Categories

eToro vs easyMarkets - Comparison of Cost, Tools, Limitation and Promotions

Explore the detailed comparison between eToro and easyMarkets focusing on trading features, platforms, and security measures.

Table of Contents

- eToro vs easyMarkets

- Offered Accounts: Features and Differences

- eToro Accounts: Limited Choices and Exclusive Services Only for a Few

- eToro Club: A Privilege for Few Rather Than an Exclusive Service

- easyMarkets Accounts: Equitable, Flexible, and Compatible

- eToro vs easyMarkets: Fees - Who is More Advantageous?

- eToro Fees and Spreads: Limited Expenses but Not Nonexistent

- Fees Incurred with easyMarkets: Advantageous but Not Very Clear

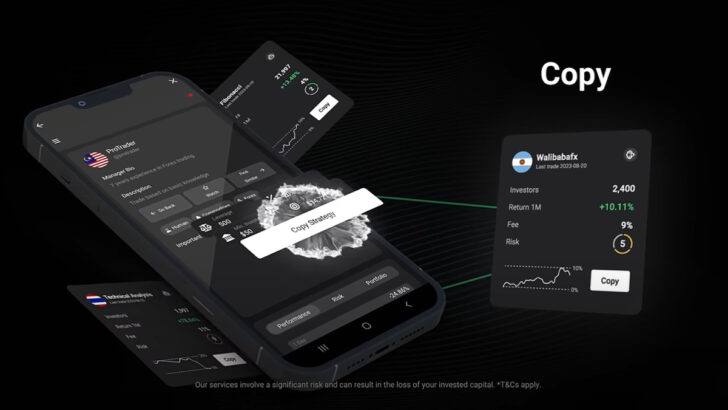

- Copy Trading: Revolutionary eToro - Zero for easyMarkets

- Copy Trading by eToro: Incredible!

- Promotions and Bonuses Offered: easyMarket Wins!!

- Interest on Balances Offered by eToro: Promising but Not Accessible to All

- easyMarkets First Deposit Bonus

- Exclusive Tools: eToro Not Convincing - easyMarket is Interesting

- Innovation and Cutting-edge Technologies: easyMarkets Tools

- Innovative Tools and Services Reserved for a Few "Chosen": eToro Disappointing

eToro and easyMarkets are leading online trading platforms that emphasize high security, optimal customer experience, and a vast range of trading instruments.

Both brokers offer advanced trading tools, competitive conditions, and are highly regulated by multiple authorities to ensure transparency and security.

Differences include easyMarkets’ offering of MetaTrader platforms and fixed spreads, while eToro provides a social trading platform and variable spreads.

eToro is distinctive for its social trading features, allowing users to copy trades of experienced traders, which is absent in easyMarkets.

easyMarkets offers features like dealCancellation and Freeze Rate, enhancing trade execution and risk management options for traders.

Find out more about easyMarkets

eToro vs easyMarkets: Comprehensive Comparison of Leading Trading Platforms

Discover the best trading platform for you—compare eToro and easyMarkets today!

| Feature | eToro | easyMarkets |

|---|---|---|

| Trading Platforms | eToro Platform, Mobile App | MetaTrader 4, MetaTrader 5, easyMarkets Platform, TradingView, Mobile App |

| Regulations | FCA, CySEC, ASIC, others | CySEC, ASIC, FSA, others |

| Unique Features | Social Trading, Copy Trading | dealCancellation, Freeze Rate |

| Minimum Deposit | Starting from $10 | Starting from $25 |

| Negative Balance Protection | Available | Available |

Find out more about easyMarkets

eToro vs easyMarkets

A real clash of titans dominating the world of online trading, they represent the nonplus ultra for high-performance investments in an environment with high levels of security, where utmost transparency is preferred.

The primary goal of both companies is to optimize customer experience, satisfying any need regardless of experience level or trading volume. Offering a wide range of state-of-the-art tools and functions, extremely competitive trading conditions, and various investment solutions, eToro and easyMarkets allow clients to operate at their best capacity on all available instruments.

To improve the offered environment and refine the service, the companies engage in constant research for updated solutions and tools and in the creation of innovative functions.

Furthermore, to support customers and free them from problems or uncertainties, both companies employ a team of industry professionals, active 24 hours a day.

Protection, utmost care, and absolute security dominate the offered environment. Legally regulated by numerous control bodies, liquidity guaranteed by international banks, and a comprehensive list of services and functions for adequate risk management (including negative balance protection) are just some of the features of two giants in the sector that, before proposing investments, commit to ensuring an environment free from unpleasant inconveniences.

In practice, two companies structured to allow customers of any category to access the markets by leveraging their knowledge to the fullest, in an environment focused entirely on the needs of those who use it.

But regardless of the quality of service offered, each broker elaborates its own objectives and services according to its own modus operandi and customer requests. Who to choose for trading? Which of the two is more suited to your own trading? In this article, we will highlight and evaluate the main differences and characteristics of both companies.

| Characteristics | easyMarkets | eToro |

|---|---|---|

| Regulations | CySEC Cyprus Securities and Exchange Commission – Australian Securities and Investments Commission ASIC – Seychelles Financial Services Authority (FSA) – Financial Services Commission FSC British Virgin Islands – South Africa Financial Sector Conduct Authority FSCA | FCA United Kingdom Financial Conduct Authority – CySEC Cyprus Securities and Exchange Commission – ASIC Australian Securities and Investments Commission – MFSA Maltese Financial Services Authority – SEC Securities and Exchange Commission – FINRA Financial Industry Regulatory Authority |

| Demo Account | Available | Available |

| Minimum Deposit | Starting from $25 (varies by selected account) | Starting from $10 |

| Maximum Leverage | 1:2000 (varies by instrument and trader’s country of residence) | 1:30 (varies by instrument and trader’s country of residence) |

| Platforms | MetaTrader 4, MetaTrader 5, easyMarkets Platform, TradingView, Mobile App | eToro Platform and Mobile App |

| Negative Balance Protection | Available | Available |

| Available Instruments | Forex, metals, indices, commodities, cryptocurrencies, and stocks | Stocks, ETFs, indices, cryptocurrencies, forex, commodities |

| Social Trading and Copy Trading | Not available | Available |

| Stop Out Level | Starting from 30% (varies by account and trader’s country of residence) | Starting from 50% (varies by account and trader’s country of residence) |

| Margin Call | Starting from 30% (varies by account and trader’s country of residence) | N/A |

| Spreads | Variable starting from 0.0 pips (varies by type of account) | Variable starting from 0.0 pips (varies by market) |

| Trading Fees | Starting from zero (varies by account) | Starting from zero |

| Deposit Fees | None | None |

| Withdrawal Fees | Zero (vary by selected payment method) | Starting from $5 (vary by funding method and for eToro Club members) |

| Available Accounts | easyMarkets Web/App TradingView, MT4 accounts: Pro – VIP – Standard, MT5 accounts | Retail account – professional account – Access to eToro Club |

| Swap-Free Account (Islamic Account) | Available | Available |

| Educational Material | Available | Available |

| Promotions and Competitions | Available (availability depends on the region and country of residence) | Available (availability varies by region and country of residence) |

Find out more about easyMarkets

eToro

International broker boasting over 35 million customers worldwide, eToro offers a secure and impeccable service with excellent investment solutions. Being strictly regulated by multiple control bodies, the broker ensures a protected and totally transparent environment from every point of view. An intuitive and easy-to-use environment allows traders of any category or need to operate with ease and optimize investments in the markets thanks to technologically advanced tools and useful functions for prudent risk management. The broker offers investments in stocks, ETFs, indices, cryptocurrencies, forex, and commodities with variable spreads starting from 0.0 pips and commissions starting from zero (varying according to the instrument and conditions available to eToro Club members).

A peculiarity that has made the broker popular concerns the launch of the innovative platform for copy trading, which offers traders the possibility of copying the strategies made by experts in the sector and deriving the same benefits. But beyond the potential profits that could arise from using the service, the platform allows traders to interact and share experiences and information, in order to refine their modus operandi and optimize their trading experience.

- Multi-asset Platform

- eToro allows traders to trade on over 7,000 financial assets, among which we can distinguish: stocks, cryptocurrencies, ETFs, indices, currencies, and commodities. Each client will be able to decide to invest using financial leverage (up to 1:30) and opt for short, medium, or long-term trading solutions.

- A trusted and transparent broker

- An undisputed leader in the online trading sector, through which millions of traders regularly trade with confidence. Legally regulated and with over ten years of experience in the market and fintech sector, eToro is committed to offering a safe service, completely focused on customer needs.

- Free insurance up to 1 million Euros/AUD

- With the idea of providing maximum support to clients, eToro offers a completely free insurance policy registered with Lloyd’s of London, one of the most important insurance companies in the world. The insurance coverage is offered exclusively only for Platinum, Platinum + and Diamond Club clients of eToro (Europe) Ltd. and eToro AUS Capital Limited. In case clients suffer unexpected losses due to an unexpected insolvency of the broker or in case of negligence, the insurance will cover every insolvency.

- Revolutionary Social Trading

- Undoubtedly the largest trading community in the world, with over 30 million clients from more than 100 countries, the Social Trading platform hosts professional traders, some of whom perform above market benchmarks. Moreover, the eToro News Feed acts like any social network, allowing traders to freely interact with each other, share excellent ideas, insights, and trading strategies.

- CopyTrader

- Considered the copy trading platform par excellence, CopyTrader eToro has literally revolutionized the service, allowing traders to follow and copy the operations carried out by experts in the sector with access to exclusive functions and tools. Before selecting the trader to follow, each client will have the opportunity to know all the characteristics, such as the risk score, the failure/success ratio, and much more. Some of the top eToro traders have shown consistent positive returns and have consistently met market benchmarks.

- Segregated Funds

- All trader funds are deposited in segregated accounts at international banks and are completely separate from the company’s capital. The broker cannot use them for its own purposes and in case of bankruptcy, the client can withdraw them without restrictions.

- High levels of cybersecurity

- Very high security standards for the protection of clients’ personal data. The information will never be shared with third parties unless permitted by law.

- Multi-regulated Broker

- eToro is held to comply with strict regulations from various authorities, including the FCA (UK), ASIC (Australia), CySec (Cyprus), GFSC (Gibraltar), FinCen, and FINRA (United States).

easyMarkets

One of the first brokers in the world to offer investments to traders of any level, easyMarkets is a company with over thirty years of experience that has determinedly shaken the foundations of an almost obsolete service, dedicated exclusively to professional traders of high investment volume. easyMarkets offers a fair environment, designed to meet the needs of any trader. A fair environment, which thanks to its user-friendly features allows both beginners and professionals to trade at their best on markets around the world.

easyMarkets allows clients to trade on Forex, metals, indices, commodities, cryptocurrencies, and stocks with excellent trading conditions (which include spreads starting from 0.0 and zero commissions) and numerous interesting and innovative services. Being an STP broker, easyMarkets allows clients to trade on the markets without any intermediary and with high liquidity.

Find out more about easyMarkets

Offered accounts: features and differences

The trading accounts offered by both brokers have been carefully crafted with the intent to fully meet customer needs. Professionals and beginners will have the opportunity to choose the most suitable option for their style and trade at their best. Below, the advantages and disadvantages of the accounts offered by the brokers.

- eToro Account

- The broker offers traders the opportunity to choose only two types of accounts, Retail and Professional. Made with the aim of ensuring excellent operability to traders of any category, the accounts offer flexible trading conditions and numerous tools to trade. However, it should be noted that to be able to enjoy exclusive conditions and tools, traders will have to join a club and deposit a minimum of $5000 on their accounts. As the funds deposited increase, the membership level in the club will rise, as well as the exclusive services. A solution not fair, reserved only for traders who have large sums of capital.

- easyMarkets Account

- The list of accounts offered by the broker provides solutions suitable for any level of experience. With access to the dedicated area, the client can decide which account is suitable for their modus operandi and start investing with activation deposits starting from $25.

eToro Account: limited choice and exclusive services only for a few

As already illustrated, the broker offers only two types of accounts for trading. The only two available accounts have a flexible structure and have been carefully created to meet the needs of experienced traders and neophytes. But to be able to take advantage of the full range of services and exclusive solutions, the trader will have to access the eToro Club program.

To become a member, the trader will have to have a minimum deposit of $5000. A benefit clearly reserved for a few, certainly not suitable for inexperienced traders or those with a low propensity for risk. A sort of “selection by category”: those who deposit more funds will be able to access a better service, if you do not deposit as required you will have to settle!

Retail eToro Account

An account particularly suitable for retail traders, the Retail account allows traders to access excellent investment solutions and manage the risk factor thanks to indispensable tools and services (such as the Investor Compensation Fund and negative balance protection). Compatible with any level of experience, the Retail account allows professionals and beginner traders to trade on the available instruments with sufficiently advantageous trading conditions that include minimized spreads and flexible commissions (which will be listed later). The account offers a very flexible environment, each client can trade using classic methods or take advantage of the innovative Copy Trading service to copy the operations of professionals in the sector.

It is important to specify that the maximum leverage available varies according to the customer’s country of residence and the product selected for trading. For example, in Europe, the maximum leverage available is 1:30 for major currency pairs, 1:20 for other currency pairs (such as EUR/NZD), gold, and indices, 1:10 for commodities and other indices, 1:5 for CFDs on stocks and ETFs, 1:2 for CFDs on cryptocurrency. The minimum deposit required for account activation is $50.

Professional eToro Account: only for those with a lot to invest

Account created exclusively for professional clients who need conditions and tools suitable for high-performance trading. Considering the very high risk propensity and the amount of funds invested, clients who want to opt for this type of account will not have the right to use functions for risk protection and will also be excluded from the Investor Compensation Fund and the Financial Ombudsman Service. The maximum leverage usable is 1:400. Compared to the Retail account, the trading expenses are lower.

To be able to access the Pro account, the client must first open a Retail account, verify it, and meet the following conditions:

- Be in possession of a portfolio worth over $500,000 (excluding cash).

- Have traded at least ten transactions in the short term with a total value of $500,000.

- Have at least one year of experience in the financial sector.

As for the “chosen” of the eToro Club, even to be able to open a PRO account, the interested trader will have to meet conditions certainly not accessible to everyone.

Open a Professional account with eToro

eToro Club: a privilege for a few rather than an exclusive service

The Club available on the eToro platform is an initiative that allows traders to take advantage of a wide range of tools, services, and cutting-edge functions. Factors considered indispensable by many traders in order to perfect their trading experience and make it as efficient as possible. The program is divided into several levels. Each level corresponds to certain services and exclusive tools. The higher the level reached, the greater the trading benefits to be exploited.

This is how it works:

- Traders holding Retail-type accounts can access the program only if certain deposit conditions are met and will be classified based on the amount of the balance deposited.

- In case the balance on the trading account varies, the eToro Club level reached by the client will be modified and consequently the benefits available.

- eToro Club is divided into five levels: Silver, Gold, Platinum, Platinum +, and Diamond.

- With a balance equal to or greater than $5,000, the trader will be automatically assigned the starting level: Silver.

- By making further deposit transactions and consequently increasing the available balance, the trader’s account will be automatically reset to the next level within 24 hours. The amounts that will allow access to the Club levels are as follows:

- Silver: $5,000

- Gold: $10,000

- Platinum: $25,000

- Platinum+: $50,000

- Diamond: $250,000

Take advantage of the benefits of eToro Club

Features and benefits of the various eToro Club levels

As already described, each level reached by clients offers trading conditions, tools, and numerous exclusive benefits. Depending on the objectives to be achieved and the trading needs, the client can opt for the most suitable level, simply by making the necessary minimum deposit. It is important to emphasize that in order not to lose the level reached or assigned, the client must maintain the minimum balance corresponding to their level. In case the balance does not meet the minimum requirements of the level reached, the trader will revert to a lower level.

eToro Club Silver Level

The Silver level is accessible with a balance starting from $5,000. By making the required deposit, the level will be automatically assigned. Traders who are assigned the Silver level will be able to enjoy the following benefits:

- Exclusive access to useful webinars on the markets.

- Smart Portfolio based on data.

- Latest generation partner applications.

- Personal Account Manager.

- Reserved for clients residing in the United Kingdom: eToro Money Visa debit card.

eToro Club Gold Level

Accessible with a balance starting from $10,000, the Gold level offers the same services and tools accessible with the Silver level with the addition of:

- Active interests on the available balance.

- Possibility to contact your own Account Manager via WhatsApp during working hours.

- Unlimited access to excellent market analyses updated weekly.

eToro Club Platinum Level

An excellent idea for professionals, the Platinum level is available with a balance starting from $25,000 and allows traders to trade informed, with minimal costs and in complete safety:

- No commission on withdrawals.

- Unlimited access to high-level digital publications.

- Dedicated partner apps and platforms.

Take advantage of the benefits of the Platinum eToro Level

eToro Club Platinum+ Level

Traders who have the opportunity to reach the Platinum+ level will be able to enjoy all the exclusives of the previous levels, with the addition of:

- Individual meetings on Zoom with your dedicated Account Manager.

- Free access to interesting sports and cultural events.

- Traders residing in Europe and the United Kingdom will be able to access the eToro Money Black program, which provides access to a more flexible environment with fewer limitations.

- UK clients: eToro black metal Visa debit card.

eToro Club Diamond Level

The highest level of the eToro Club, Diamond is an environment reserved only for professional traders with very high investment volumes and a high propensity for risk. Diamond allows you to enjoy the full range of benefits available in the previous levels with the addition of:

- Exclusive and totally free access to important digital publications.

- Zero commissions on exchanges.

- Private contacts with your Account Manager on Zoom.

- Participation in eToro Diamond events.

Considerations on the eToro Club

Given the deposit conditions, which fundamentally require the trader to make continuous deposits in order not to lose the assigned level, the eToro Club is clearly an initiative dedicated to experts in the sector who have the ability to invest large sums of money. Beginners, simply more cautious traders, or other categories of traders who do not have the ability to invest such large sums will have to “settle” for the standard service offered. An unfair policy, which rewards only those who can afford to deposit and invest a lot, without considering other initiatives proposed by the broker reserved only for Club members. It’s as if the broker wanted to say: “if you invest a lot you can earn a lot, but if you invest small sums eToro is not for you…”

easyMarkets Accounts: fair, flexible, and compatible

Regardless of the country of residence and trading conditions that may vary based on the regulatory body, the structure of the accounts offered by easyMarkets allows traders of any level to operate with extreme fluidity on markets around the world, using all the tools and services available fairly (accessible to beginners, experts, traders with high investment volumes, etc.). Each client will have the faculty to decide which account is most suitable for their modus operandi and trade to the fullest of their capabilities.

It’s important to emphasize that easyMarkets also offers traders an exclusive environment with cutting-edge tools and advantageous discounts: The VIP account. An account that involves paying a fixed fee for access. However, despite this, the wide range of available accounts allows traders to operate using all the tools and services available, without limitations.

Find out more about easyMarkets

The accounts offered by the broker are:

- easyMarkets Web/App and TradingView

- MT4 VIP

- MT4 Premium

- MT4 Standard

- MT5

easyMarkets Web/App and TradingView Account

Account type created to meet the trading needs of any trader. The easyMarkets Web/App and TradingView account offers both beginner and expert traders an excellent trading experience, with fixed spreads starting from 0.8 pip, zero commissions, and a minimum deposit of only $25.

| Features | easyMarkets Web/App and TradingView Account |

|---|---|

| Minimum transaction size | 0.01 lots |

| Type of spread | Fixed |

| EUR/USD starting from | 0.8 pip |

| GBP/USD starting from | 1.4 pip |

| USD/JPY starting from | 1.5 pip |

| OIL/USD starting from | 0.04 USD |

| XAU/USD starting from | 0.40 USD |

| Minimum deposit | 25 US dollars |

| Maximum leverage | 1:200 |

| Trading commissions | Zero |

| Account management fees | Zero |

| Customer phone support | Yes |

| Personal Account Manager | Yes |

| Trading phone and live chat 24/5 | Available |

| No slippage | Yes |

| Stop Loss | Free |

| Negative Balance Protection | Active |

| Fundamental analysis | Available |

| Daily email: Technical Trading Central Analysis | Yes |

| Central trading indicator | No |

| Account currency | Euro (EUR), Canadian dollar (CAD), Czech koruna (CZK), Japanese yen (JPY), New Zealand dollar (NZD), US dollar (USD), Singapore dollar (SGD), Swiss franc (CHF), British pound (GBP), Mexican peso (MXN), Australian dollar (AUD), Polish zloty (PLN), Turkish lira (TRY), Chinese yuan (CNY), Hong Kong dollar (HKD), Norwegian krone (NOK), Swedish krona (SEK), South African rand (ZAR), Bitcoin (BTC) |

Open an easyMarkets Web/App and TradingView Account

MT4 VIP Account

Account mainly suitable for traders with high investment volumes who need certain conditions and tools to better manage their operations, the VIP account offers professional trading with extremely high performance. Fixed spreads reduced to a minimum, a maximum leverage up to 1:400, and zero trading commissions.

| Features | MT4 VIP Account |

|---|---|

| Minimum transaction size | 0.01 lots |

| Type of spread | Fixed |

| EUR/USD starting from | 0.7 pip |

| GBP/USD starting from | 1.3 pip |

| USD/JPY starting from | 1.0 pip |

| OIL/USD starting from | 0.03 USD |

| XAU/USD starting from | 0.35 USD |

| Minimum deposit | 10,000 US dollars |

| Maximum leverage | 1:400 |

| Trading commissions | Zero |

| Account management fees | Zero |

| Customer phone support | Yes |

| Personal Account Manager | Yes |

| Trading phone and live chat 24/5 | Available |

| No slippage | Not available |

| Stop Loss | Paid |

| Negative Balance Protection | Active |

| Fundamental analysis | Available |

| Daily email: Technical Trading Central Analysis | Yes |

| Central trading indicator | Available |

| Account currency | Euro (EUR), Canadian dollar (CAD), Czech koruna (CZK), Japanese yen (JPY), New Zealand dollar (NZD), US dollar (USD), Singapore dollar (SGD), Swiss franc (CHF), British pound (GBP), Mexican peso (MXN), Australian dollar (AUD), Polish zloty (PLN), Turkish lira (TRY), Chinese yuan (CNY), Hong Kong dollar (HKD), Norwegian krone (NOK), Swedish krona (SEK), South African rand (ZAR), Bitcoin (BTC) |

Open an MT4 VIP easyMarkets Account

MT4 Premium Account

Ideal choice for professional traders who need particular tools and services to structure their strategies, the Premium account offers everything necessary to face the markets at their best.

| Features | MT4 Premium Account |

|---|---|

| Minimum transaction size | 0.01 lots |

| Type of spread | Fixed |

| EUR/USD starting from | 1.2 pip |

| GBP/USD starting from | 1.8 pip |

| USD/JPY starting from | 1.8 pip |

| OIL/USD starting from | 0.04 USD |

| XAU/USD starting from | 0.40 USD |

| Minimum deposit | 10,000 US dollars |

| Maximum leverage | 1:400 |

| Trading commissions | Zero |

| Account management fees | Zero |

| Customer phone support | Yes |

| Personal Account Manager | Yes |

| Trading phone and live chat 24/5 | Available |

| No slippage | Not available |

| Stop Loss | Paid |

| Negative Balance Protection | Active |

| Fundamental analysis | Available |

| Daily email: Technical Trading Central Analysis | Yes |

| Central trading indicator | Available |

| Account currency | Euro (EUR), Canadian dollar (CAD), Czech koruna (CZK), Japanese yen (JPY), New Zealand dollar (NZD), US dollar (USD), Singapore dollar (SGD), Swiss franc (CHF), British pound (GBP), Mexican peso (MXN), Australian dollar (AUD), Polish zloty (PLN), Turkish lira (TRY), Chinese yuan (CNY), Hong Kong dollar (HKD), Norwegian krone (NOK), Swedish krona (SEK), South African rand (ZAR), Bitcoin (BTC) |

Open an MT4 Premium easyMarkets Account

MT4 Standard Account

An account designed mainly for beginner traders who do not intend to invest excessive funds, the Standard offers low-risk trading with limited costs. A minimum deposit of $25, zero commissions, and extremely competitive spreads, will allow the novice to engage in the markets without having to worry about excessive losses.

| Features | MT4 Standard Account |

|---|---|

| Minimum transaction size | 0.01 lots |

| Type of spread | Fixed |

| EUR/USD starting from | 1.7 pip |

| GBP/USD starting from | 2.3 pip |

| USD/JPY starting from | 2.0 pip |

| OIL/USD starting from | 0.05 USD |

| XAU/USD starting from | 0.45 USD |

| Minimum deposit | 25 US dollars |

| Maximum leverage | 1:400 |

| Trading commissions | Zero |

| Account management fees | Zero |

| Customer phone support | Yes | Personal Account Manager | Yes | Trading phone and live chat 24/5 | Available | No slippage | Not available | Stop Loss | Paid | Negative Balance Protection | Active | Fundamental analysis | Available | Daily email: Technical Trading Central Analysis | Yes | Central trading indicator | Available | Account currency | Euro (EUR), Canadian dollar (CAD), Czech koruna (CZK), Japanese yen (JPY), New Zealand dollar (NZD), US dollar (USD), Singapore dollar (SGD), Swiss franc (CHF), British pound (GBP), Mexican peso (MXN), Australian dollar (AUD), Polish zloty (PLN), Turkish lira (TRY), Chinese yuan (CNY), Hong Kong dollar (HKD), Norwegian krone (NOK), Swedish krona (SEK), South African rand (ZAR), Bitcoin (BTC) |

Open an MT4 Standard easyMarkets Account

MT5 Account

Account dedicated to both professional and beginner traders who want to invest their funds on one of the most powerful platforms ever created: MT5. Professional trading but with an intuitive environment that allows clients of any category to invest at their best on the markets, with advantageous fixed spreads, a max leverage up to 1:2000, and no trading commissions.

| Features | MT5 Account |

|---|---|

| Minimum transaction size | 0.01 lots | Type of spread | Fixed | EUR/USD starting from | 0.7 pip | GBP/USD starting from | 0.9 pip | USD/JPY starting from | 1.0 pip | OIL/USD starting from | 0.011 USD | XAU/USD starting from | 0.20 USD | Minimum deposit | 25 US dollars | Maximum leverage | 1:2000 | Trading commissions | Zero | Account management fees | Zero | Customer phone support | Yes | Personal Account Manager | Yes | Trading phone and live chat 24/5 | Available | No slippage | Not available | Stop Loss | Paid | Negative Balance Protection | Active | Fundamental analysis | Available | Daily email: Technical Trading Central Analysis | Yes | Central trading indicator | Available | Account currency | Euro (EUR), Canadian dollar (CAD), Czech koruna (CZK), Japanese yen (JPY), New Zealand dollar (NZD), US dollar (USD), Singapore dollar (SGD), Swiss franc (CHF), British pound (GBP), Mexican peso (MXN), Australian dollar (AUD), Polish zloty (PLN), Turkish lira (TRY), Chinese yuan (CNY), Hong Kong dollar (HKD), Norwegian krone (NOK), Swedish krona (SEK), South African rand (ZAR), Bitcoin (BTC) |

Open an MT5 easyMarkets Account

uBTC easyMarkets Account

Innovative solution for traders who prefer trading entirely focused on crypto, the uBTC easyMarkets account allows any operation (deposits, exchanges, withdrawals, and much more) to be carried out using Bitcoin.

Using blockchain technology, which allows for the secure and transparent recording and sharing of information, the account enables traders to trade over 200 instruments quickly and with extreme simplicity, without having to exchange bitcoin for FIAT currencies.

Furthermore, to simplify and further improve the trading experience, the new uBTC account from easyMarkets will automatically create a new bitcoin wallet. This will optimize any operation, as clients will have the opportunity to react quickly and safely during moments of high volatility and take advantage of it when possible.

Open a uBTC easyMarkets Account

eToro vs easyMarkets: fees – Who is more advantageous?

A fundamental element that induces traders to choose a broker with whom to invest and entrust their funds concerns the costs to be borne for withdrawal-deposit transactions, negotiations, account management, spreads, etc. Being undisputed giants in the sector, both rigorously regulated by Tier-1 control bodies, both eToro and easyMarkets offer transparent and advantageous trading.

A fundamental difference between the two brokers concerns the spread. While eToro offers variable spreads based on the markets, easyMarkets imposes a fixed spread.

| Fees | easyMarkets | eToro | |||||

|---|---|---|---|---|---|---|---|

| Account opening costs | Zero | Zero | |||||

| Management fees | Zero | None | Deposit fees | No | No | Withdrawal fees | No | Starting from $5 | Custody fee | Zero | Zero | Inactivity fee | Not provided | $10 monthly | Spread | Fixed starting from 0.7 pip | Variable starting from 0.0 pip | Overnight fees | Yes | Yes |

| Commissions | easyMarkets |

|---|---|

| Account opening costs | Zero |

| Management fees | Zero |

| Deposit fees | No |

| Withdrawal fees | No |

| Custody fee | Zero |

| Inactivity tax | Not provided |

| Spread | Fixed starting from 0.7 pip |

| Overnight fees | Yes |

Copy Trading: Revolutionary eToro – Zero Absolute easyMarkets

A service that now dominates in the world of online trading given its enticing features, Copy Trading is an innovative investment technique that allows traders to copy operations elaborated by professionals in the sector and derive the same benefits. In practice, using the platform dedicated to the service, the trader (follower) will be able to select the expert to follow (Master) and copy the desired strategies. The selected operations will be executed automatically on the follower’s account. A service highly sought after by traders of any category (but usually indicated for beginners), Copy Trading also allows interacting with traders with proven experience, confronting other investors, and receiving useful advice to improve one’s trading style.

Regarding the Copy Trading service, there is an abyssal difference between eToro and easyMarkets. Indeed, between the two, only eToro allows access. Despite being a leading broker in the sector, easyMarkets does not include among its excellent services, the possibility to access a platform dedicated to Copy Trading. A sore point, since it allows customers with limited experiences and knowledge (especially beginners) to earn on the markets. On the contrary, eToro offers traders the opportunity to access the largest community in the world, with millions of users and almost unlimited investment opportunities.

Find out more about easyMarkets

- eToro Copy Trading

- With millions of traders of any category and a wide list of updated services, CopyTrader eToro is by far the most imposing and complete platform for copy trading in the world. From the intuitive interface, totally free and with many technologically advanced services and functions, CopyTrader eToro is a perfect environment to be able to derive earnings, perfect one’s style knowledge, and interact with experts in the sector. Another feature to consider regards the possibility to test the environment through a demo account. In this way, customers will be able to engage in negotiations without running risks, before deciding whether to trade for real

- Copy Trading easyMarkets: nonexistent

- It is unexplainable how a broker of such scope does not allow its customers to access such an innovative and advantageous service as copy trading. Despite the extremely fair environment that literally allows everyone to access any available service or tool and a policy focused on innovation and total security, the broker limits itself to offering “standard” trading focused mainly on the individual, without considering the importance of the “collective” aspect in trading.

| Copy trading platform | eToro |

|---|---|

| Type | eToro Copy Trading Platform |

| Costs | Zero commissions (excluding costs to Access Top investors) |

| Availability | International |

| Community and social trading | Yes |

| Demo account version | Yes |

Find out more about easyMarkets

eToro Copy Trading: Incredible!

The quintessential Copy Trading, with over 35 million users worldwide and an incredible list of professionals with proven experience, the eToro CopyTrader platform is by far the largest community of traders and investors in the world. To distinguish itself from most companies that use external platforms to offer access to the copy trading service, eToro manages and executes all operations on its own servers, without having to request interventions from external operators. This feature allows the broker to bring together Master and Follower in a single and imposing international community.

A platform created with the idea of improving and personalizing a service already offered on the markets, eToro Copy Trading has radically changed the approach to the service with its extraordinary and innovative features:

- An intuitive environment that allows customers of any category to operate on the platform with extreme ease. To start trading, the customer will simply have to access the “Copy People” screen and choose the trader to follow, viewing the list of available masters.

- Unlike other brokers that offer the same service, eToro’s Copy Trading has no additional costs to be able to execute copy operations. The customer will only have to provide for ordinary expenses, such as trading spreads or any commissions.

- The free access to the Community allows followers to easily and accurately select the master to follow and copy, viewing in detail the characteristics, risk propensity, trading preferences, trading volume, success percentage, and much more.

- By accessing the innovative “Popular Investors” section, the customer will have the opportunity to decide whether to follow the most performing professionals and copy their strategies. It is important to make it known that to be able to copy the operations of the “Popular” masters, each trader will have to pay a commission (but only in case of successful operations).

- Guaranteed freedom and total control. Even if the selected strategies will be copied and executed automatically on the follower’s account, the latter will at any time be able to decide whether to interrupt or pause an operation, include additional services to optimize risk management, make changes to the amount of funds to be invested.

Furthermore, in case the trader was “undecided” and wanted to test the service without having to risk funds, the broker allows opening a demo version of the account, with a virtual portfolio of $100,000 that the customer can use to test themselves.

- Quick Copy Trading.

- Regardless of the timing in executing operations and the experience of the traders, eToro’s copy trading platform allows everyone to copy strategies with extreme ease and without excessive restrictions or limitations. All selected operations will be copied automatically and instantly executed in the trading account of the follower.

- Zero management costs.

- Opening a new real account with eToro does not entail management costs and the customer will have free and unrestricted access to the service. The trader will only have to provide for the minimum activation deposit of the account and any commissions to be paid to the popular master.

- Experience and gain.

- In addition to being able to derive extra earnings through copied strategies, the platform allows community members to perfect their own style, increasing knowledge and experiences through the sharing of useful information and the work carried out by millions of users. CopyTrader includes among its services and tools: a wide range of portfolios, statistics, risk scores of other traders, and much more. Furthermore, with access to the platform, everyone will be able to interact, chat on various channels, analyze strategies to be executed diligently, and consequently improve their modus operandi.

Trader Profile

To further optimize the experience of community members, eToro recommends that traders create a detailed profile, in order to present themselves adequately to the community and produce effective statistics, created based on their own trading needs and habits:

- Feed.

- Section of the profile that allows community members access to all social activities, including posts and comments. This section will also allow the display of biographical data.

- Statistics.

- A very practical function that offers the possibility to visualize the profits made and the success/failure ratio. Essential for excellent management of one’s activities.

- Portfolio.

- Allows visualizing trading preferences, risk propensity, trading volume, and other details of investors to be copied. Indispensable to be able to select and copy a strategy fully compatible with one’s own needs.

- Chart.

- Function that simulates the results of a hypothetical investment of $10,000 on the selected master. A sort of qualitative test that allows evaluating the master to be copied.

It is important to underline that although eToro suggests setting one’s own profile to “public,” each customer will always be able to decide in total freedom whether to make their experiences public or set them to “private.” And if the customer does not intend to share the information of his profile, he will simply have to click on “Private Profile”. To make changes to the privacy levels of one’s profile, click on the “settings” icon and access the “profile privacy” section.

Social News Feed

Another innovative service to consider, the Social News Feed allows the trader to integrate social media into their online trading activities. This allows community members to view in detail both the tools and the masters to follow. Interesting comparisons, chats, and useful tips.

- Publication of updates on operations performed.

- Tag the tools on which you have decided to invest.

- Tag the people interested in the topic.

- Share posts on the feed.

- Comment on published posts.

- Create totally free feeds, compatible with one’s own interests.

The trader will be able to receive and share information on:

- Useful updated news published by eToro, information on the latest and interesting tools available and useful live webinars.

- Live updates, updated notifications on advantageous promotions, interesting news on the markets and free access to financial conversations on Twittersphere.

- Instagram.

- Rapid succession updates from eToro, viewable in a clear and precise graphic format.

- Youtube.

- Video tutorials, interviews, informative videos, and much more. With access to the information available on the channel, the customer will be able to improve their style and perfect the operations to be executed.

How to Access eToro’s Copy Trading

To be able to access the copy trading service, the interested trader will have to open a real account with the broker and verify the information by sending the required documentation. With access to their client area, the trader can then decide whether to opt for copy trading, simply by clicking on the dedicated icon.

Access the eToro Copy Trading service

Promos and Bonuses Offered: easyMarket win!!

Another feature that often conditions traders in the choice of a trusted broker is the offer of interesting promos and advantageous initiatives that allow trading on the markets with an extra gear. Bonuses on deposits, discounts, exclusive offers, and interesting prize competitions, created with the sole objective of benefiting the customer and spurring them on in creating increasingly effective strategies.

Between the two brokers, the only one that periodically offers customers both advantageous and appealing promos is easyMarket. Indeed, eToro does not offer customers programs of this type and limits itself to proposing only to Club members some exclusive initiatives. Consequently, traders intending to take advantage of promos and advantageous bonuses will have to opt for easyMarkets.

Find out more about easyMarkets

Interests on the balance offered by eToro: promising but not accessible to all

More than a real promotional initiative, the “Interests on balance” program offered by the broker can be considered as a particular incentive, proposed to encourage traders to increase their balance levels. Indeed, the promo offers traders up to 4.3% annual interest withdrawable, credited monthly to the eToro account.

- Extremely advantageous rates

- The higher the deposit made, the greater the interest that the trader will receive based on the funds deposited. Interest percentages up to 4.3% annually.

- Monthly credit.

- The matured interests will be credited automatically on the eToro account balance every month

- No restrictions or constraints

- The trader will be able to decide at any time to make a possible withdrawal, using the payment method most suitable to their needs.

But it is important to remember that traders interested in activating the promo, will have to subscribe to the eToro Club and make a minimum deposit of 5000 US dollars to access the first level and take advantage of the deposited funds.

| Club Balance | $250,000 | $50,000 | $25,000 | $10,000 |

|---|---|---|---|---|

| Annual interest rate | 4.3% | 4% | 3% | 1% |

- What is the Club Balance?

- The Total Club Balance allows setting the rate on which the interests will be calculated. In practice, it is the total net worth realized on one’s own account, including traded funds and available cash balance.

- What is the available cash balance?

- The available cash balance is the total of uninvested funds deposited on the accounts at a given time. Interest will be calculated on the cash balance.

- Receiving interests

-

- Available only for club-registered clients

- Calculated every day and credited monthly

- The rates change depending on the Club membership level and based on the available balance.

- How to activate the promo on your eToro account?

-

- Access your eToro account. Traders not yet holding a real account with the broker, will have to sign up and verify the account.

- Deposit the funds necessary to activate the initiative (minimum balance to access the club)

- Access the eToro Club dashboard. Scroll down to the “Interests on balance” icon, click to change it from “Deactivated” to “Active”.

- How are the interests calculated?

- Even if the rate is annual, it will be calculated every day and credited monthly.

- When are the interests credited to the account?

- The interest credit will be carried out automatically within the 5th working day of the following month, in the early hours of the morning (GMT time zone).

- What is the minimum amount that can be received as interest?

- The minimum amount of interests that can be received is $0.01

- If you activate the promo in the middle of the month, will interests be recognized for the entire month?

- No, the promo is not retroactive. Interests will accrue from the date of activation of the promo.

- Will any expenses be calculated on the interests?

- The commissions to be paid depend on the laws of one’s country of residence. Each trader will have to verify whether they will have to pay by visiting the official website of the broker or contacting the support team.

Redeem the interests on balance with eToro

First Deposit Bonus easyMarkets

| Promotion | Bonus on the first deposit |

|---|---|

| Minimum activation deposit | 100 USD |

| Percentage of the bonus | Varies based on the capital deposited 30% – 40% – 50% |

| Max extra funds | $2000 |

| Withdrawal of the bonus | Not available |

| Profit withdrawal | Available without restrictions |

| Compatible accounts | Any account offered by the broker |

| Multiple requests of the offer | Not allowed (one customer – one bonus) |

| Negotiable instruments | Forex, metals, commodities, cryptocurrencies, indices, stocks |

In addition to offering an environment totally focused on the needs of the customers with flexible and advantageous trading conditions, the broker is committed to periodically offering interesting promotional initiatives, in order to enhance the work of its customers and spur them on to give their best to achieve their objectives. One of the most popular and appreciated promos by customers is the “First Deposit Bonus”.

Find out more about easyMarkets

A very versatile as well as advantageous promotional initiative, the First Deposit Bonus offered by the broker allows customers to choose the amount of extra funds to receive (in percentage) based on the amount of capital deposited with the first deposit. In a nutshell, the bonus that each customer can receive changes as the funds credited to their own account vary and as the funds deposited increase, the percentage of extra funds will also increase:

| First Deposit | Bonus in percentage | Minimum credit | Maximum credit |

|---|---|---|---|

| $100 – $199 | 30% | $30 | $60 |

| $200 – $1000 | 50% | $100 | $500 |

| $1001 – $5000 | 40% | $400 | $2000 |

The bonus can be activated by any trader holding a new real account rigorously verified with easyMarket, and to make the request, it will be sufficient to carry out the following very simple steps:

- Open a new real Account with easyMarkets.

- Make a minimum deposit of 100 USD.

- Contact your relationship manager and request the “First Deposit” bonus.

- Accept terms and conditions of use during the registration step.

It is important to specify that the extra funds resulting from the initiative cannot be withdrawn, but it will be possible to use them exclusively to trade on the markets. Any profits generated through the use of the bonus funds can be withdrawn at any time.

Get the First Deposit Bonus of easyMarkets

Terms and Conditions of the easyMarkets Bonus

The promo is freely accessible, and all traders will be able to request it and benefit from it. Being activatable only on new accounts, on which no operation has been carried out:

- New traders will have to open an account, verify it, and make the minimum deposit necessary for activation.

- Traders already holding one or more accounts with the broker, will necessarily have to open a new account to join the initiative.

In addition to having to open an account and deposit the funds necessary for the activation of the promo, each customer will be required to read and accept the terms and conditions of use carefully. In the next list, a summary of the main rules and information to know to access the initiative:

- In the case of deposits in a currency different from that of the account, the extra funds will be automatically converted into the base currency of the account and subsequently credited at the current market rate.

- All possible profits can be withdrawn without any restriction.

- In the event that no trading operations are carried out for a maximum time of 30 days from the credit of the extra funds, the broker will have the right to charge the amount of the bonus.

- Extra funds cannot be withdrawn and traders will have the possibility to use them exclusively to trade. As for withdrawals, hypothetical transfers between accounts will not be allowed.

- Any withdrawals requested during the entire promotional period will cause a proportional reduction of the bonus. For example:

- A trader deposits 2,000 dollars.

- Receives a bonus of 800 dollars

- If the trader proceeds to make a withdrawal of 1000$ (equal to 59% of the deposit made), easyMarket will proceed to charge 50% of the bonus, equal to 400 dollars.

- Furthermore, any withdrawal made after trading will result in the total charge of the bonus.

- Each customer will have the right to request the bonus only once and on a single account. Consequently, multiple participations in the promo by the same trader will cause the inevitable disqualification of the latter.

- It is important to emphasize that the promo is not available in all countries. Therefore, the interested trader will have to contact the support team or visit the official website to verify whether it is possible to request access in their country.

Find out more about easyMarkets

Exclusive Tools: eToro Does Not Convince – easyMarket Is Interesting

Access to innovative tools and services is a crucial factor that induces traders to choose their trusted broker. Indeed, in addition to a safe environment, competitive conditions, and excellent investment solutions, being able to take advantage of exclusive services to optimize one’s operations suggests how much the broker actually cares about the needs of its customers.

Both brokers compared in this article offer customers interesting solutions and services. But certainly, among the two, easyMarket is undoubtedly the most innovative.

- easyMarkets

- The broker offers customers unique tools, capable of guaranteeing the customer advantageous trading, simple, with limited risks and minimal costs: easyTrade – dealCancellation – Freeze the Price.

- eToro

- In addition to the exemplary copy trading service accessible for free by anyone and other services to trade informed, the broker offers nothing exciting. Exclusive services and tools are reserved only for customers who have the possibility (and the capabilities) to access the eToro Club. A somewhat selective approach towards customers, which almost seeks to “exclude” cautious or beginner traders who do not intend to invest large sums of capital (without necessarily using the copy trading platform). Disappointing.

Innovation and cutting-edge technologies: easyMarkets tools

Regarding the tools and cutting-edge services, easyMarkets stands out for its extremely high commitment to research and creation of increasingly advantageous and interesting solutions. A constant commitment to be able to offer the customer everything necessary to derive the maximum advantage from any operation.

Available only on the platform of this leading broker in the sector, they make easyMarkets a suitable choice for traders of any level who intend to put themselves in the game by managing their finances in the best possible way and minimizing the risks of loss.

Among the various tools offered, three have aroused considerable interest in traders: easyTrade – Freeze Rate – dealCancellation.

easyTrade

A tool synonymous with absolute innovation, available only with easyMarkets, easyTrade allows customers to trade without margins, with zero spreads, and quantifying risks before executing any operation.

Furthermore, the tool allows traders to execute an operation quickly and simply in just three steps. The customer can set the amount to trade, the duration of the operation, and whether the rate will rise or fall.

The advantages of using easyTrade are the following:

- The trader will have the opportunity to trade without any margin requirement and no need to set a stop-loss. Any operation carried out will not be blocked due to a margin stop-out. Moreover, since the risk is already predefined and locked, it will not be necessary to set the stop-loss.

- An extremely simple solution for trading that compresses high-quality trading into just three very simple steps, making it possible to open a position with a specific duration.

- Excellent solution in particularly volatile market moments, such as during market openings or scheduled political announcements like the NFPs.

- Every customer will be able to act in total freedom and without restrictions, being able to close the position at any time (even before the expiration of the easyTrade).

- Limited Risk: each trader will have the opportunity to calibrate the maximum risk on a specific underlying financial instrument, setting the preferred risk level before executing the operation.

To trade an easyTrade it is important for the trader to know that:

- Risk

- Even before opening any position, you will be able to establish the maximum amount you are willing to risk.

- Equivalent trade size

- Trade size that varies according to the options selected.

- Trade Time

- Represents the duration of the easyTrade. Once the preset times have expired, the operation will close automatically. But if deemed necessary, it will be possible to close the position before the expiration.

- Rate

- Market price that the customer is trading at a given moment.

- Potential payment

- Precise and intuitive chart that allows the trader to visualize the progress of their operations and the profits made based on the options chosen.

- Up & Down

- Once the easyTrade is set, the trader will have to carefully decide whether the rate will rise or fall.

- Payout Target

- Function that allows customers to automatically close a position as soon as the predefined price with the payment objective is reached. To be able to use and activate it, the trader will have to load the easyMarkets web platform or the iOS/Android mobile app, select the open position, and subsequently click on the “modify” icon.

Take advantage of easyTrader for trading

Freeze Rate

An exceptional tool more rare than unique, Freeze Rate allows locking the price at which one wants to trade. The trader will have a buffer of a handful of seconds to be able to execute their operation. Although it is a very short fraction of time, a few seconds can significantly impact in extremely volatile markets like Forex or cryptocurrencies.

Why use it?

- Locks the price for three seconds on the financial markets. The more volatile the market, the greater the advantages that the trader can derive.

- Extremely useful before announcements from central banks, policymakers, or significant market events, such as Non-farm payrolls.

- The Freeze Rate is indicated for intraday strategies or for executing high-frequency operations within 24 hours.

To use the tool, it will be enough to carry out the following very simple steps:

- Click on the preferred tool visible on the right side of the screen.

- Click on the “Freeze Rate” icon, visible between the “Sell” and “Buy” icons.

- You will get a temporary buffer to choose whether to click on the “SELL” or “BUY” icon. A bar will indicate the duration of the block.

- The trader will have the possibility to freeze the price several times, but it should be considered that a slight delay could cause a variation in the price.

Take advantage of Freeze Rate on easyMarkets

dealCancellation

A truly revolutionary tool that allows customers to trade literally at zero risks. dealCancellation allows traders to select a margin of one, three, or six hours to be able to cancel a particular order, in the event that the market moves in the opposite direction. In practice, the tool allows traders to cancel the executed operation up to the moment of expiration and save the invested amount.

When is it possible to use this tool?

- Significant market events

- During significant market events, many brokers increase margins or inexplicably completely block trading. With easyMarket this does not happen, on the contrary, the broker offers traders this fantastic tool to be able to trade without excessive risks during major events of the economic calendar.

- Trading without worries

- Sometimes carrying out an operation causes states of agitation, but with dealCancellation it is possible to cancel the operation in case it is losing, without worries.

- Exploiting volatility

- Generally, traders do not trade in moments of extremely volatile markets, since it could cause significant losses even in the short term. But it is also true that as the risks to be run in an investment increase, the possibilities of profit also increase considerably. Having dealCancellation available, each trader will be able to exploit volatility to their advantage.

It is important to specify that dealCancellation involves the payment of a commission to be able to be used. To know the costs, visit the official website and access the area dedicated to the tool.

To be able to use the service, it will be enough to carry out the following very simple steps:

- At the moment in which a trader decides to open an offer, the trader will have to click on the shield-shaped icon to activate dealCancellation and choose the duration of 1, 3, or 6 hours.

- To be able to view the operations with active dealCancellation, access your Report on open operations. On all protected operations, the green shield will appear.

- In case of a losing operation, cancel it within the set deadline. Attention, dealCancellation is not available on all the instruments offered and it is not possible to activate it on positions already opened.

In addition to the innovative solutions just described, the broker allows traders to trade using:

- Free stop loss: a tool considered essential for creating well-structured strategies and adequate risk management, the stop loss allows to protect oneself from unexpected losses caused by sudden market fluctuations. The broker not only offers free use of the tool but guarantees that the operation will be closed automatically in case of a market against.

- Zero slippage: The requested price will be the one executed for the operation. Total guarantee of an execution of operations at the expected price.

Trade at zero risks with dealCancellation easyMarkets

Innovative tools and services reserved for a few “chosen ones”: eToro disappointing

As already mentioned, despite the broker being the creator of one of the largest copy trading platforms in the world and offering excellent trading conditions to trade optimally on the markets, it reserves the use of a wide range of innovative tools, exclusive services, and more advantageous trading conditions, only to the “chosen” of the eToro club.

Indeed, in addition to some advantageous solutions such as crypto staking and Smart Wallets, the broker reserves last-generation functions and services only and exclusively to club members.

To become a member of the eToro club, a trader will have to meet the requirements, which require the customer to deposit on their account amounts not less than $5000 and to maintain their balance not less than such amount, In practice, to be able to use any services and innovative tools the trader will have to pay.

As already described, a somewhat unfair service that surely a trader does not expect from an international broker of this caliber. It is true, eToro copy trading is nothing short of revolutionary, allowing totally free interaction on the platform and the copying of operations carried out by other investors. But for traders looking for their own dimension who do not intend to share or copy strategies, how will they be able to manage their operations? What support does the broker offer?

Copy trading is an excellent investment option, but it is not the only solution to be able to expand one’s experiences and knowledge. Indeed, innovative tools and services allow traders of any level to put themselves in the game and understand how to operate on the markets based on their own capabilities.

- Smart Wallets

- Designed and selected with care by the broker’s analysts, the innovative investment portfolios have been created mainly for long-term trading and offer excellent investment prospects. Created to satisfy the trends of any trader, the Smart Wallets represent a practical and diversified solution to trade on the main market trends. The service is totally free and is accessible by any customer of the broker. There are 5 different portfolios that the trader can select that vary according to the individual needs of each customer:

- Core Equity: designed for traders with a high risk propensity

- Core Dynamic: an excellent choice for professional traders who opt for long-term investments

- Core Moderate: Suitable for cautious traders who prefer a moderate approach in trading.

- Core Stability: created for clients with balanced exposure.

- Core Income: For traders with a low risk propensity.

- Staking

- Staking is a service much sought after by traders that allows crypto-asset holders to automatically receive rewards in units of the same asset. A process very similar to active interests credited based on deposited funds. In case a trader owns a crypto-asset, they will only have to set it to “staking” on the dedicated service page.

Crypto-asset Non-Club (Bronze) Silver Club Members Gold Club Members Platinum Club Members Platinum+ Club Members Diamond Club Members Intro days of crypto-assets Ethereum (ETH) 45% 55% 65% 75% 85% 90% 7 days (rewards will be credited on the 8th day) Solana (SOL) 45% 55% 65% 75% 85% 90% 7 days (rewards will be credited on the 8th day) Cardano (ADA) 45% 55% 65% 75% 85% 90% 7 days (rewards will be credited on the 8th day) Tron (TRX) 45% 55% 65% 75% 85% 90% 7 days (rewards will be credited on the 8th day) Near Protocol (NEAR) 45% 55% 65% 75% 85% 90% 7 days (rewards will be credited on the 8th day) Polygon (POL) 45% 55% 65% 75% 85% 90% 7 days (rewards will be credited on the 8th day)

Find out more about easyMarkets

FAQs to summarize the article

- What are the main differences between eToro and easyMarkets?

- eToro offers social and copy trading features, while easyMarkets provides tools like dealCancellation and Freeze Rate for enhanced trading risk management.

- What trading platforms do eToro and easyMarkets offer?

- eToro operates its own platform and mobile app, while easyMarkets offers MetaTrader 4, MetaTrader 5, its proprietary platform, TradingView, and a mobile app.

- Are eToro and easyMarkets well-regulated?

- Yes, both platforms are regulated by multiple top-tier authorities, ensuring high levels of security and operational standards.

- What is the minimum deposit for eToro and easyMarkets?

- eToro requires a minimum deposit of $10, whereas easyMarkets requires a minimum of $25.

- Do both brokers offer negative balance protection?

- Yes, both eToro and easyMarkets offer negative balance protection to safeguard traders from losing more than their account balance.

- Can I engage in social trading on both platforms?

- Social trading is available on eToro, including features that allow you to copy the trades of experienced traders. easyMarkets does not offer a social trading platform.

- What unique trading tools does easyMarkets offer?

- easyMarkets provides unique tools such as dealCancellation, which allows you to cancel losing trades within an hour for a fee, and Freeze Rate, which lets you freeze a price momentarily to execute trades.

- What are the spread types offered by eToro and easyMarkets?

- eToro offers variable spreads, while easyMarkets offers fixed spreads, providing predictability in trading costs.

- Which broker is better for beginners?

- Both brokers cater well to beginners, but eToro’s social trading platform may be particularly beneficial for new traders looking to learn from experienced ones.

- Which broker offers more financial instruments?

- Both brokers offer a wide range of trading instruments including forex, stocks, commodities, and cryptocurrencies, but eToro has a broader selection due to its larger scale and social trading focus.

Latest Features

- Close