Categories

Introduction of Easy Scalping Strategy

Learn effective scalping strategies to maximize your forex trading profits in minutes.

Scalping in trading refers to a strategy where traders aim to gain profits from small price changes, utilizing a short-term trading style that requires constant market monitoring. The strategy is deemed risky and demands strong discipline and robust risk management techniques. The “5 Minute Scalping Strategy” focuses on using timeframes like H1 and M5 and is applied to liquid currency pairs with tools like EMAs and SMA for precise entry and exit points. Another advanced scalping strategy discussed is “Gold-scalping,” which involves trading gold with specific indicators like Williams’ Percent Range for sharp entry and exit based on oscillator movements. Both strategies emphasize the necessity of quick decision-making and continuous monitoring, highlighting the potential for profit as well as the risk of significant losses.

Master Scalping in Forex: Strategies and Tips for Quick Profits

Unlock the power of scalping to boost your trading efficiency and profitability!

| Strategy | Time Frame | Key Indicators | Asset Types |

|---|---|---|---|

| 5 Minute Scalping | H1, M5 | 8, 21, 13 EMAs | EUR/USD, GBP/USD, others |

| Gold-scalping | M1 | Williams’ Percent Range | Gold, Silver |

What is Easy Scalping Strategy?

Scalping may seem like a scary word in people’s minds. Traders, in turn, discover many opportunities hidden behind their meaning. In trading, you don’t have to do anything with a human scalp. Instead, you make a pip cut on small changes in price. In the literature, scalping is defined as a short-term trading style, which helps to succeed in the market from the slightest and as many price changes as possible in a day. Experts identify scalping as a fairly risky trading approach, which requires monitoring on the charts throughout the day. Therefore, a scalper needs to have nerves of steel and follow the market carefully. It is important to know tips about risk management and to place entry and stop loss levels in the right way. A beginner who is confident in scalping can become a coward if he does not have an algorithm to enter the market. Today, we will help you in this struggle and share with you some effective strategies for scalping.

First of all, let’s find out if this scalping strategy is useful for you.

You are a scalper if:

- Trade on small time frames (M1, M5, M15);

- Likes to risk and ready to devote all your time to trading;

- Trade when the market is volatile/busy;

- Want to have a large position size to get more profit from short term trading.

If you answered “yes” to more than these two points, then you are a true scalper! For those of you who answered “yes”; You may be considering that approach right now. Nonetheless, the strategy we will explain below is easy and understandable. We’re sure anyone can try it and see how effective it is.

5 Minute Scalping Strategy

Key elements:

- Timeframe: H1, M5

- Currency pairs: liquid with tight spreads (EUR/USD, GBP/USD, USD/CHF, USD/JPY)

- Indicators: 8-, 21-, and 13- EMAs

Buy scenario algorithm

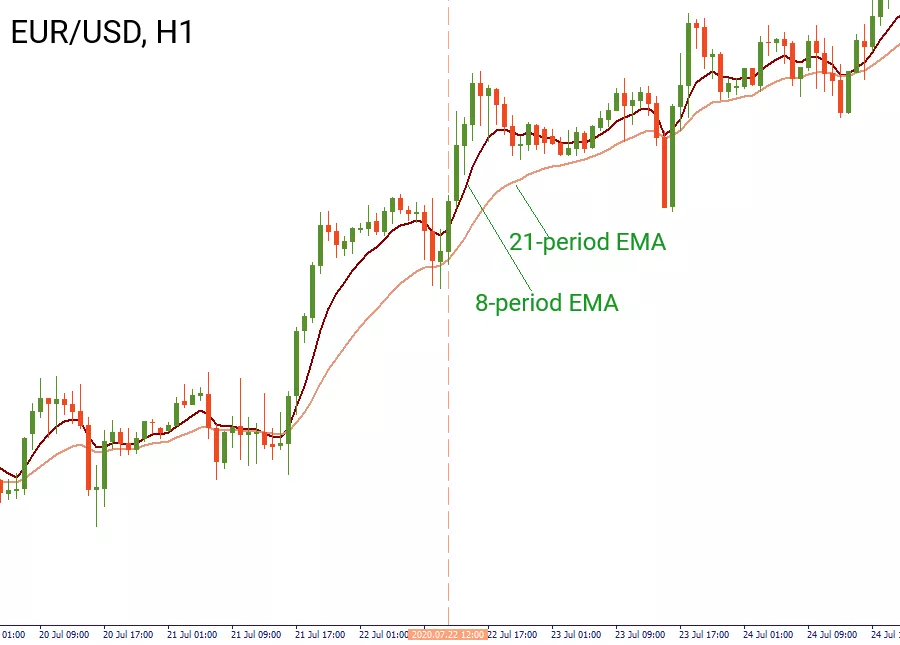

- First, we need to make sure that the trend is down. To do so, we open the H1 chart and enter the 8- and 21- EMA. To do that, open Metatrader, click “Indicators” – “Insert” – “Trend” – “Moving Average”.

- For a buy scenario, we should see an increase. To confirm the trend, the 8-period EMA must be above the 21-period EMA. Moving Averages must not cross each other.

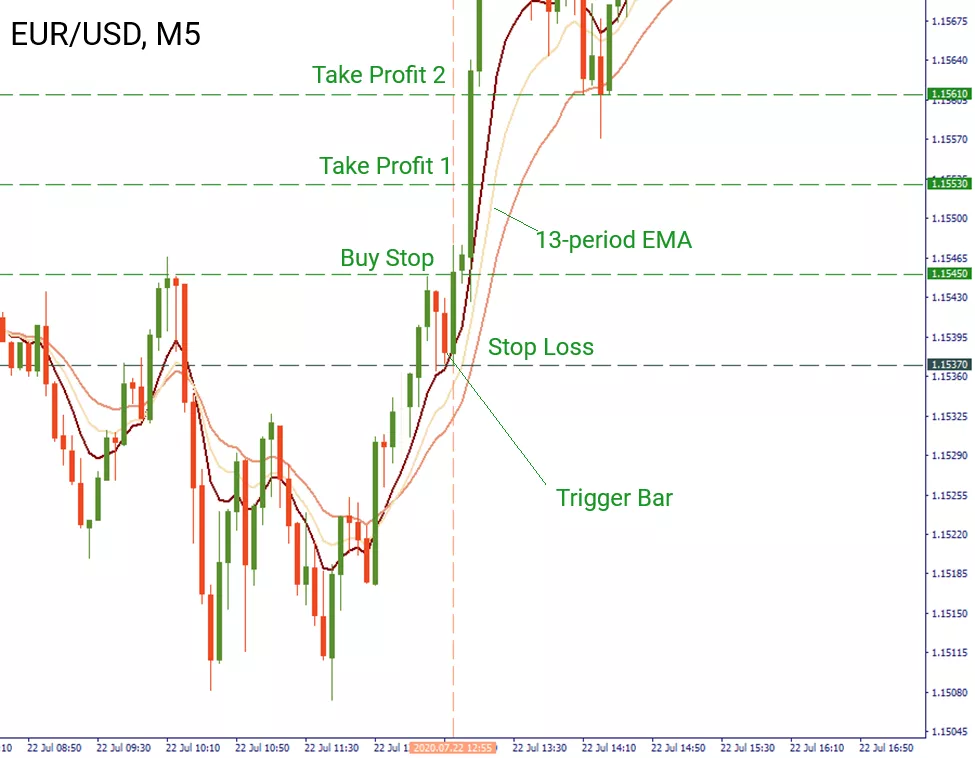

- Now we go to M5 and enter the 13 period SMA. This moving average is needed to see the gap between the 8-period EMA and the 21-period EMA. The wider the trend, the stronger the trend.

- We are waiting for the candlestick to touch the 8 period EMA at the bottom. This is our trigger.

- We need to find the highest candlestick that appears before the trigger bar.

- Buy orders are placed at the top of this candlestick. The stop loss is equal to the low of the trigger bar.

- We place the first take profit at the same distance as the distance between the entry and stop loss. If the trend remains strong at H1 and we are confident enough, we can double our prize and close the position at a distance twice as large as the distance between the entry and stop loss.

Let’s look at an example. We will look at the EUR/USD chart on July 22. On H1 we can see that the price is moving in an uptrend. The 8-period exponential moving average moves above the 21-period.

We switch to M5 and wait for the candlestick to test the 8 period EMA from its lower shadow. The trigger candle occurred at 12:55 am on July 22. We count down 5 candlesticks from trigger one and choose the candlestick with the highest position. We open long positions at 1.1545. We place a buy stop order at the highest position on the candlestick. The stop loss is placed at the bottom of the trigger bar at 1.1537, while the take profit level goes to:

1.1545-1.1537=0.0008

TP1 = 1.1545+0.0008=1.1553

TP2 = 1.1553+0.0008=1.1561

Sell scenario algorithm

On the other hand, let’s look at the steps for opening a short position.

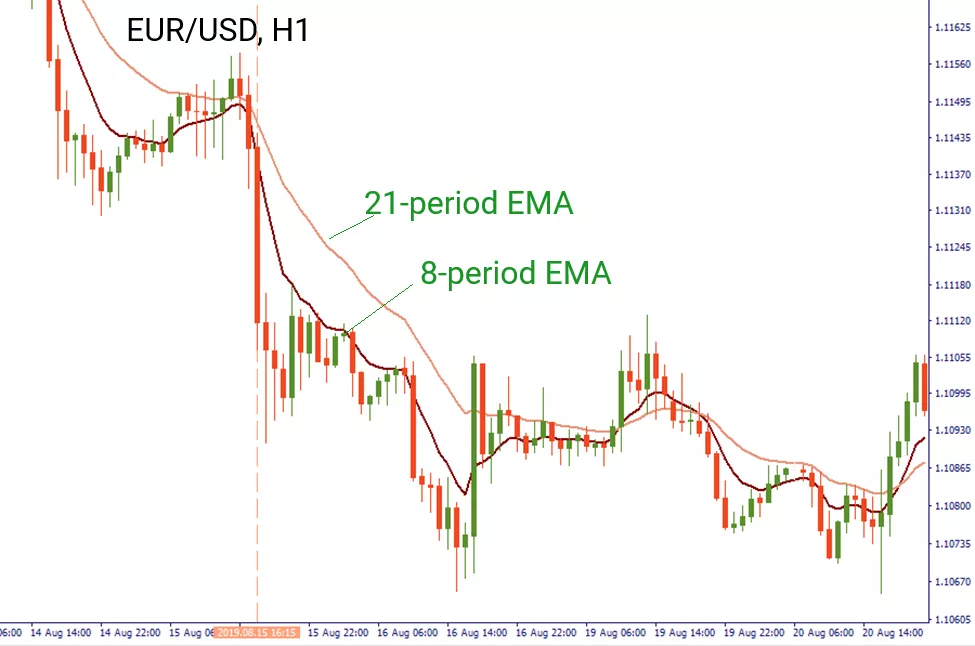

- On H1, the 8-period EMA should be below the 21-period EMA. This confirms a downtrend. Remember, as with the buy scenario, the moving averages should not cross each other.

- We turn our attention to the M5 chart and place the 13-period SMA there. The wider the trend, the stronger the trend.

- We are waiting for the candlestick to touch the 8-period EMA at its highest. This is our trigger.

- We need to find the lowest candlestick that appears before the trigger bar.

- Sell orders are placed at the lowest point on this candlestick. Stop loss is placed at the highest part of the trigger bar.

- The first take profit is equal to the size of our stop loss. The second is twice as large as the distance between the entry and stop loss.

On the H1 chart of EUR/USD we can see that the pair is moving in a descending trend. The 8 period EMA is moving below the 21 period EMA.

We open the M5 chart and wait for the trigger bar. Will appear at 4:25pm on August 15th. We count down 5 candlesticks from trigger one and choose the candlestick with the lowest. This is our sell order heading to 1.1134. Stop loss is placed at the high of the trigger bar at 1.1144. The take profit level is calculated as follows:

1.1144-1.1134=0.0010

TP1 = 1.1134-0.0010=1.1124

TP2 = 1.1124-0.0010=1.1114

Gold-scalping

The second strategy is for those who like to trade gold and want to learn how to scalp precious metals. Keep in mind that it requires your full attention to the graphics.

Key elements:

- Timeframes: M1

- Assets: gold, silver

- Indicator: Williams’ Percent Range: Fast (9) and Slow (54) With periods of -30 and -70

Buy scenario algorithm

You need to buy when the fast and slow oscillators break above -30. Close your position when the fast oscillator (9) leaves the zone. The stop loss goes a few pips below the nearest support level.

Sell scenario algorithm

When you consider opening a short position, you need to sell when the slow and fast oscillator breaks below -70 and close it when it leaves the zone. The stop loss is placed a few pips above the nearest resistance level.

Below you can see an example of a long order. We open positions when the fast and slow oscillators are above the -30 level at 1 946.12 and close at 1 948.67 when the fast oscillator crosses the -30 level to the downside. Level 1 945 marks our stop loss.

Now you know what strategies you can use for scalping. We highly recommend you give it a try! At the same time, remember about risk management and don’t be greedy. This simple advice can save you from trading failure.

FAQs

- What is scalping in forex trading?

- Scalping is a trading strategy that aims to profit from small price changes, requiring active management and strong discipline.

- What are the key elements of the 5 Minute Scalping Strategy?

- This strategy uses H1 and M5 timeframes, focusing on liquid currency pairs with EMAs and SMA for accurate trading.

- How do I execute a buy scenario in scalping?

- Confirm an uptrend with EMAs on H1, find the trigger on M5, and place buy orders above the high of the selected candlestick.

- What is the gold-scalping strategy?

- It involves trading gold on the M1 timeframe using the Williams’ Percent Range indicator to identify quick entry and exit points.

- What should I consider before starting scalping?

- Understand the risks, have a clear strategy, and be prepared to spend significant time monitoring the markets.

- Can beginners practice scalping strategies?

- Yes, but with caution and preferably after gaining experience with demo accounts due to the high-risk nature of scalping.

- What risk management techniques are essential for scalping?

- Setting appropriate stop-loss orders, managing position sizes, and knowing when to exit are crucial for minimizing losses.

- Are there specific times better suited for scalping?

- Yes, scalping is most effective during high market volatility and busy trading hours.

- How important is technology in scalping?

- Very important; fast execution speeds and real-time data feeds are critical for the success of scalping strategies.

- Can scalping be automated?

- Yes, some traders use automated systems to implement scalping strategies, though manual oversight is recommended.

Latest Features

- Close