Question: What's the minimum deposit amount of Errante?

Errante, a strictly regulated ECN broker overseen by CySEC, emphasizes security with client funds stored in top-tier banks and a strong technological framework. The broker’s minimum deposit requirement is set at €50, aiming to make trading accessible for a broad spectrum of traders. Errante offers several account options tailored to different trader levels, including Standard, Premium, VIP, and Tailor Made accounts, each designed to meet specific trading needs and financial commitments. Technological advancements at Errante include advanced analysis tools and state-of-the-art trading platforms that cater to all trader levels, promoting effective trading strategies. The €50 minimum deposit encourages accessibility, risk management, and flexibility, making it ideal for new traders to start with minimal financial commitment.

Errante Minimum Deposit Requirements: Accessible Trading for Every Trader

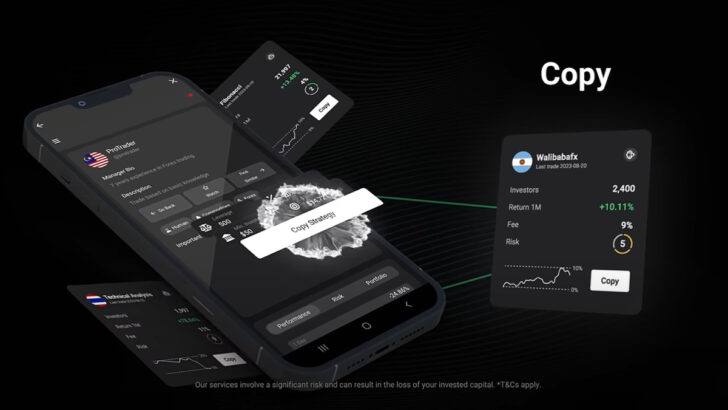

Explore Errante’s low minimum deposit requirement, tailored account options, and advanced trading platforms to kickstart your trading journey.

| Feature | Description |

|---|---|

| Regulatory Compliance | Regulated by CySEC with strict standards for client fund segregation and security. |

| Minimum Deposit | €50, designed to make trading accessible to a wide range of traders. |

| Account Types | Standard, Premium, VIP, and Tailor Made, each offering unique benefits suited to different trading levels and strategies. |

| Technological Advancements | Includes cutting-edge trading platforms and advanced analysis tools. |

| Trading Conditions | Competitive conditions with commissions from zero and variable spreads starting from 0.0 pip. |

Start trading with just €50 at Errante and unlock a world of trading opportunities!

Errante, a strictly regulated ECN broker, is recognized for its high safety standards and robust trading environment. This article provides an in-depth analysis of Errante’s minimum deposit requirement, a crucial aspect for traders preparing to engage with this platform.

Regulatory Compliance and Security

Errante’s operations are overseen by the Cyprus Securities and Exchange Commission (CySEC), ensuring adherence to stringent regulatory standards. This includes capital adequacy and client fund segregation, with client funds stored in top-tier banks to ensure maximum security. The broker’s commitment to safety is mirrored in its state-of-the-art technological framework and comprehensive support system.

Minimum Deposit Requirement

Errante’s competitive trading conditions are highlighted by its minimum deposit requirement of €50. This low threshold is designed to make the trading platform accessible to a wider audience, allowing traders of various financial backgrounds to participate in forex, stocks, energies, commodities, metals, and indices trading.

Account Options

- Standard Account

- Ideal for beginners, offering zero commissions and a minimum deposit of €50.

- Premium Account

- Targets more experienced traders, with a minimum deposit of €100 and zero commissions for enhanced trading conditions.

- VIP Account

- Caters to high-volume traders, offering premium features for a minimum deposit of €5000.

- Tailor Made Account

- Provides customizable options for professional traders, with a minimum deposit starting at €15000.

Technological Advancements and Trading Conditions

Errante prides itself on integrating the latest technological advancements to support effective trading strategies. The broker offers advanced analysis tools and cutting-edge trading platforms that are crucial for both new and experienced traders. Competitive conditions such as commissions starting from zero and variable spreads from 0.0 pip underscore the broker’s commitment to providing favorable trading conditions.

Why a €50 Minimum Deposit?

- Accessibility: It lowers the barrier for entry, allowing novice traders to experiment with real money trading without a significant financial outlay.

- Risk Management: It enables traders to manage their risk effectively by not requiring a large initial commitment.

- Flexibility: Traders can test different trading strategies and platforms with minimal risk.

Errante’s minimum deposit requirement reflects its dedication to making forex and CFD trading accessible to a broader audience while maintaining high standards of security and regulatory compliance. Whether you are a novice looking to dip your toes in the trading world or an experienced trader seeking a reliable platform, Errante’s structured account system and competitive conditions provide a solid foundation for trading success.

FAQs

- What regulatory body oversees Errante?

- Cyprus Securities and Exchange Commission (CySEC).

- What is the minimum deposit required at Errante?

- €50, allowing for accessible entry into trading markets.

- What account types does Errante offer?

- Standard, Premium, VIP, and Tailor Made accounts, each tailored to meet specific trader requirements and goals.

- How does Errante ensure the security of my funds?

- Client funds are kept in segregated accounts at top-tier banks, under CySEC regulations.

- What trading platforms does Errante provide?

- Errante offers MetaTrader platforms, known for their robustness and advanced features.

- What are the commissions for trading at Errante?

- Commissions start from zero, with specific rates depending on the account type.

- Why is the minimum deposit set at €50?

- To lower the barrier for entry and allow new traders to start with minimal risk.

- Can I manage risk effectively with a low deposit?

- Yes, the €50 minimum deposit allows for effective risk management by limiting initial financial exposure.

- What types of financial instruments can I trade at Errante?

- Forex, stocks, energies, commodities, metals, and indices.

- How can I learn to trade at Errante?

- Errante offers extensive educational resources including webinars, tutorials, and articles.

Latest Features

- Close