial Services Authority (“MFSA”) – Financial Services Regulatory Authority (“FSRA”) of the Abu Dhabi Global Market (“ADGM”) – Australian Securities & Investments Commission (“ASIC”) – Financial Services Authority Seychelles (“FSAS”) – Financial Crimes Enforcement Network (FinCEN) in the United States – Gibraltar Financial Services Commission |

| Demo Account | Available |

| Minimum Deposit | $50 – $10 in the United Kingdom – $1 in the USA ) |

| Maximum Leverage | 1:400 (varies by instrument and country of residence of the trader) |

| Platforms | eToro, eToro App |

| Negative Balance Protection | Available |

| Available Instruments | Forex, precious metals, stocks, indices, cryptocurrencies, and ETFs |

| Social and Copy Trading | Available |

| Stop Out Level | Starting from 20% (varies by country of residence) |

| Margin Call | Starting from 100% (varies by country of residence) |

| Spread | Variable starting from 0.0 pips (varies by account type and selected instrument) |

| Trading Commissions | Starting from zero (varies by account) |

| Deposit Commissions | None |

| Withdrawal Commissions | Vary by selected payment method |

| Available Accounts | Retail Account, Professional Account, eToro Club |

| Swap-free Account (Islamic Account) | Available |

| Educational Material | Available |

| Promotions and Competitions | Available (availability depends on the region and country of residence) |

In addition to the excellent service offered, the broker offers a wide range of financing methods suitable for any need. With access to their own area and by clicking on the icon dedicated to the service, in a few minutes the client will be able to carry out the desired operation, in complete safety and with great simplicity.

Deposits with eToro

All deposit transactions made by clients are constantly monitored and comply with strict security standards. Each transaction carried out will be transmitted using Secure Socket Layer (SSL) technology, which guarantees maximum protection for the client’s sensitive data.

The procedure that allows you to proceed with a deposit is very simple, the client will have to access their personal area, select the preferred financing method and follow the following steps:

- Access your account

- Click on the “Deposit Funds” icon

- Select the amount to deposit and the currency.

- Choose the financing method most suitable to your style.

In addition to the speed of execution and security on each operation, the broker allows you to make periodic automated deposits with a credit or debit card. Once the deposit has been made with your own card, on the “deposit confirmation screen” it will be possible to set periodic weekly, bi-weekly or monthly deposits: access “Settings” – Click on the “Periodic Deposits” icon – choose the amount to deposit automatically.

Below, the range of available deposit methods:

| Financing Method | Times | Currencies | Countries | Maximum Single Deposit | Available for Withdrawals | Info |

|---|---|---|---|---|---|---|

| eToroMoney | Immediate | GBP, EUR | To be verified on the official site | $500,000 | Yes | The trader must have funds deposited on the eToro Money account balance |

| Credit/debit cards | Immediate | To be verified on the official site | International | $40,000 | Yes | Visa, MasterCard, Visa Electron, and Maestro |

| PAYPAL | Immediate | USD, GBP, EUR, and AUD | International | $10,000 | Yes | The trader must be the owner of an active PayPal account |

| Neteller | Immediate | USD, GBP, EUR | International | $10,000 | Yes | The trader must be the owner of a Neteller account |

| Skrill | Immediate | USD, GBP, EUR | International | $10,000 | Yes | The trader must be the owner of a Skrill account |

| Bank transfer | 4-7 days | USD, GBP, EUR, AUD, AED | International | Unlimited | Yes | It is advisable to always provide the transaction ID to avoid delays in crediting the funds |

| Online Banking – Trustly (EU area) | Immediate | EUR, GBP SEK, NOK | Norway, Sweden | $40,000 USD | Not available | Simply access your online bank account and perform the operation |

Traders with unverified accounts will be able to make deposits not exceeding $2,250. To carry out any withdrawals, the verification process will need to be performed.

Withdrawals with eToro

Just like deposits, withdrawal operations can also be carried out easily and securely. In just a few moments the trader will be able to choose the financing method to use, decide the amount to withdraw, and send the request.

- In order to withdraw funds, the broker charges a small commission of 5 USD.

- The minimum withdrawable amount is $30

- Processing times vary depending on the selected method.

li>Any additional commissions depending on the selected method are not managed by the broker

li>Withdrawals with a currency different from the one previously set involve the payment of a currency conversion commission.

| Withdrawal Method | Times required for the crediting of funds after the withdrawal request |

|---|---|

| eToro Money | Instantaneous withdrawal |

| Credit/debit card | Up to 10 working days |

| Bank transfer | Up to 10 working days |

| PayPal | Up to 2 working days |

| Neteller | Up to 2 working days |

| Skrill | Up to 2 working days |

| Trustly | Up to 2 working days |

| iDEAL | Up to 2 working days |

In conclusion, the ability to perform rapid and secure deposits and withdrawals is a fundamental factor that significantly influences a trader’s choice of broker. The brokers highlighted—Deriv, easyMarkets, HFM, LiteFinance, and eToro—excel in providing these services, ensuring that traders can manage their investments efficiently and with confidence. Each broker also supports a range of advanced trading tools and platforms that cater to different trading strategies and preferences. Ultimately, these brokers demonstrate a commitment to meeting the needs of their clients through comprehensive regulatory compliance, diverse trading instruments, and a focus on security and customer service. Choosing any of these brokers ensures that traders have access to top-tier trading environments where they can execute transactions swiftly and securely.

FAQs of this article

- What factors make a broker desirable for traders?

- Factors include quick and unrestricted execution of deposits and withdrawals, data security, a wide range of trading instruments, superior trading conditions, cutting-edge platforms, and transparent fee structures.

- Why are rapid deposits crucial for traders?

- Rapid deposits allow traders to take immediate advantage of trading opportunities or to cover positions in volatile markets, enhancing their trading strategy effectiveness.

- What encourages traders to invest with a broker?

- Having the ability to withdraw funds anytime without restrictions encourages traders to invest more with a broker, knowing they can access their money easily.

- How do fast and secure transactions affect a trader’s choice of broker?

- Efficient transaction processes that allow for speedy deposits and withdrawals with high security are a primary reason for traders choosing a particular broker.

- What standards do brokers claim to meet regarding deposit/withdrawal services?

- Many brokers claim to offer efficient deposit/withdrawal services, but only a few actually ensure transactions are both rapid and secure, which is crucial for traders.

- Who are considered the top brokers for easy and secure deposits/withdrawals?

- The top brokers known for easy and secure deposits and withdrawals include Deriv, easyMarkets, HFM, LiteFinance, and eToro.