IFC Markets' single account to trade Forex and all CFDs

Trade multiple financial instruments using a single account with IFC Markets and choose from various account types with competitive spreads and leverage.

Many brokerage companies are now offering a unified trading account that allows traders to access multiple financial instruments, including currencies, stocks, indices, and commodities. While some brokers claim to provide direct market access, in reality, most operate through sub-accounts or intermediaries, making the execution process less transparent. IFC Markets provides a reliable alternative by offering CFDs on various instruments with fixed spreads, ensuring greater transparency and predictable trading conditions. They offer multiple account types across three trading platforms (NetTradeX, MT4, and MT5) with different spreads, leverage levels, and deposit requirements. This approach allows traders to choose the best account type based on their trading strategy, ensuring flexibility and a competitive edge.

Unified Trading Accounts: Trade Forex, Stocks & Commodities with IFC Markets

Simplify your trading with IFC Markets’ unified account—trade Forex, stocks, indices, and commodities with fixed spreads and flexible trading conditions!

| Topic | Key Details |

|---|---|

| Unified Trading Account | Trade currencies, stocks, indices, and commodities from a single account. |

| Direct Market Access | Most brokers use intermediaries, making direct access claims misleading. |

| IFC Markets Advantage | Offers CFDs with fixed spreads, ensuring transparent trading conditions. |

| Available Platforms | NetTradeX, MT4, and MT5, each with different features. |

| Account Types | Standard, Micro, and Demo accounts with various deposit and leverage options. |

Single account, trade currencies, stocks, commodities, etc.

To provide you with comprehensive brokerage services, you can log in to one account to trade multiple financial instruments.

In recent years, numerous companies have provided brokerage services in the foreign exchange market and CFD, and the number is still growing, which has increased competition among brokerage companies.

This has prompted companies to improve trading conditions and expand effective trading to attract customers.

First, the company began to reduce the spread, and then ECN and money management accounts appeared.

The company actively provides customers with a better trading experience, so that customers can get more profits.

A new idea and function are currently needed to attract customers.

One of the main advantages of attracting clients now is to offer a large number of trading instruments, if before the company offered clients to trade in different currency pairs, one of the prerequisites for attracting clients now is to trade multiple market instruments (stocks, indices, commodities, etc.).

This is the main trend in the future.

There are now two main options.

Analyze the particularity of the two schemes, and their advantages, and disadvantages.

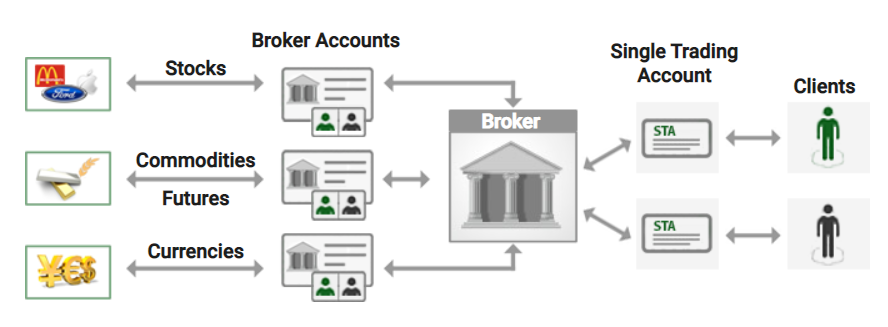

The essence of the first plan is that the company announces the use of the trading platform to directly access the major stock exchanges in the United States, Europe, and Asia to trade a variety of financial instruments.

At first, everything looks very attractive to customers, however, further analysis will cause many problems, directly in the market, in other words, the customer’s transaction directly to the market without going through a broker, requiring the customer to open his own personal account and handle a special set of documents.

In fact, in this scheme, the customer can provide Personal identity documents and open an account directly with the company.

In addition, through the direct mode of the company’s trading platform, the platform needs to be registered with each exchange.

At present, most brokers cannot meet this condition.

So it is certain that the straight-through mode will not be offered to the client, the execution of the trade is through the company sub-account or other broker, so that is why there is silence on this issue.

This does not guarantee that the client’s trade will go directly to the market.

Also needs to be added Yes, in this mode, all instrument spreads are floating, providing the possibility to manipulate trading results.

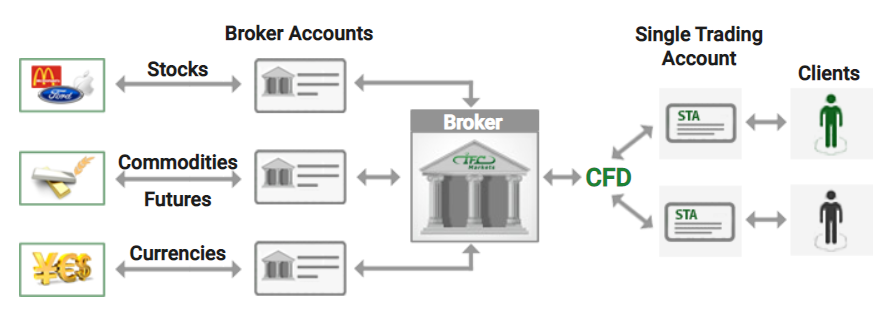

The second option, using a single trading account to trade financial instruments on the world’s major stock exchanges, is very clear and transparent.

It involves all forms of CFD (CFD on stocks, indices and commodities), IFC Markets Providing such a service is an absolute leader.

The difference from the opaqueness of the first scheme is that there will not be a declaration of direct access to various exchanges.

The company itself is the issuer of the CFD contracts and provides the required liquidity.

The company buys and sells the client’s CFD contracts at the beginning, As part of its risk management strategy, hedging positions may go directly to the market or liquidity providers.

It should be noted that, unlike the first scheme, the spread of IFC Markets in this scheme is fixed.

This is very important for customers.

The floating spread makes it impossible to enter and exit the market accurately.

Therefore, the profit and loss cannot be accurately implemented.

IFC Markets provides clients with CFDs, which are based on global stock indices, US, European and Asian stocks and commodities.

There are currently about 500 CFD instruments available for trading, and the number continues to increase, and IFC Markets plans to The number reaches 1000.

In summary, we re-emphasize that the CFD solution is reasonable, transparent, and can enable clients to use their trading strategies more effectively.

Fixed and Variable Spreads – Trading Account Types

IFC Markets offers more than 10 trading accounts with 3 different trading platforms.

See the tables below to know the difference of trading conditions and choose the right account type and platform for your strategy.

| NetTradeX | Standard-Fixed & Floating | Beginner-Fixed & Floating | Demo-Fixed & Floating |

|---|---|---|---|

| Balance currency | USD EUR JPY uBTC | USD EUR JPY uBTC | USD EUR JPY uBTC |

| Initial deposit | 1000 USD, 1000 EUR, 100000 JPY | 1 USD, 1 EUR, 100 JPY | – |

| Maximum equity | – | 5000 USD | – |

| Leverage | 1:1 – 1:200 | 1:1 – 1:400 | 1:1 – 1:400 |

| Min. fixed spread | From 1.8 pips | From 1.8 pips | From 1.8 pips |

| Min. floating spread | From 0.4 pips | From 0.4 pips | From 0.4 pips |

| Short margin level (Stop out) | 10% | 10% | 10% |

| Minimum volume of the deal (forex) | 10000 units | 100 units | 100 units |

| Market newsline | Available | Available | – |

| Accounting system of positions | Hedged/Netting | Hedged/Netting | Hedged/Netting |

| Registration Page | Open Standard-Fixed & Floating Account | Open Beginner-Fixed & Floating Account | Open Demo-Fixed & Floating Account |

Open IFC Markets NetTradeX Account

| MT4 | Standard-Fixed | Micro-Fixed | Demo-Fixed |

|---|---|---|---|

| Balance currency | USD EUR JPY | USD EUR JPY | USD EUR JPY |

| Initial deposit | 1000 USD | 1000 EUR | 100000 JPY | 1 USD | 1 EUR | 100 JPY | – |

| Maximum equity | – | 5000 USD | 5000 EUR | 500 000 JPY | – |

| Leverage | 1:1 – 1:200 | 1:1 – 1:400 | 1:1 – 1:400 |

| Min. fixed spread | From 1.8 pips | From 1.8 pips | From 1.8 pips |

| Short margin level (Stop out) | 10% | 10% | 10% |

| Minimum volume of the deal (forex) | 0.1 lot | 0.01 lot | 0.01 lot |

| Market newsline | Available | Available | Unavailable |

| Accounting system of positions | Hedged | Hedged | Hedged |

| Registration Page | Open Standard-Fixed Account | Open Micro-Fixed Account | Open Demo-Fixed Account |

| MT5 | Standard-Floating | Micro-Floating | Demo-Floating |

|---|---|---|---|

| Balance currency | USD EUR JPY | USD EUR JPY | USD EUR JPY |

| Initial deposit | 1000 USD | 1000 EUR | 100000 JPY | 1 USD | 1 EUR | 100 JPY | – |

| Maximum equity | – | 5000 USD | 5000 EUR | 500 000 JPY | – |

| Leverage | 1:1 – 1:200 | 1:1 – 1:400 | 1:1 – 1:400 |

| Min. floating spread | From 0.4 pips | From 0.4 pips | From 0.4 pips |

| Short margin level (Stop out) | 10% | 10% | 10% |

| Minimum volume of the deal (forex) | 0.1 lot | 0.01 lot | 0.01 lot |

| Market newsline | Available | Available | Unavailable |

| Accounting system of positions | Hedged and Netting | Hedged and Netting | Hedged and Netting |

| Registration Page | Open Standard-Floating Account | Open Micro-Floating Account | Open Demo-Floating Account |

FAQs

- What is a unified trading account?

- A unified trading account allows traders to access Forex, stocks, indices, and commodities from a single account.

- Does IFC Markets provide direct market access?

- No, IFC Markets operates through CFDs, ensuring transparency and fixed spreads.

- What trading platforms does IFC Markets support?

- IFC Markets supports NetTradeX, MT4, and MT5 trading platforms.

- What are the main differences between the trading account types?

- Standard accounts have higher deposits, while Micro accounts offer lower minimum deposits with higher leverage.

- How many financial instruments can I trade with IFC Markets?

- Currently, there are around 500 CFD instruments available, with plans to expand to 1,000.

- What is the advantage of using fixed spreads?

- Fixed spreads ensure stable trading conditions and help traders avoid price manipulation.

- What is the minimum deposit required for IFC Markets accounts?

- It varies by account type, with some requiring as little as $1.

- Are demo accounts available?

- Yes, IFC Markets offers demo accounts for practice trading.

- What leverage options are available?

- Leverage ranges from 1:1 to 1:400, depending on the account type.

- Is there a risk of price manipulation with floating spreads?

- Yes, floating spreads can make entry and exit points unpredictable, potentially affecting profitability.

Latest Features

- Close