Question: What's the spread cost & commission of Errante?

Errante is a highly regarded ECN broker offering a secure and efficient trading environment for all levels of traders. It provides a variety of account types with competitive conditions, such as zero commissions and low spreads starting at 0.0 pip. The broker offers a wide range of trading instruments including forex, stocks, commodities, and energies, with adjustable leverage options. Errante also supports multiple funding and withdrawal methods and prides itself on quick, secure transactions. The platform includes advanced tools like MetaTrader 5, educational resources, and a dedicated customer support team available 24/5.

Errante Review: Top ECN Broker for Secure & Efficient Forex and CFD Trading

Explore Errante’s zero-commission trading, low spreads, and powerful trading platforms for optimal trading efficiency.

| Feature | Details |

|---|---|

| Account Types | Standard, Premium, VIP, Tailor Made; variable commissions and spreads |

| Trading Instruments | Forex, Stocks, Commodities, Indices, Energies |

| Leverage | Maximum varies by instrument |

| Platform | MetaTrader 5, mobile apps, real-time data, customizable tools |

| Support and Education | 24/5 customer support, educational resources, webinars, tutorials |

Join Errante today to experience advanced, commission-free trading with spreads from 0.0 pip – Your gateway to successful trading!

Errante, a strictly regulated ECN broker, is highly regarded for offering a secure and beneficial investment experience, ideal for traders at all levels of experience. Founded by seasoned professionals, Errante aims to provide a reliable, safe, and transparent trading environment.

Commission and Spread Costs

Errante distinguishes itself with competitive and flexible trading conditions. It operates as an ECN broker, allowing direct market access without intermediary interference, which enhances trading efficiency and cost-effectiveness. The broker’s pricing structure is designed to accommodate various trading styles and volumes, offering commissions starting from zero and variable spreads beginning at 0.0 pip. The minimum deposit requirement is modest at €50, making it accessible for novice traders while still offering value to more experienced market participants.

Account Types and Customization

Errante provides a variety of account options, each tailored to different trader needs, from beginners to professionals. These include:

- Standard Account: Features include zero commissions, spreads starting at 1.8 pips, and a minimum deposit of €50. This account is ideal for new traders.

- Premium Account: Offers more advanced features with spreads from 1 pip and zero commissions, suited for experienced traders with a minimum deposit of €100.

- VIP Account: Caters to high-volume traders with spreads from 0.8 pips, no commissions, and a required minimum deposit of €5000.

- Tailor Made Account: Provides customizable trading conditions for professional traders, with spreads starting at 0.0 pip and variable commissions based on the trading activity.

Each account offers different leverage options and access to all trading instruments, including forex, stocks, commodities, and indices. Traders can also opt for Islamic accounts and take advantage of automated trading features.

Trading Instruments and Leverage

Errante offers a wide range of trading instruments:

- Forex: Traders can choose from over 50 currency pairs with competitive conditions.

- Stocks and Indices: Offers CFDs on major company stocks and global indices, enabling traders to speculate on price movements without owning the actual shares.

- Commodities and Metals: Traders can invest in various commodities and metals, which are often used as safe-haven assets.

- Energies: Includes trading on energy products like oil and natural gas.

The maximum leverage offered varies by instrument, ensuring traders can choose the level of risk and potential reward that suits their trading style.

Funding and Withdrawals

Errante supports various funding and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets like Neteller and Skrill. The broker prides itself on fast and secure transactions, with most deposits and withdrawals processed quickly. While deposits are generally free of charge, withdrawals may incur a small fee depending on the method used.

Technology and Platform

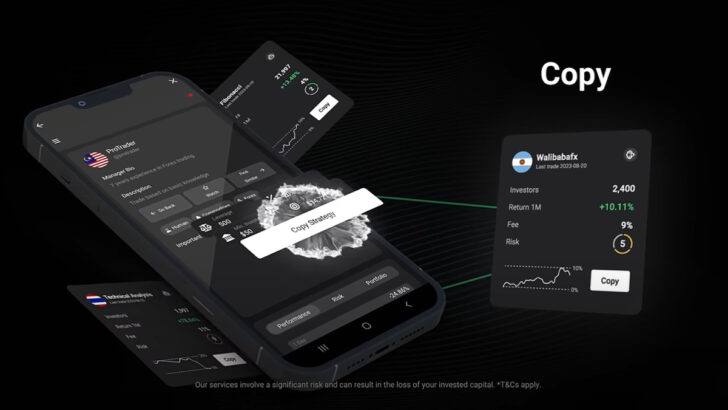

Errante provides access to industry-leading platforms like MetaTrader 5 and proprietary tools designed to enhance trading effectiveness. These platforms are equipped with advanced analytical tools, real-time data, and customizable features that cater to both new and experienced traders. Additionally, Errante offers mobile apps to manage accounts and trade on the go, ensuring clients can react quickly to market changes.

Customer Support and Education

The broker ensures maximum support with a customer service team available 24/5. Traders can access a comprehensive educational resource center that includes webinars, tutorials, and guides designed to enhance trading knowledge and skills.

Errante’s commitment to providing a secure and transparent trading environment, combined with its competitive conditions and comprehensive educational resources, makes it a top choice for traders seeking a reliable ECN broker. Whether a beginner or a seasoned trader, Errante offers the tools and conditions needed to pursue a wide range of trading strategies effectively. For more information or to open an account, traders can visit the official website at Errante.com.

FAQs

- What account types does Errante offer?

- Errante offers Standard, Premium, VIP, and Tailor Made accounts, each designed for different trading needs and strategies.

- What trading platforms are available at Errante?

- Errante provides access to MetaTrader 5 and mobile apps, featuring advanced analytical tools and real-time data.

- What types of trading instruments can I trade with Errante?

- Errante offers a wide range of instruments including forex, stocks, commodities, indices, and energies.

- What are the commission and spread costs at Errante?

- Errante offers competitive trading conditions with commissions starting from zero and spreads beginning at 0.0 pip.

- How can I fund my Errante account?

- Accounts can be funded via bank transfers, credit/debit cards, and e-wallets like Neteller and Skrill.

- Is there a minimum deposit requirement at Errante?

- Yes, the minimum deposit starts at €50 for a Standard Account.

- Does Errante offer educational resources?

- Yes, Errante provides a comprehensive educational resource center that includes webinars, tutorials, and guides.

- What are the leverage options at Errante?

- The maximum leverage offered varies by trading instrument, suitable for different risk appetites.

- How does Errante ensure transaction security?

- Errante prides itself on quick and secure processing of deposits and withdrawals, supporting various reliable methods.

- Who can trade with Errante?

- Errante is suitable for all levels of traders, from beginners to professionals seeking efficient and secure trading conditions.

Latest Features

- Close