Is iFOREX a safe broker? What payment methods does it offer?

Explore trading on iFOREX, a secure platform with zero commission, advanced tools, and negative balance protection. Ideal for all trader levels.

iFOREX is a well-established online broker with nearly thirty years in the industry, offering a secure, transparent trading environment.

It supports a wide range of trading instruments like forex, commodities, and cryptocurrencies, and is regulated by CySec and BVI FSC.

The broker provides a zero-commission trading environment, offers negative balance protection, and supports various deposit and withdrawal methods.

Features like the iFOREX App and advanced security measures such as SSL encryption enhance user experience and safety.

iFOREX is ideal for both beginners and experienced traders, providing tools like economic calendars, signals, and advanced charts for effective trading strategies.

| Feature | Detail |

|---|---|

| Regulation | CySec, BVI FSC |

| Trading Instruments | Forex, Stocks, Cryptos, etc. |

| Commission | Zero |

| Security | SSL Encryption, Two-Factor Authentication |

| Minimum Deposit | $100 |

| Leverage | Up to 1:400 |

| Negative Balance Protection | Yes |

| Trading Platform | iFOREX App, Mobile First |

Is trading with iFOREX safe?

| Features | Details |

|---|---|

| Regulations | BVI FSC British Virgin Islands Financial Services Commission – CySec Cyprus Securities and Exchange Commission |

| Available Instruments | Forex, commodities, indices, stocks, ETFs, and cryptocurrency-based CFDs |

| Trading Platforms | iFOREX Platform – Mobile first – iFOREX App |

| Minimum Deposit | $100 (varies based on country of residence) |

| Leverage | Up to 1:400 (varies based on country of residence) |

| Spread | Variable starting from 0.6 pips |

| Trading Commissions | Zero |

| Deposit/Withdrawal Fees | Zero |

| Account Types | Demo, Real, Swap-Free |

| Negative Balance Protection | Available |

| Customer Support | 24/7 Multilingual |

| Security Measures | SSL Encryption, Two-Factor Authentication, Verified Accounts |

| PAMM – MAM Accounts | Not available |

| Minimum Order | 0.01 lot |

| Stop out | Not available |

| Margin call | Not available |

| Contests and bonuses | Trading bonus, cashback, bonuses up to 50% on first deposit |

| Order Execution | Market |

| Liquidity Provider | London Stock Exchange, German Stock Exchange, Italian Stock Exchange |

| Affiliate Program | Yes |

| Account Currency | USD – EUR |

| Deposit – Withdrawal Methods | Included: Bank Transfer, VISA / Mastercard, Neteller, Skrill, Bitcoin |

A broker that has been operating in the markets for nearly thirty years, iFOREX can be considered a sort of pioneer in the online trading industry. Created back in 1996, today iFOREX is a giant that allows more than eight million clients worldwide to trade in a secure, transparent environment with excellent investment solutions.

Given its years of honored service, it might be seen as an “old-school” broker with obsolete beliefs and too traditional trading, but that is not the case. Indeed, iFOREX bases its operations on a perfect combination of cutting-edge technology, ample guaranteed liquidity, maximum support, and total transparency.

The environment offered is intuitive and well-structured, allowing traders of any level to negotiate optimally on forex, commodities, indices, stocks, ETFs, and cryptocurrencies with advantageous trading conditions (without any commission and reduced spreads to a minimum) and constantly updated technologies.

Strictly regulated by multiple control bodies (including CySec and BVI FSC), the broker guarantees traders total transparency and extremely high security standards on sensitive data and deposited funds. Virtually impenetrable protection protocols allow traders to negotiate on the markets without worries and focus exclusively on devising effective strategies.

- Safe broker.

- With almost thirty years of experience in the markets and implementing very high security measures, the broker allows clients to operate in a protected environment with excellent investment possibilities.

- Negative balance protection

- A risk protection feature that does not allow clients to lose more than what is deposited in their account.

- Real-time margin protection

- Thanks to the use of cutting-edge technology and excellent risk management features, each client can make the most of their account’s margin and precisely monitor risks to avoid a negative balance.

- Protected information.

- All sensitive client data will be transmitted and processed through encryption services such as firewalls and Secure Socket Layering (SSL).

- Segregated bank accounts.

- All trader funds will be deposited in segregated accounts at very high-level banks and will be separated from the company’s capital. The broker will not be able to use them for secondary purposes, and in case of defaults or company failures, the client will be able to manage their finances freely and withdraw funds without any problem.

- Cutting-edge technology and maximum transparency.

- Nothing hidden or unclear. The broker allows access to automated features to know with maximum clarity and in real time any cost, trading conditions, or price of an instrument. Management and real-time account reporting, margin analysis, income statement, transaction confirmation function, and accurate market analysis performed by experts in the field.

- Insurance.

- In some countries (Europe) the broker offers clients insurance in case of disputes. A fund for the protection of investors up to €20,000.

- Innovative “1-on-1 Training” service

- Are you new to the world of trading? The broker offers beginners an almost revolutionary solution to expand their knowledge and optimize investments: 1-on-1 Training. A completely personalized individual support that allows both beginners and experts to confront professionals in the field (on demo accounts without risks) and assimilate knowledge and experiences useful for refining their trading techniques.

In addition to the high security and excellent protection guaranteed by strict protocols, the broker offers traders a wide range of tools, created exclusively to assist traders in decision-making processes, in creating increasingly effective strategies, a precise and detailed vision of the opening and closing of operations performed on the markets:

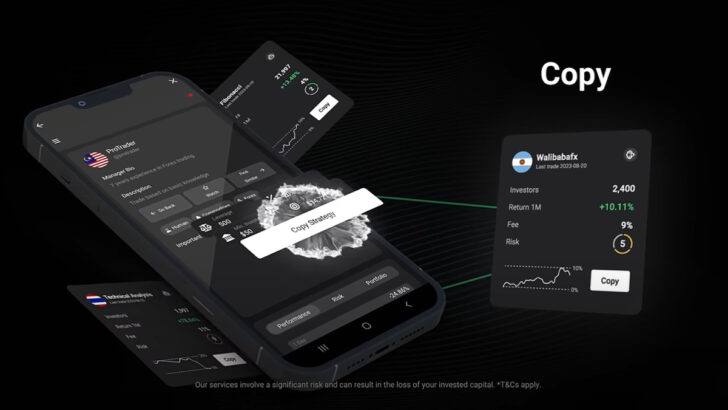

- iFOREX App

- State-of-the-art software with an intuitive interface, easily accessible by traders of any level, the innovative iFOREX App allows the use of excellent functions to optimize investments and also assists the trader by monitoring the market in search of interesting assets.

- The Trading Expert

- A service that allows clients to follow and observe professionals at work. While they execute operations, set profit levels, and manage fluctuations, the client can assimilate new techniques and perfect their style.

- Economic Calendar

- Considered by most traders an essential tool for trading up-to-date, the economic calendar allows knowing announcements and events that have or could influence the markets. Every trader can catalog events of interest based on importance, region, or date, to always be ready to execute effective operations.

- Useful Videos

- A useful section dedicated to updates, allows clients to consult videos concerning advantageous offers, detailed analyses, market analysis, and platform actions.

- Signals

- Considered by traders an essential tool for structuring effective strategies, signals act as an alarm bell, warning traders in case of significant price changes and market trends. Useful to stay updated on any market changes, signals allow traders to make the most of any potentially advantageous opportunity

- Daily Opportunities

- The iForex platform allows clients to know practically instantly any interesting data. In an environment as continuously evolving as the markets, the client will be able to know prices in real time and monitor with extreme precision the performance of hundreds of financial instruments

- Trading Sentiment

- An innovative and interesting service, Trading Sentiment allows clients to know what other traders think of a specific instrument. In this way, it will be possible to assess more clearly how and when to invest. Extremely intuitive and accessible with a few clicks.

- Advanced Charts

- Updated in real-time not only allow the client to know both historical data and real-time prices but also include a complete range of professional tools for technical analysis, including a wide range of indicators such as RSI, MACD, moving averages, Bollinger Bands, and much more.

- Technical Analysis

- On the charts, each investor will be able to view historical data and updated stock prices in real-time that allow making informed decisions with extreme ease.

- News and Information

- Being informed is essential to be able to make the most of one’s operations. The broker offers clients access to a section dedicated exclusively to the latest market news and the best financial reports in the industry.

Commissions and additional fees

Regarding the issue of general costs and fees to be borne, the broker does not offer trading with excessive costs, making markets accessible to traders of any level. Being a strictly regulated broker, iForex allows clients to know any cost or commission with extreme simplicity, precision, and transparency. This feature is highly sought after especially by traders who prefer clear and safe operations under every aspect.

- Minimum deposit

- To be able to activate their account and start trading, each client will have to deposit a minimum of $100. The minimum deposit may vary based on the country of residence.

- Trading commissions

- With the exception of variable spreads based on the market and the selected instrument, the broker imposes no trading commission.

- CFD commissions

- No commission charged for investments on CFDs

- Forex commissions

- The broker does not impose direct commissions on investments in forex markets, except for Overnight fees, which may be charged based on interest rates.

- Commissions on futures

- Zero commissions on futures

- Account management fee

- No amount charged for account maintenance.

- Inactivity fees

- Applied only after 12 consecutive months of inactivity, the expense to be incurred will be $5 (charged each month).

- Deposit commissions

- None (there may be fees to be incurred that vary based on the selected payment method and do not depend on the broker)

- Withdrawal commissions

- No commission for withdrawals. But it is worth noting that the selected payment method may require payment of a fee up to a maximum of 20 US dollars

- Overnight funding commissions

- On CFD Forex operations opened overnight, the broker will apply Overnight funding commissions, the expenses to be incurred will be calculated based on interest rates and a mark-up.

- Currency conversion commissions

- In the event that a deposit or withdrawal operation is executed in a currency other than the base currency of the account, the broker may apply currency conversion fees.

- Commission for guaranteed stop order

- Zero commissions for using the tool

Safe deposits and withdrawals?

A giant in the industry strictly regulated like iForex, could only guarantee customers an excellent deposit-withdrawal service with very high security protocols. With the goal of providing a tailor-made payment service for all customers, the iFOREX funding methods have been designed to meet a diverse financial landscape in various countries. Having conducted careful research on customer habits and needs, the payment methods available vary based on the country of residence and allow for quick, safe, and free transactions.

- Deposits

- The range of available deposit methods is impressive. Among the various options available are bank transfers, credit cards, debit cards, and e-wallets. But regardless of the country of residence, preferences, or the amount of funds to be credited to one’s account, the broker will not charge any commission.

- Withdrawals

- All withdrawal requests will be processed based on the deposit method used to credit funds to one’s account. Based on the selected operator, operations carried out via credit card may require up to 28 days, while for bank transfers, operations will generally be carried out within 3-5 business days. Although the broker does not charge any commission for withdrawal transactions, based on the selected method the client may pay a fee of up to 20 dollars

Deposit methods

As just mentioned, the broker offers a wide range of funding methods that vary based on the trader’s country of residence. Very high safety standards will ensure maximum protection on transactions and funds deposited. Each operation will be carried out with maximum transparency, both the trader and the broker itself will have the opportunity to ascertain its reliability and successful execution. To further enhance the experience of its customers, regardless of the needs or country of residence, the broker will not charge any commission on deposits. The minimum deposit executable is only $100.

Below, the entire list of available deposit methods:

| Payment Method | Currency | Timing | Max Amount |

|---|---|---|---|

| Mastercard | USD, EUR, GBP, JPY | Instant – up to 2 business days | 10,000 US dollars (varies based on country of residence) |

| Visa | USD, EUR, GBP, JPY | Instant – up to 2 business days | 10,000 US dollars (varies based on country of residence) |

| Neteller | INR, USD, EUR, GBP, JPY | Instant to 1 business day | 10,000 US dollars |

| Cryptocurrency wallets | EUR – USD | Instant to 1 business day | 70,000 US dollars (varies based on country of residence) |

| Skrill | USD, EUR, GBP, JPY, CHF | Instant to 1 business day | 10,000 US dollars |

| Yandex | INR, USD, EUR, GBP, JPY | Instant to 1 business day | MAX N.D. |

| Voucher | USD | Instant | 3,000 US dollars |

| AstropayWallet | USD | Instant | 30,000 US dollars |

| Online banking services | USD | 3-5 business days | 5,000 US dollars (varies based on country of residence) |

| PIX | USD | Instant – 1 business day | 40,000 BRL |

| ePay.bg | USD, EUR, GBP, JPY, CHF | Instant | Max N.D. |

| paysafecard | USD, EUR, GBP, CHF | Instant | 1,000 US dollars |

| Kuady | USD | Instant | Max N.D. |

| Alipay | QR CNY | Within 24 hours | 50,000 CNY |

| Local credit card | USD | Up to 28 business days | 1,000 US dollars (varies based on country of residence) |

| PSE | USD | Within 24 hours | 4,500 US dollars |

| Efecty | USD | Instant | Max N.D. |

| Trustly | USD, EUR, GBP, JPY, CHF | Instant | Max N.D. |

| Pichincha Mi Vecino | USD | Within 24 hours | 200 US dollars |

| Cash payment | USD | Immediate | 5,000 US dollars (available only in some countries) |

| Fast transfer (Skrill Direct) | USD, EUR, GBP, JPY, CHF | Instant | Max N.D. |

| GlobePay | USD | Instant | Max N.D. |

| UPI | INR | Within 24 business hours | 50,000 INR |

| Bank transfer | USD, EUR, GBP, JPY, CHF (varies based on country of residence) | Within 3-5 business days but varies based on country of residence | Max N.D. |

| QRIS | IDR | Instant | 10,000,000 IDR |

| Apple Pay | USD, EUR, JPY | Instant | Max N.D. |

| PayPal | SEK, PLN, USD, EUR, CHF | Immediate | Max N.D. |

| Sticpay | KRW, USD, JPY | Instant | Max N.D. |

| OXXO | USD | Immediate | 10,000 MXN |

| Pago Efectivo | USD | Immediate | Max N.D. |

| PromptPay | USD (varies based on country of residence) | Immediate – 24 business hours | 2,000 USD varies based on country of residence |

| VIETQR | VND | Within 24 hours | 499,999,999 VND |

To be able to make a rapid and totally secure fund deposit, just follow the next simple steps:

- Access your real iForex account on the official broker’s website or via mobile app.

- Enter your username and password in the appropriate spaces.

- Viewing the main menu or accessing your account settings, click on the “Deposit” or “Funding” icon.

- In this section, the list of available funding methods will be listed (including BTC, Visa / Mastercard, Skrill, Bank Transfer, Neteller, USDT, Ethereum). Choose the most suitable for your needs and click on the “Continue” icon.

- In this step, it will be necessary to enter the transaction details. The trader will need to decide the amount to deposit (starting from $100) and provide the necessary information that varies based on the selected payment method.

- Check the provided data with accuracy and click on “Deposit” or “Send” to confirm the transaction.

- Once the deposit request has been processed, verify that the funds have actually been credited to the account balance

It’s important to remember that to be able to deposit funds, each account must be rigorously verified.

Withdrawals

Just like deposits, withdrawal operations will be managed quickly and in complete safety. Having to perform a withdrawal with the same method used for crediting funds, the methods available for withdrawing funds are practically the same. The broker will not charge any commission, but it is important to specify the following:

- Withdrawal operations carried out using a credit card with a currency different from that set on the account, may be subject to the payment of commissions (for example, cash advance or exchange fees) that will be charged by the credit card issuer.

- Withdrawals via bank transfer: it is important to specify that a commission of up to $20 may be applied, which will be deducted from the withdrawals transferred to the client’s bank account. Japanese traders may incur a fee of 2,000 ¥ for bank transfers between 5,000 and 100,000 ¥. Clients residing in India may be subject to a commission of $5 applied for withdrawals via local bank transfer and a commission of $20 for withdrawals via international bank transfer.

To be able to perform a withdrawal from your account, the customer will have to carry out the next easy steps:

- Visit the official website or open the app on your mobile device.

- Access your account by entering your credentials (username and password).

- In the main menu, click on the “Withdraw funds” icon.

- Enter the desired amount in the appropriate space and click on the “Continue” icon.

- In the new window, select the payment method to be used for the operation and click on “Continue”. Depending on the method used for deposits, this step may not be available for all.

- Provide the necessary information for the transaction and follow the instructions.

- Once the request is made, wait for the operation to be executed and subsequently verify the credit of funds in your bank account.

Just like for deposit transactions, the broker does not allow withdrawals to account holders who have not been verified. Therefore, customers who have not yet carried out this verification process will need to proceed to access such operations.

How to open a real account with iForex?

Regardless of the country of residence or the regulatory body that protects it, the process that allows opening an account with the broker remains unchanged. Each customer can sign up quickly and start investing safely.

The broker does not offer a wide range of accounts for trading. Each trader will be able to access the markets only with a single account: Standard. Although it may seem almost prohibitive, the only account offered by the broker is designed to allow traders of any level to trade to the best of their abilities. Beginners, experts, or high-volume investment traders will be able to take advantage of the wide range of tools available in an extremely intuitive environment with flexible and advantageous trading conditions. The Standard Account provides efficient access to the markets, with technologically advanced charts, real-time updates, and a user-friendly interface.

Moreover, traders intending to test the offered environment without having to commit funds can opt for opening a demo version of the account and test the offered environment at zero risk.

Being an internationally regulated broker, iForex requires clients to verify the information entered during registration, sending documents that prove actual identity.

To be able to open an account, just follow the next very simple steps:

- Step one.

- To start, the trader will have to visit the official website and click on the “Register” icon visible at the top right of the screen. On the new page, fill out the first form by entering: first name, last name, email, phone number, and creating a password. Click on “Start Now”. Alternatively, the trader can start signing up by sharing their credentials through their Google, Apple, or Facebook account.

- Step two.

- Read carefully and accept the terms and conditions of use. Click on “Continue”.

- Step three.

- In this step, the trader will be required to answer some questions that will allow the broker to evaluate their level of experience and provide the following information:

- Personal Information: country of residence, tax code, type of occupation, political exposure, etc.

- Financial situation and investment objectives: source of income, annual income, net worth, how much they intend to invest, risk tolerance, preferred trading type, etc.

- Knowledge and experience: answer questions regarding trading, in order to allow the broker to evaluate the level of experience of the future client.

- Step three.

- To activate their account, the trader will have to undergo a verification process to prove their real identity and country of origin. To proceed, they will need to send a clear front and back photo of a valid identification document (ID card, driver’s license, passport) and a recent utility bill (electricity, gas, internet) in the applicant’s name and with a complete address of residence clearly visible.

- Last step

- If deemed suitable, the trader can make an initial deposit and start trading safely on markets around the world.

| Standard Account | Description |

|---|---|

| Minimum deposit | $100 |

| Max leverage | 1:400 (varies based on country of residence) |

| Spread | Variable starting from 0.6 pip |

| Trading commissions | Zero |

| Available instruments | forex, commodities, indices, stocks, ETFs, and cryptocurrencies |

| Stop out | No |

| Margin call | No |

| Account currency | USD (varies based on country of residence) |

| Minimum trading volume | 0.01 |

| Contests and bonuses | Trading bonus, cashback, bonuses up to 50% on the first deposit (available based on country of residence) |

FAQs

- Is iFOREX a regulated broker?

- Yes, iFOREX is regulated by CySec and BVI FSC, ensuring a secure trading environment.

- What trading instruments are available on iFOREX?

- iFOREX offers forex, commodities, indices, stocks, ETFs, and cryptocurrency-based CFDs.

- Are there any commissions on iFOREX?

- No, iFOREX offers zero trading commissions across all its trading instruments.

- What security measures does iFOREX implement?

- iFOREX uses SSL encryption and two-factor authentication to ensure high security standards.

- What is the minimum deposit required on iFOREX?

- The minimum deposit requirement on iFOREX is $100, which may vary based on the country of residence.

- Does iFOREX offer negative balance protection?

- Yes, iFOREX provides negative balance protection to prevent clients from losing more than their deposited amount.

- What platforms does iFOREX offer for trading?

- iFOREX provides a mobile-first trading platform and the iFOREX App, tailored for optimal trading experience.

- Can beginners trade on iFOREX?

- Yes, iFOREX is suitable for beginners, offering educational resources and demo accounts for practice.

- Are there any bonuses or contests on iFOREX?

- iFOREX frequently offers trading bonuses, cashback, and bonuses up to 50% on the first deposit.

- How can I open a real account with iFOREX?

- To open an account, visit iFOREX’s official website, register, and follow the verification process to start trading.

Latest Features

- Close