What is easyMarkets' dealCancellation and how does it work?

easyMarkets provides traders with advanced risk management tools, including dealCancellation and fixed spreads, for a safer trading experience.

Proper risk management is essential for traders to maintain long-term profitability, separating them from gamblers. easyMarkets offers various risk management tools, including stop-loss options and dealCancellation, to help limit losses. The dealCancellation feature allows traders to cancel transactions within a specified timeframe, reducing exposure to market volatility. Fixed spreads provided by easyMarkets ensure traders can predict trading costs without worrying about additional fees. The platform also offers different account types, catering to traders with varying risk tolerance and investment goals.

Master Risk Management with easyMarkets’ dealCancellation Feature

Trade confidently with easyMarkets’ dealCancellation feature and minimize your risks today!

| Feature | Details |

|---|---|

| Risk Management Tools | Stop-loss, dealCancellation |

| dealCancellation Benefit | Allows trade cancellation within a timeframe |

| Trading Cost Transparency | Fixed spreads ensure predictable costs |

| Account Types | VIP, Premium, Standard |

| Market Protection | Limits losses in volatile market conditions |

What’s the Best risk management tool?

Most long-time traders attribute their success to proper risk management.

This is the factor that separates true traders from gamblers who cannot keep making stable profits even if they win big.

Some important aspects of risk management include setting stop losses, sizing positions, profit: risk ratios, and taking into account other charges such as spreads and processing costs.

All of this affects a trader’s account balance and winning percentage.

Go to easyMarkets Official Website

A risk management function “dealCancellation”

When it comes to limiting losses from trading, you may be familiar with various stop losses such as equity stops, time stops, and technical stops.

When using stop-loss, you have already set the amount of funds in your account that are at risk during trading, the amount of time your assets will be locked in an open position, and the technical level that will determine the invalidation of your thoughts.

Putting these together, for example, if the amount of funds for an account exposed to a transaction is 1% and the invalidation point is 200 pips from the entry price, you can determine the size of the position for that particular transaction.

However, if you don’t have the time to do these calculations yourself, easyMarkets guarantees stop-loss that allows you to limit your losses without worrying about slippage.

This feature helps prevent negative balances at no additional cost during times of high market volatility or during black swan-like events.

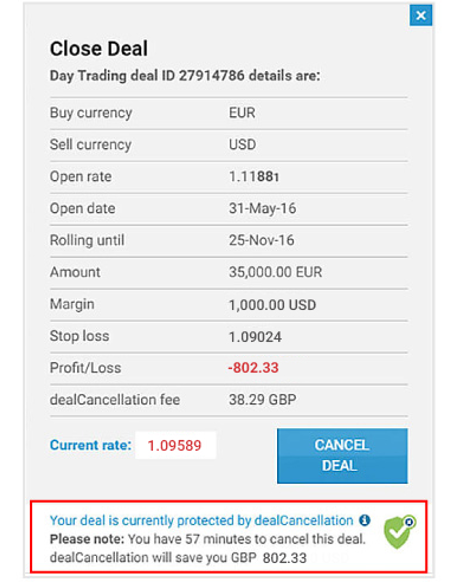

Another useful risk management tool provided by easyMarkets is the dealCancellation feature, which allows you to cancel a transaction until the expiration date.

Trade with easyMarkets’ dealCancellation

These features are available for most securities unless otherwise specified and can be used by simply sliding the deal Cancellation on.

This means that you can further limit losses from potentially lossy transactions as long as dealCancellation is available within 60 minutes.

The cost of the dealCancellation feature can vary depending on the security, the size of the position, and market conditions, but the cost is already stated before it becomes effective.

If you cancel your order, your risked funds will be returned to your account and your fees will be deducted, but you may incur less loss than you would incur at a stop out.

Finally, the profit or loss calculation also incorporates possible spreads and other processing costs.

Keep in mind that if the market is highly volatile, spreads may widen, resulting in lower profits and higher losses.

However, if you use a broker such as easyMarkets that offers fixed spreads, you can trade with all costs taken into account from the beginning without worrying about additional costs.

These spreads can be easily referenced in easyMarkets’ FX spreads and pricing table, which includes the contract size for each product, the pip value, and the minimum margin required.

This information is useful not only for calculating the size of the position but also for checking the transparency of the broker, such as whether it costs anything else.

Open easyMarkets’ Account to try out the dealCancellation feature today.

Open easyMarkets’s Account for free

Comparison of easyMarkets trading account types

There are mainly 4 different account types available with easyMarkets as follows:

| Platform | easyMarkets Web/App and TradingView | MT4 | MT5 | ||||

|---|---|---|---|---|---|---|---|

| Account Type | VIP | Premium | Standard | VIP | Premium | Standard | Standard |

| Spread Type | Fixed | Fixed | Fixed | Fixed | Fixed | Fixed | Variable (Floating) |

| Minimum Spread | 0.8 pips | 1.5 pips | 1.8 pips | 0.7 pips | 1.2 pips | 1.7 pips | 0.6 pips |

| Required Minimum Deposit | 10,000 USD | 2,000 USD | 25 USD | 10,000 USD | 2,000 USD | 25 USD | 25 USD |

| Minimum Trading Volume | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Leverage | 1:200 | 1:200 | 1:200 | 1:400 | 1:400 | 1:400 | 1:500 |

| Trading Commission | None | None | None | None | None | None | None |

| Account Fee | None | None | None | None | None | None | None |

| Personal Account Manager | Available | Available | Available | Available | Available | Available | Available |

| No Slippage | Optional | Optional | Optional | Unavailable | Unavailable | Unavailable | Unavailable |

| Guaranteed Stop Loss | Optional | Optional | Optional | Unavailable | Unavailable | Unavailable | Unavailable |

| NBP (Negative Balance Protection) | Available | Available | Available | Available | Available | Available | Available |

| Trading Central | Unavailable | Unavailable | Unavailable | Available | Available | Available | Available |

| Sign Up Links | Open VIP Web Account | Open Premium Web Account | Open Standard Web Account | Open VIP MT4 Account | Open Premium MT4 Account | Open Standard MT4 Account | Open Standard MT5 Account |

For all of the above account types, you can choose an account base currency from: Euro (EUR), Canadian Dollar (CAD), Czech Koruna (CZK), Japanese Yen (JPY), New Zealand Dollar (NZD), U.S. Dollar (USD), Singapore Dollar (SGD), Swiss Franc (CHF), British Pound (GBP), Mexican Peso (MXN), Australian Dollar (AUD), Polish Zloty (PLN), Turkish Lira (TRY), Chinese Yuan (CNY), Hong Kong Dollar (HKD), Norwegian Krone (NOK), Swedish Krona (SEK), South African Rand (ZAR), and Bitcoin (BTC).

FAQs

- What is the best risk management tool for traders?

- Proper risk management includes stop-loss settings, position sizing, and risk-to-reward ratios.

- What is dealCancellation on easyMarkets?

- dealCancellation allows traders to cancel trades within a limited time to minimize losses.

- How does fixed spread trading help with risk management?

- Fixed spreads ensure traders know their costs upfront, reducing unexpected trading expenses.

- Which account types does easyMarkets offer?

- easyMarkets provides VIP, Premium, and Standard accounts for different trading needs.

- Is dealCancellation available for all trades?

- dealCancellation applies to most securities, but availability depends on market conditions.

- How does easyMarkets prevent negative balances?

- By offering guaranteed stop-loss and dealCancellation, easyMarkets helps prevent large losses.

- Can I use dealCancellation for free?

- There is a cost for using dealCancellation, but it is displayed before activation.

- What happens if I cancel a trade using dealCancellation?

- The risked funds are returned to your account minus a small fee.

- Does easyMarkets provide leverage?

- Yes, easyMarkets offers leverage depending on the account type and market regulations.

- Where can I sign up for an easyMarkets account?

- You can sign up on the official easyMarkets website and select your preferred account type.

Latest Features

- Close