The Best Forex Broker for News-Time Scalping trading

Explore how to leverage LMFX’s unrestricted trading on MT4 during Forex market news releases for optimal profit.

The article discusses the advantages of using LMFX for trading during news releases, highlighting its lack of restrictions and optimal trading conditions. It explains the significance of market sentiment before news release, and how traders can use this to their advantage by trading based on predictions and market conditions. The article also warns about the risks associated with trading during the actual news release due to potential volatility and price adjustments already factored by the market. It provides a practical example using Non-farm payroll data, showing the impact on the USD. Finally, it compares LMFX’s three different trading account types, emphasizing the flexibility and options available to traders.

Maximize Forex Trading Profits During News Releases with LMFX’s Unrestricted MT4 Platform

Start trading with LMFX today—unrestricted access and optimal conditions for news-time Forex trading!

| Feature | Details |

|---|---|

| Trading during news | Allowed without restrictions |

| Broker type | STP Forex broker |

| Account Types | Fixed, Zero, Premium |

| Key Strategy | Trade based on market sentiment before news release |

| Risks | High volatility and pre-priced news impact |

Open LMFX’s MT4 account for News-Time Trading

During news releases, the prices of the Forex market move dynamically and many traders see them as great opportunities to trade.

The only problem is to find the broker that allows news-time trading.

Many traders do mention that they allow news-time trade but many of them come with restrictions.

And if the broker’s condition such as the leverage and the trading cost, aren’t suitable for such trading methods, that will make it mcu harder to realize profits during news-time.

LMFX, an STP Forex broker allows all kinds of trading methods with no restrictions.

Including the news-time trading, in this case, you can perform it with no limits and pursue profits freely.

LMFX is a recommended Forex broker for any type of trader, especially for traders who want to perform specific trading strategies that require an optimal trading condition.

You still don’t have an account with LMFX yet? Go to LMFX’s Official Website and find out more about their service today.

Trade Forex with no restrictions

How to trade on news release?

When reading fundamentals or news articles you sometimes see sentences like “if the US CPI data is higher than predicted, the USD will strengthen”. That sounds easy right? But the reality is not so, there are some things you should know to be able to achieve success in trading. We will help you to find out these things.

Have you ever heard the phrase “buy when there are rumors, sell when the news is out”? This is a common phrase in the trading world such as “the trend is your friend”. The idea is simple: traders should pay attention to the sentiment of the market and the state of the market. If the market sees a positive outlook for the currency pair, the price will go up. However, if the prediction is not so good, the trader will open a short position order.

Trade during News-time on LMFX

When is a good time to trade on news releases?

Here we have to pay attention to one important thing: market sentiment is created before the news is released. When you read sentences like “if the data supports, the currency exchange rate will strengthen”, then maybe you think it’s best to wait until the news is released before opening orders. But it might be a big mistake. There are times when it is better to open an order position one day before the news is released. That’s why you need to know the sentiment of the market.

But how can that happen? In fact the market is also made up of millions of traders. They take the decision to open a buy or sell order; invest or exit the trade depending on their expectations of what will happen next to the price of the currency. The goal is to buy when prices are low and sell when prices are high. Simply put, if everyone expects good news to be released in Europe, then they will buy the Euro before the news is released when the price is still cheap and hope to sell when the price is high after the positive news is released. Sounds reasonable right?

So what should you do? The solution is easy: you have to pay attention to fundamental analysis. If we talk about economic data, then you have to look at the economic calendar and predictions. If you see the prediction is higher than the previously released data, then it’s a good idea to open a buy order against that currency. On the contrary, if the prediction is negative, then it is better to open a sell order against the currency. Look at the H1 timeframe and check if there is a short-term trend according to the economic predictions listed on the economic calendar. If the trend does exist, then you can open orders before the news is released. In this way, you will be trading based on market sentiment.

Facts on the news release

If you are trading before an economic event occurs, it would be wise to close the position for 2 reasons. The first reason, if the news released is as expected, traders may “sell when the news is released” or, in other words, they close the positions they had opened before the news was released. Massive profit taking can cause currency prices to fall even if the news released is positive. This may happen when the news release is already priced (the price of the currency is fixed when the news is released, so the currency doesn’t react to the market).

You may see many examples during central bank meetings. If the market is already anticipating an increase in interest rates, the currency tends to strengthen before the central bank announces its decision. Since the decision already determines the price of the currency, there is a high probability that the currency will weaken after the news is released, as traders anticipating a rate hike will start selling.

The second reason, economic indicators can always disappoint. As a result, traders who already expect a good release will immediately take a sell action and the impact of currency prices will weaken. If you trade before the news is released, then you will avoid this risk.

The same considerations make the risk of entering the market even greater right after the news is released because market volatility is high and moves against your expectations.

Keep in mind that you can always read the analysis on fbs.com. Our experts do their best to gather comprehensive information about the world economy so that you can draw sound conclusions and profit from your trades.

Example of News time trading

Let’s look at an example. Non-farm payroll data (one of the most influential statistical indicators) has a big impact on the USD. On August 3, 2018, NFP data was released. The predictions were negative, and the actual data appeared to be worse than predicted. As a result, the USD had lost its momentum to strengthen after 3 days prior to strengthening. USD lost a few points that day, but continued to show strength in the following days.

Incoming price news.

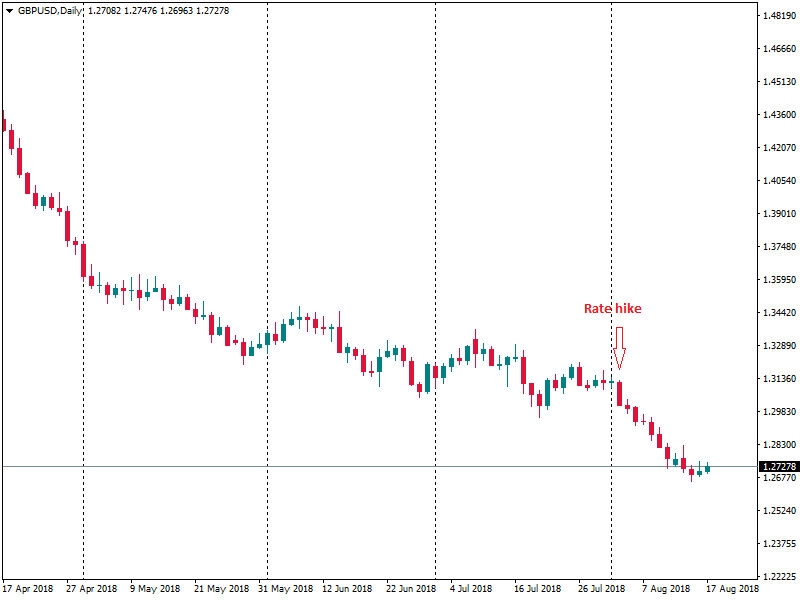

The Bank of England raised interest rates on August 2 but did not support GBP prices. Worse yet after the news was released, the GBP/USD pair even weakened. The first reason is because the market is already anticipating an increase in interest rates. The second reason which is the most important reason is that you have to pay attention to other important factors. While waiting for the news to be released, you should check the general market sentiment. Important news such as escalation of the trading war, Brexit deal can affect currency prices more than the release of economic data. That’s why the British pound did not strengthen before the news was released and even weakened after the news was released.

If you want to learn how to increase your profit when the news is released, then you must follow these conditions:

- Get the latest information on economic news.

- Improve your understanding of market sentiment by checking the latest economic releases and market reactions.

- Study the correlations between various news releases (for example, how retail sales can affect GDP, PPI, CPI, etc; if retail sales data exceeds market expectations, we can wait for the GDP release which has the potential to strengthen the currency).

In conclusion, we can say that the most important thing that every trader should remember to trade when the news is released is to know the market sentiment and trade long before the data is released.

Comparison of LMFX’s all trading account types

LMFX has 3 trading account types which are Fixed, Zero and Premium.

See the comparison of these 3 trading account types below and choose the right account type for your trading strategy.

| Account Type | Fixed | Zero | Premium |

|---|---|---|---|

| Minimum Spread | Fixed from 1.8 pips | From 0.0 pips | From 1.0 pip |

| Maximum Leverage | 1:400 | 1:250 | 1:1000 |

| Minimum Deposit Amount | $250 | $100 | $50 |

| Trading Commission | None | 4 USD per lot | None |

| Account Currency | USD & EUR | USD & EUR | USD & EUR |

| Available Markets | Forex, Gold, Silver, Oil, Indices, Share CFDs and Commodities | Forex, Gold, Silver, Oil, Indices, Share CFDs and Commodities | Forex, Gold, Silver, Oil, Indices, Share CFDs and Commodities |

| Max Trading Volume | 75 lots | 100 lots | 60 lots |

| Max Number of Open Trades | 150 | 200 | 100 |

| Web Trader | Available | Available | Available |

| Mobile App | Available | Available | Available |

| Margin Call % | 30% | 50% | 50% |

| Stop Out % | 15% | 20% | 20% |

| Account Registration | Open Fixed Account | Open Zero Account | Open Premium Account |

FAQs

- What is LMFX?

- LMFX is an STP Forex broker that allows trading without restrictions, including news-time trading.

- Can I trade during news releases with LMFX?

- Yes, LMFX allows trading during news releases without any restrictions.

- What should I consider when trading on news releases?

- It’s crucial to understand market sentiment and the predicted impact of news on currency prices.

- What are the risks of trading during news releases?

- Trading during news releases can be risky due to high market volatility and pre-priced news effects.

- How can I maximize profits during news-time trading?

- Trade based on market sentiment before the news release and avoid the initial volatility post-release.

- What types of trading accounts does LMFX offer?

- LMFX offers Fixed, Zero, and Premium trading accounts to cater to various trading strategies.

- What is the minimum deposit required for a trading account?

- Minimum deposits vary by account type, starting from $50 for a Premium account.

- Are there any commissions on trades?

- The Zero account has a commission of 4 USD per lot, whereas the Fixed and Premium accounts do not have any commissions.

- What markets can I trade with LMFX?

- You can trade Forex, Gold, Silver, Oil, Indices, Share CFDs, and Commodities.

- How can I open an account with LMFX?

- You can open an account by visiting LMFX’s official website and following the account registration process.

Latest Features

- Close